Credit Cards (SA)

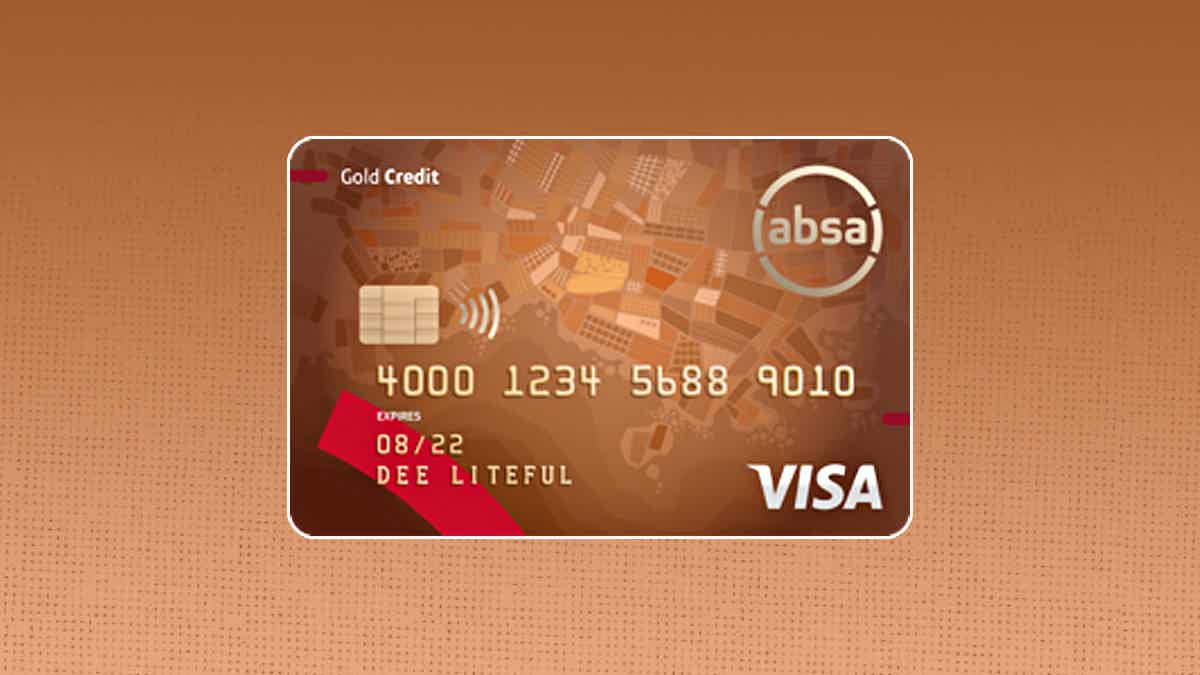

Absa Gold Credit Card review: High rewards!

Are you in need of a good rewards card with travel perks? If so, read our Absa Gold Credit Card review to see the pros and cons of this card!

Absa Gold Credit Card: Travel benefits and rewards!

If you’re looking for a rewards credit card with great travel benefits, you can read our Absa Gold Credit Card review! With this card, you can earn points while spending and get other perks!

How to apply for the Absa Gold Credit Card?

Do you need a rewards card with travel benefits? If so, read our post to learn how to apply for the Absa Gold Credit Card!

| Requirements* | R4 000 monthly income requirement; Documents: South African ID book or smart card, proof of residence, and others; Age: 18 years or older. *Terms apply. |

| Initiation fee | Not disclosed. |

| Monthly fee* | R23.20 for Absa rewards membership; R55 credit facility account fee. *Terms apply. |

| Rate*s | Up to 57 days interest-free (valid for eligible transactions). *Terms apply. |

| Rewards | Up to 1.15% cash back when paying with an Absa credit card or others; Up to 30% real cash back for eligible purchases and more. *Terms apply. |

With this card, you can enjoy exclusive access to airport lounges worldwide. Moreover, you can get exclusive rates at local and international Bidvest airport lounges!

Also, you’ll find travel insurance when booking international return tickets! So if you’re ready to start enjoying some serious travel perks, look no further than the Absa Gold Credit Card!

And keep reading our Absa Gold Credit Card review to learn more about this card’s pros and cons and much more!

How does the Absa Gold Credit Card work?

With this credit card, you’ll be able to earn high rewards if you enroll in the Absa rewards program. Moreover, you can even get exclusive Visa perks, such as Visa Global Merchant offers.

Also, you’ll get access to NotifyMe, which is a way to get alerts on your phone through SMS to keep track of your account and credit card activities.

In addition, you can even build your credit history while using this card and making all your payments on time.

You will be redirected to another website

Absa Gold Credit Card benefits

Now that you’ve learned more about how the Absa Gold Credit Card works in this review, we’ll show you its pros and cons. So, check out our lists below of the main pros and cons to help you decide!

Pros

- You’ll have access to travel insurance with exclusive rates;

- There are discounts at the Bidvest Airport Lounge with exclusive rates;

- You’ll have a chance to increase your credit score if you use your card responsibly;

- There is an Absa rewards program available to get high rewards;

- You can make contactless payments;

- There are account alert options to keep track of your credit card.

Cons

- There is not much information about initiation fees and other fees;

- You’ll need to pay a monthly fee for many things, including credit card usage and rewards programs.

How good does your credit score need to be?

There is not much information about the credit score requirements to get this credit card. However, you’ll need to fit some eligibility requirements.

Also, you’ll need to go through an affordability assessment during the application.

However, if you use your card responsibly, you’ll be able to increase your credit history over time!

How to apply for Absa Gold Credit Card?

To apply for this card, you’ll need to fit some requirements, such as R4 000 monthly income, proof of residence, and others. But you can do it all online through the official website!

How to apply for the Absa Gold Credit Card?

Do you need a rewards card with travel benefits? If so, read our post to learn how to apply for the Absa Gold Credit Card!

About the author / Aline Barbosa

Trending Topics

How to apply for the Xtra Savings Card?

See how to apply for an Xtra Savings Card and start earning great discounts, prizes, and rewards on your purchases at Shoprite and Checkers.

Keep Reading

How to apply for the Absa Personal Loan?

Learn how simple it is to apply for an Absa Personal Loan and borrow up to R350 000 with terms of up to 84 months and flexible repayments.

Keep Reading

How to apply for the Isivande Women’s Fund?

See how to apply for an Isivande Women's Fund to get investments ranging from R30 000 to R2 million to promote women's economic empowerment.

Keep ReadingYou may also like

United℠ Explorer Card application: how does it work?

Wondering how to apply for the United℠ Explorer Card? We'll show you how easy it is and what benefits you can expect. Keep reading!

Keep Reading

Learn to apply easily for the Red Arrow Loans

Do you want to know how to get up to $5,000 on a payday loan? Look no further! Learn how to apply for Red Arrow Loans, and the money might be deposited in your account in hours.

Keep Reading

United℠ Explorer Card review

Read out this United℠ Explorer Card review to familiarize yourself with this travel card that offers great rewards for frequent travelers, including a 50,000-mile sign-up bonus. Plus, there's no annual fee for the first year. Read on!

Keep Reading