Finances (US)

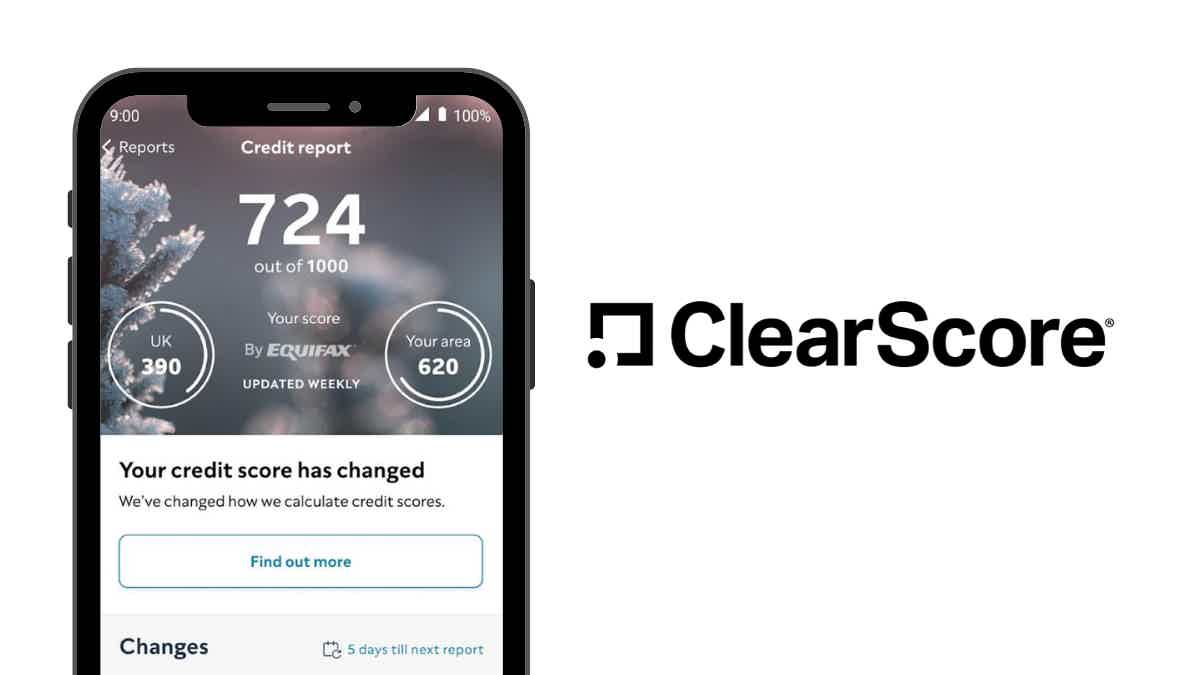

ClearScore full review: learn more about your score!

If you're a British person interested in keeping track of your score, you'll find great use of our post with a ClearScore review. So, read on!

ClearScore: monitor your score for free!

Do you want to be able to keep an eye on your credit score? Our post with a ClearScore review can help you out! We’ll explain how the platform works and what benefits it has to offer.

Learn how to join Clear Score

Are you looking to keep tabs on your credit score? Wondering how it works and how to monitor it? So, read on to learn how to join ClearScore!

Moreover, if you’re a British person who is interested in your credit score, you’ll find great benefits with ClearScore. You can check your credit score and credit report for free at any time!

There are other incredible features for you to monitor your score and learn more about. Plus, you can even learn how to increase your score to get better loan and credit card deals!

So, if you’re interested in monitoring and increasing your score, keep reading our ClearScore review to learn more!

How does ClearScore work?

If you like to keep track of your finances, you probably know that monitoring your credit score is important. Also, you can find platforms to check your credit score and credit report for free!

And ClearScore is one of the best British credit score monitoring platforms in the market! Moreover, you can learn how to increase your score and get protection and other perks!

For example, you can check your credit score and review your credit report for free with ClearScore. However, you’ll need to pay for some extra useful services.

Also, you can get access to identity protection monitoring. With this, you can find out if your data has been exposed somewhere on the web. Also, you can see what data has been exposed.

Moreover, you can check your bank transactions and others to identify fraud as fast as possible if it happens.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

ClearScore benefits

This credit score monitoring service offers incredible perks for those who want to monitor and improve their score. You can also find credit cards and loan options with personalized offers on the website.

Moreover, you can track and review your credit report and check your credit score for free through ClearScore platform.

Also, you can find information about your credit score and how to increase it to help you take better care of your finances.

In addition, you should know that there are also some downsides to this credit score monitoring tool, as with any other. Therefore, check out our list below with the pros and cons we found in this ClearScore review!

Pros

- Track your credit report and monitor your credit score for free;

- Find identity protection features to keep your data safe;

- You can get access to personalized credit cards and loan offers.

Cons

- The platform is only available in certain countries;

- You need to pay for some extra services offered.

Should you use the ClearScore platform?

If you live in the United Kingdom, South Africa, Australia, or Canada, you can find this platform’s services to enjoy. Also, you can use ClearScore to review your credit reports, increase your score and get other data protection.

Moreover, if you have the time and plan to improve your finances and keep track of your score, ClearScore can be an incredibly helpful platform!

How to join ClearScore?

You can easily join ClearScore with your best email and enjoy the benefits you saw listed in this review. Also, you’ll need to provide some other information to help them keep track of your score!

The following content will tell you everything about the process to start using Clear Score.

Learn how to join Clear Score

Are you looking to keep tabs on your credit score? Wondering how it works and how to monitor it? So, read on to learn how to join ClearScore!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for RoadLoans?

If you need a car but don't have the money to get one, you can learn how to apply for a loan with RoadLoans! Read on to learn more!

Keep Reading

Chase Freedom Flex℠ vs Chase Freedom Unlimited® card: Which is the best?

Do you need a card with valuable cash back rewards? Read more to know which one is best: Chase Freedom Flex℠ or Chase Freedom Unlimited®!

Keep Reading

American Express® Business Line of Credit review: grow your business faster!

If you have a business and are looking for a loan, you can read our American Express® Business Line of Credit review to learn more!

Keep ReadingYou may also like

Chase Freedom Unlimited® review: is it worth it?

Chase Freedom Unlimited® is a simple, straightforward product. Its 1.5% cash back on all purchases makes it easy to earn rewards no matter where you shop. And, there's no annual fee! Read our review to learn about its features.

Keep Reading

Sam´s Club Credit Plus Member Mastercard credit card review: is it worth it?

Find out if the Sam’s Club Credit Plus Member Mastercard credit card is right for you. This no-annual-fee option offers rewards on gas, dining, and select popular categories. Read this review to learn more!

Keep Reading

10 reasons not to refinance your home

Is refinancing your home right for you? Here are 10 compelling reasons why you might want to think twice when refinancing your home. Keep reading!

Keep Reading