Account (US)

Crescent Bank review: get access to CD accounts

If you need a bank that offers excellent CD account options and other financial products, read our Crescent Bank review!

Crescent Bank: no fees for some products!

If you’re looking for a bank to do your everyday banking with, you’ll love our Crescent Bank review! This regional bank offers a number of convenient features, like CD accounts and online banking!

How to apply for Crescent Bank financial products?

If you're interested about Crescent Bank services, you can read this post to learn hwo to join and apply for it.

| Financial products offered* | Savings account with Certificate of Deposit (CD); Individual Retirement Accounts (IRAs); Personal checking account; Money Market account; My Auto Loan; Jumbo savings account, and more. *Terms apply. |

| Fees* | No monthly fees for the Jumbo savings account, CD savings account; From $0 to $10 service charge for the personal checking account; $10 (personal) and $12 (commercial) for the Money Market account; and more *Terms apply. |

| Minimum balance | $1,000 account minimum. |

| Investment choices | CD investment; Savings account. |

Also, you can find other financial products that will make your life easier. You can find IRA accounts, auto loans, savings accounts, and other incredible products for your everyday spending.

Keep reading this Crescent Bank review to see how this bank works. Maybe this is just what you’re looking for!

How is banking with Crescent Bank?

You can find many benefits while banking with Crescent Bank. Also, you can join this bank to get the many savings accounts they offer.

You can join the Jumbo savings account and earn a 0.80% APY to save even more money each year!

Moreover, you can get a Certificates of Deposit account to earn a 2.75% APY on a 12 month CD! Also, you can check the rates daily on their website.

In addition, you can find auto loans to help you get your dream car! You can make automatic payments and manage your transaction history in the mobile app!

Also, you can find a personal checking account with as little as a $100 minimum opening deposit. And you can even get a debit card with this account!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Crescent Bank experience: is it trustworthy?

You can be sure that your banking experience with Crescent Bank will be as safe as possible. Also, you can be sure that some of their accounts are FDIC insured!

Also, you can find that you can open your CD account for no fees. However, you may be charged some fees if you don’t follow the terms and conditions.

And as you may know, this bank also has some downsides as with any other bank. So, you can read our list below of the pros and cons of banking with Crescent Bank we found in our review.

Pros

- Many varied financial products are available;

- Auto loan available;

- High-yield savings account;

- CD savings account;

- No fees for some products.

Cons

- There are no credit cards available;

- You may pay some fees with some products.

Should you choose Crescent Bank?

If you’re looking for a bank that follows some traditional banking aspects but also has some modern banking, you may like this bank.

Also, you can use this bank to see if you enjoy their customer service. And if you don’t like it, you can easily close your account and look for an option that best suits your financial needs.

How to start banking with Crescent Bank?

It can be easy to start banking with Crescent Bank. All you need is to go to your computer and find the official website to provide the personal information required!

And if you need some guidance, the following content will give you a walkthrough of the application process.

How to apply for Crescent Bank financial products?

If you're interested about Crescent Bank services, you can read this post to learn hwo to join and apply for it.

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Upgrade Triple Cash Rewards Visa® Card application

Upgrade Triple Cash Rewards Visa® is a hybrid credit card and personal loan. Learn how to apply for one and enjoy unlimited cash back!

Keep Reading

How to apply for the U.S. Bank Cash+® Visa Signature® credit card?

The U.S. Bank Cash+® Visa Signature® credit card is a good choice if you want a variable reward program with no annual fee. See how to apply!

Keep Reading

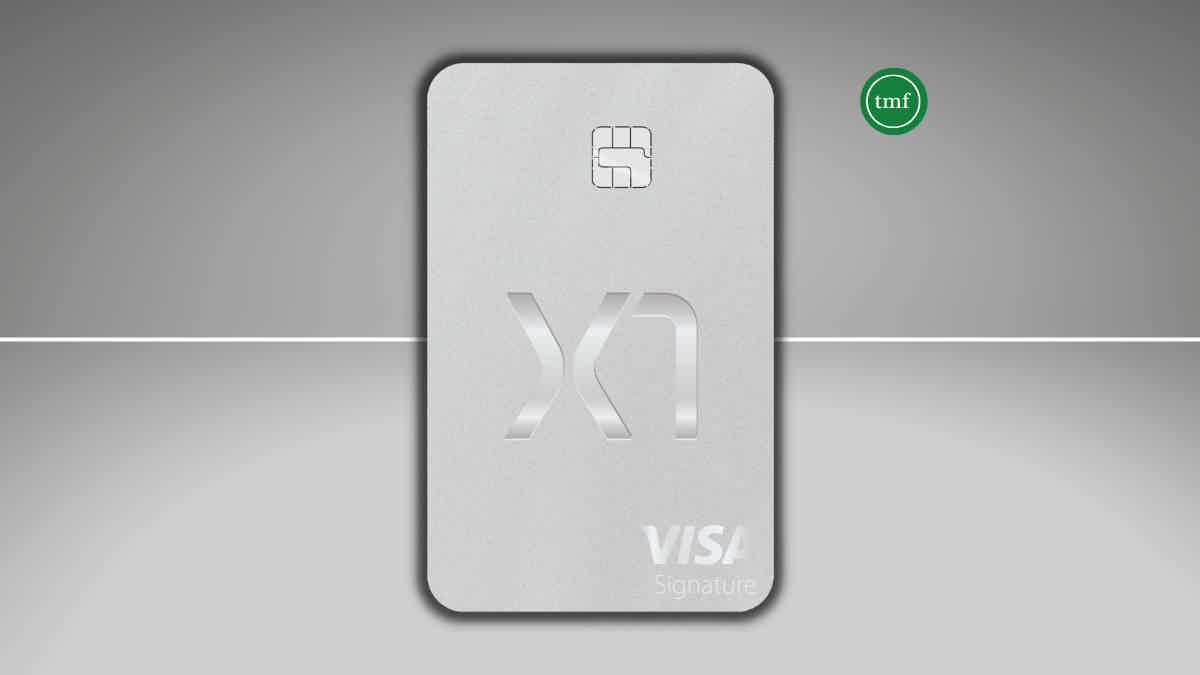

How to apply for the X1 Credit Card?

Do you need a reliable and flexible credit card to help make your financial dreams come true? Read on to apply for the X1 Credit Card!

Keep ReadingYou may also like

First Citizens Bank Rewards Credit Card Review: 0% intro APR

First Citizens Bank Rewards Credit Card: Should it be your next card? It boasts no annual fee and rewards on everyday spending. We break it down in our post. Read on!

Keep Reading

The US economy could enter a state of stagflation soon

Mohamed El-Erian, the chief economic adviser at Allianz, warns that stagflation is likely unavoidable even if the Federal Reserve manages to avoid a full-fledged recession. Read more below.

Keep Reading

10 Types of Credit Cards You Should Know About

Find out what types of credit card can be better for you and your lifestyle, from travel rewards cards to cash back. Keep reading!

Keep Reading