Credit Cards (US)

Dubai First Royale: overview on Dubai First Royale card

The Dubai First Royale credit card is one of the most exclusive cards in the world. It has luxurious benefits for select clients. Learn more about it here!

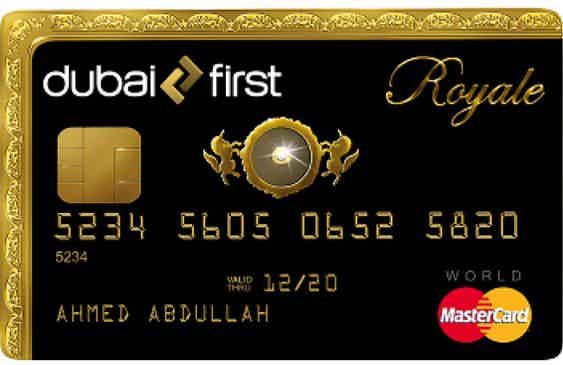

Dubai First Royale credit card

What do you know about luxury credit cards? These cards offer exclusive benefits for select clients. The Dubai First Royale credit card is one of the most exclusive cards in the world.

This card is made for special people with extraordinary needs, and it is definitely not just any ordinary card. It is made of expensive and exclusive material, including real gold!

The card is issued in the United Arab Emirates and most clients are Emirati, but it is available for select clients from anywhere in the world. Keep reading to know more about this very exclusive card.

How to apply for Dubai First Royale credit card

Check out important information on how to get one of the most exclusive cards in the world.

| Credit Score | No recommended credit score |

| Annual Fee | Undisclosed |

| Regular APR | Unknown |

| Welcome bonus | Unknown |

| Rewards | Undisclosed There are personalized benefits |

What is special about the Dubai First Royale card?

There is little information about this card’s specific benefits and rewards because the company likes to keep them undisclosed.

But this card has several special characteristics known to the public. It is made with expensive materials. The edges are trimmed in real gold and there is even an approximately .325 carat diamond in the middle.

As this is a luxury card, it has zero credit limits, cardholders can spend any amount, with no restrictions, no matter how much they spend. And cardholders have access to a dedicated relationship manager and a lifestyle manager.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Who qualifies for the Dubai First Royale credit card?

There are specific requirements for someone to qualify for this card. It is only available for wealthy people with high spending power, including the members of the royal family of Saudi Arabia.

Only being rich is not enough, you have to be an extraordinary multi-millionaire potential client to be qualified. If you want to know whether you are qualified to get this card, we recommend our post about how good your credit score needs to be.

Dubai First has the purpose of providing anything their clients wish to have and to meet any request they make. With that being said, to qualify for this card, you need to be someone with extraordinary needs.

Dubai First Royale credit card full review

Do you still want to know more about the Dubai First Royale credit card? Here is a full review with information about how the card works, its benefits and more!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

OppFi® credit card full review

If you are looking for a card that helps you build your credit history, take a look at this OppFi® credit card review article today!

Keep Reading

Choose the perfect credit card for you: All credit types are welcome to apply!

Find out how you can choose a credit card that is perfect for your score and everyday needs with this list we've compiled for you!

Keep Reading

How to start banking with Discover Bank?

Discover Bank features a range of financial products with no fees, so you can choose which fits your needs better. See how to start banking!

Keep ReadingYou may also like

Types of loans: understand which one is best for you

When it comes to borrowing money, there are many types of loans. Learn more about each type and determine which is best for you. Keep reading!

Keep Reading

Apply for the Blue Cash Preferred® Card from American Express

Are you wondering what the Blue Cash Preferred® Card from American Express is all about? Get the scoop on their application process, rewards programs, bonus offers, and more. Read on!

Keep Reading

Earn up to 5% cash back: Apply for Instacart Mastercard® today

Ready to save big on groceries? Follow our tutorial to apply for the Instacart Mastercard® and seize cash back - enjoy $0 annual fee! Read on!

Keep Reading