Personal Finance (US)

Equifax Credit Score and Monitoring full review

Equifax offers many valuable products for credit monitoring and protection. Check out the full review!

Equifax review: check out your credit score and reports instantly!

Equifax is a global data, technology, and analytics company. It is present in 24 countries and carries 122 years of brand heritage. Overall, this Equifax review will tell you exactly how it works and all its benefits.

Businesses and individuals rely on the company to access valuable data about credit so that they can make wise decisions about customers.

How to apply for Equifax?

Equifax offers many plans for credit and report monitoring and protection. Check out how to apply!

In this article, we will review the products offered by Equifax, its features, and the public served.

So, keep reading to learn all about this major credit bureau.

How does Equifax Credit Monitoring work?

Equifax is one of the major credit bureaus among two other companies. It offers a wide range of products and services for individuals and businesses.

The company gathers credit data in its technological and analytical environment so everyone can rely on it to make wise decisions.

In the personal section, Equifax offers basic and premium products, including a family plan.

Now, check out the options:

- Equifax Complete™ Premier: it includes 3-Bureau credit file monitoring and ID theft protection for $19.95 per month;

- Equifax Complete™ Family Plan: it allows the addition of one adult plus credit monitoring for up to 4 children. The features are the same as the Premier plan. The price is $19.95 per month;

- Norton™ 360 with LifeLock™ Ultimate Plus: it includes all-in-one protection for your devices and online privacy for $29.99 per month in the first year.

Furthermore, the company offers basic plans as follows:

- EQUIFAX Core Credit™: monthly credit score and report for free;

- EQUIFAX Credit Monitor™: it includes security alerts for $4.95 per month;

- EQUIFAX Complete™: it includes credit monitoring and ID protection for $9.95 per month.

Moreover, this credit bureau offers solutions for businesses, including credit risk tools, data for verifications, fraud protection, marketing solutions, and Workforce Management.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Equifax Credit Score & Monitoring benefits review: is it legit and accurate?

Equifax is one of the most reliable credit bureaus in the world. Basically, it gathers credit data in an analytical and technological environment on which individuals and businesses rely to make wise decisions.

Furthermore, the company offers many tools and plans no matter what your need is, from free and basic plans to complete ones.

Check out the list of pros and cons before getting started with a plan.

Pros

- Equifax offers a wide range of products and services for individuals and businesses;

- The basic plan includes credit monitoring for free;

- The company features a family package;

- Most plans include ID protection;

- The offerings for businesses are complete and reliable.

Cons

- The free plan doesn’t offer protection.

How to join Equifax?

Now, learn how easy it is to join Equifax by choosing the best plan for your credit monitoring and protection.

How to apply for Equifax?

Equifax offers many plans for credit & report monitoring and protection. Check out how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for My Green Loans?

My Green Loans can help you get access up to $40,000 within one business day. Keep reading and find out how to apply for it!

Keep Reading

Bankruptcy or consumer proposal: differences and full comparison

If you have a lot of debt, you might be thinking of bankruptcy or consumer proposal. Read more to find out which is the best option for you!

Keep Reading

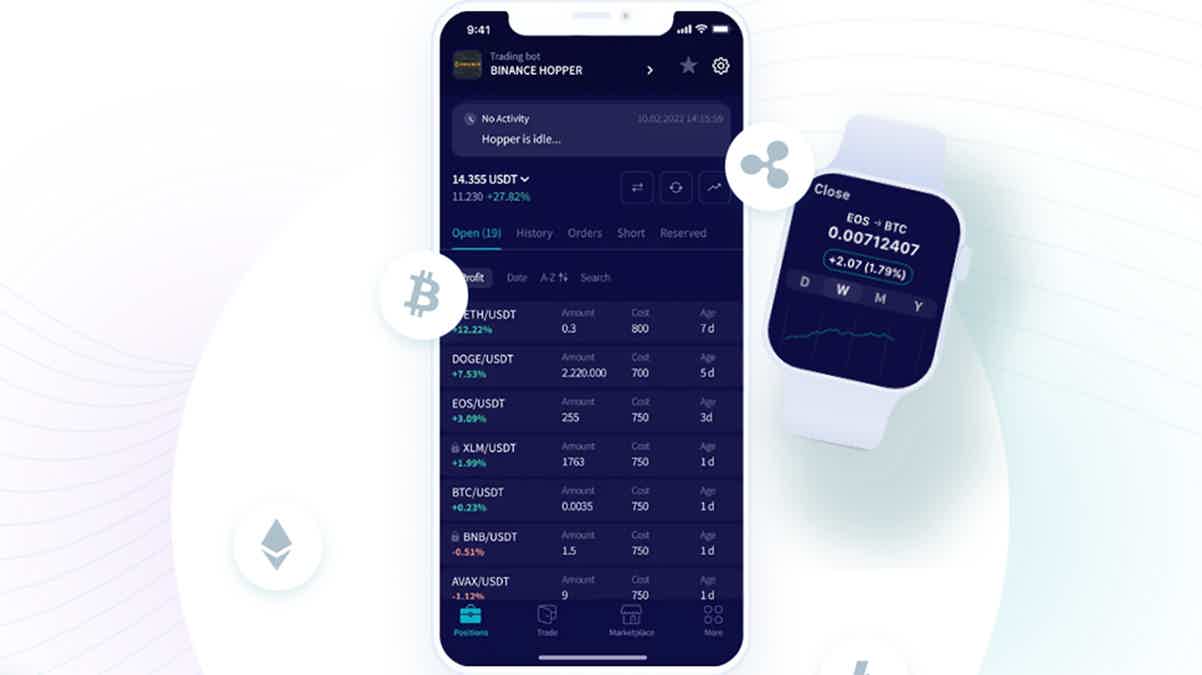

Cryptohopper review: The Most Powerful Crypto Trading Bot

Check out Cryptohopper review. Learn how the most powerful crypto trading bot works and start investing in digital coins with less effort.

Keep ReadingYou may also like

Milestone® Mastercard® application: how does it work?

Are you looking for a way to build credit? If so, you can try with the Milestone® Mastercard®. And there is no need for security deposit! Read on to learn how to apply!

Keep Reading

WWE Netspend® Prepaid Mastercard®: apply today

Apply for the WWE Netspend® Prepaid Mastercard® and simplify your finances - 0% APR and amazing benefits! Read on and learn more!

Keep Reading

How to buy cheap flights on Kayak

Buy cheap flights on Kayak! Learn how to use this popular travel search engine's tools to get low-cost tickets from $29.99! Read on!

Keep Reading