SA

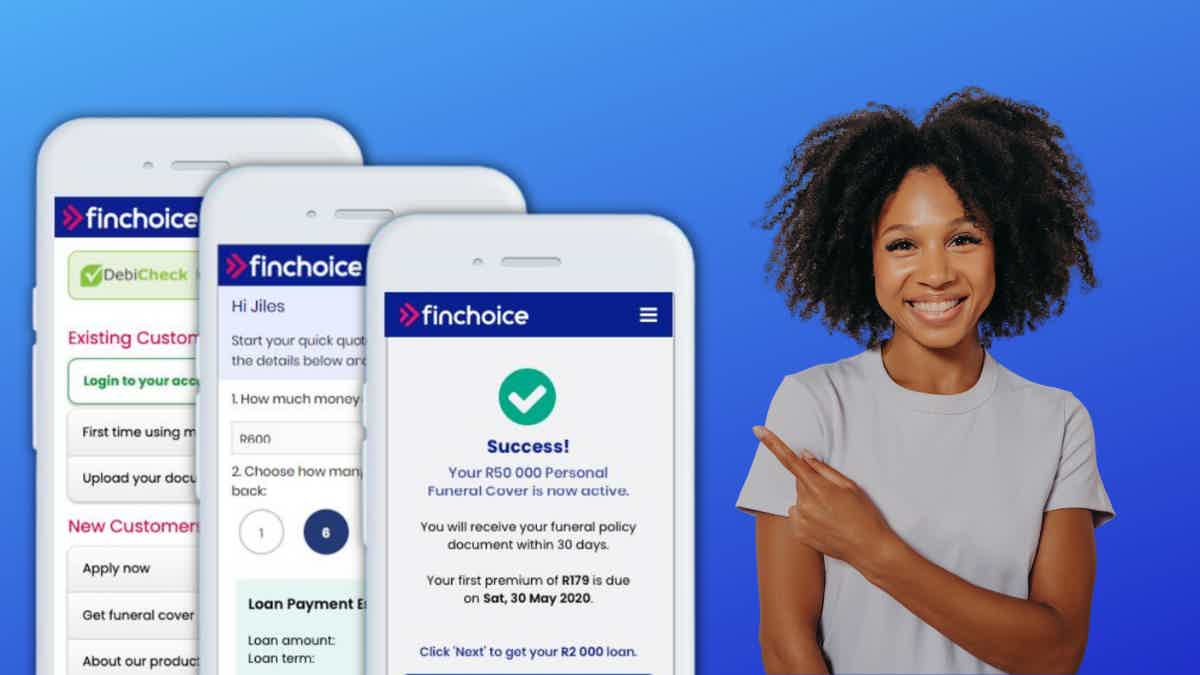

Finchoice Personal Loan review: simple and fast solutions

If you need to kickstart a dream, you have come to the right place because this Finchoice Personal Loan review will show you if it is worthwhile.

Finchoice Personal Loan: up to R40,000 with Personal Protection Plan

Are you planning to cover an unexpected expense or renovate your house? Then, this Finchoice Personal Loan review is worth reading.

How to apply for the Finchoice Personal Loan?

Take a minute to see how easy it is to apply for a Finchoice Personal Loan, and take 2 minutes to get a free quote! Borrow up to R40,000 now!

In essence, this lender gives you the tools and the accessibility you need to get the loan you want and manage it properly so you can focus on your plans.

| APR | Depends on the loan agreement |

| Loan Purpose | Personal |

| Loan Amounts | Up to R40,000 |

| Credit Needed | All credit ratings are considered for a Finchoice Personal Loan |

| Terms | Up to 24 months |

| Origination Fee | Not disclosed |

| Late Fee | Not disclosed |

| Early Payoff Penalty | Not disclosed |

Undoubtedly, it can be a reasonable choice for you, especially because it follows the National Credit Act about affordability. That is, a credit provider can only offer a loan that you can afford to pay back.

How does the Finchoice Personal Loan work?

Finchoice offers different types of loans depending on your particular circumstances. Generally, you can borrow up to R40,000 with repayments of six, 12, or 24 months.

Although the conditions vary according to credit records and loan agreements, this lender commits to the affordability regulation of the National Credit Act, which means it will only offer you what you can afford to repay, as shown before on this Finchoice Personal Loan review.

Therefore, you can feel peace of mind knowing the agreement offered is personalized according to your needs and goals.

Also, it provides you with a Personal Protection Plan, in which the outstanding balance you might have will be settled in case of an unfortunate situation.

In addition, you can access a Flexi Loan, a simpler solution for those who need up to R8,000.

In this case, the repayment terms are up to six months, and you can apply for more after paying back the balance.

Finchoice offers other types of credit solutions designed with simplicity and flexibility, including a Funeral Cover and a MobiMoney alternative for loans of up to R10,000.

Last, you can get a quote for free within only two minutes just to certify if there would be a solution for you.

You will be redirected to another website

Finchoice Personal Loan benefits

Certainly, this credit provider is worth considering if you are looking for reasonable and reliable loans. Finchoice Personal Loan offers personal protection plan, affordable rates and fees, and quick application.

Pros

- It complies with the affordability regulation of the National Credit Act;

- It offers different types of loans for different purposes;

- It provides you with a Personal Protection Plan;

- It offers up to R40,000 with terms of six, 12, or 24 months.

Cons

- Disadvantages weren’t found.

How good does your credit score need to be?

Even though Finchoice considers less-than-perfect credit records, the chances of getting better conditions depend on your creditworthiness. Thus, the higher your rating more flexible your terms will be.

How to apply for a Finchoice Personal Loan?

If you want to get a free quote within two minutes, check out how simple it is to apply for a Finchoice Personal Loan.

How to apply for the Finchoice Personal Loan?

Take a minute to see how easy it is to apply for a Finchoice Personal Loan, and take 2 minutes to get a free quote! Borrow up to R40,000 now!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Absa Gold Credit Card review: High rewards!

If you're in the market for a new rewards credit card, you can read our Absa Gold Credit Card review to learn more and see the travel perks!

Keep Reading

How to apply for the Savvy Plus Bank Account?

Looking for the perfect account with travel benefits and ways to meet your banking needs? Read on to apply for the Savvy Plus Bank Account!

Keep Reading

RMB Private Bank Credit Card review: eBucks and travel perks!

Are you looking for a card with travel perks and eBucks rewards? If so, read our RMB Private Bank Credit Card review to learn more!

Keep ReadingYou may also like

Credit card interest rates are rising, start paying it down now!

If you carry a balance on your credit cards, now may be the time to start paying it down. Learn about several strategies that can help you reach your goal.

Keep ReadingGet creative: 8 apps that turn photos into awesome caricatures

Want to impress your friends with your photo editing skills? These apps turn your photos into stunning caricatures with just a few taps. Keep reading!

Keep Reading

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Find out if the Applied Bank® Gold Preferred® Secured Visa® Credit Card is right for you. Learn how to apply, what features it has and whether or not a credit check is required.

Keep Reading