Finances (US)

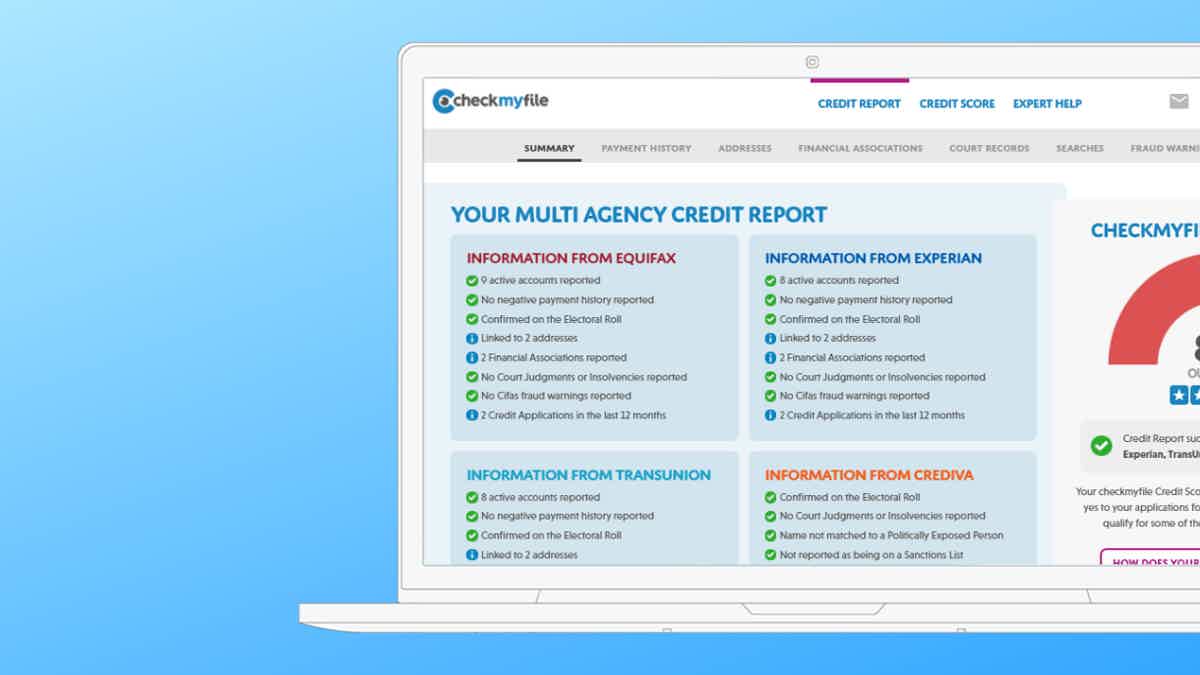

Checkmyfile review: check your report for free

Do you need to check your report to improve your finances and get professional help to keep track of it? If so, read our Checkmyfile review!

Checkmyfile: try for free for 30 days!

Are you looking for a way to improve your finances by managing your credit score? If so, you’re in the right place because, in this Checkmyfile review, you’ll learn all about this platform!

How to join Checkmyfile?

If you are looking for a credit score monitoring platform in the UK, check out our post about how to join Checkmyfile!

Also, with Checkmyfile, you can get access to your score and credit report from Equifax, Experian, and others! So, you’ll get a complete view of how your financial situation is for free for 30 days!

Moreover, you can get a personalized view of your credit score to help you improve your finances even more!

Therefore, we all know that raising your credit score and keeping track of it is the best way to improve your finances. Moreover, you can even start to save more money to reach some financial goals!

So, if you want to start building a healthier financial life, check out our Checkmyfile review!

How does Checkmyfile work?

This credit report platform allows you to keep track of your credit score and your finances to improve them. Also, you can find their services available mainly in the UK.

Plus, you can get your financial data from four different credit agencies, not just one. So, you can get your credit report and financial data from Equifax, Experian, TransUnion, and Crediva!

This way, you’ll be able to really know what your credit score is. And you’ll be able to have an idea if your score is good to get the loan you need or the credit card you wish to apply for.

Plus, you can get access to your free credit report for 30 days!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Checkmyfile benefits

As we mentioned, you can find many benefits when joining the Checkmyfile platform. You can get help to find errors on your credit report. With this, you’ll be able to learn how to report these errors.

Then, you can always have a professional helping you in keeping track of your finances. And you’ll be able to have a credit report that is always correct with no errors if you make the right use of this platform!

However, as with any other credit reporting platform, this one also has some downsides. For example, you’ll only get the free version for 30 days. After that, you’ll need to pay a £14.99 monthly fee to keep using it.

But you’ll be able to cancel at any time through the phone! So, check out our list below of the pros and cons of this Checkmyfile review!

Pros

- You can check your credit report and score for free for 30 days;

- There are professionals available to help you.

Cons

- You’ll need to pay a £14.99 monthly fee after 30 days of free use.

How good does your credit score need to be?

You don’t need to have a high credit score to join this platform. You only need to provide your information and the need to build and keep track of your score.

How to join Checkmyfile?

You can easily join the Checkmyfile platform to check your report. However, you’ll need to provide your financial information and credit card info to start making the payments after 30 days of free use!

How to join Checkmyfile?

If you are looking for a credit score monitoring platform in the UK, check out our post about how to join Checkmyfile!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Buy On Trust Lending?

The Buy On Trust Lending is a great choice if you don’t have a good credit score and want flexibility on payments. See how to apply!

Keep Reading

Dubai First Royale credit card full review

The Dubai First Royale credit card is made for the most exclusive people in the world. Learn more about this luxurious card.

Keep Reading

Who are the Capital One airline partners?

Are you a Capital One customer looking for ways to enjoy the benefits of Capital One airline partners? Read on to learn more about them!

Keep ReadingYou may also like

Earn up to 4% back: Verizon Visa® Card Review

From earning cashback on everyday expenses to enjoying travel benefits, the Verizon Visa® Card has something for everyone. Have a look!

Keep Reading

Chase Sapphire Reserve® review: Free airport lounge access worldwide

Are you thinking of jet-setting with a new travel card? Check out our Chase Sapphire Reserve® review and see if it's just what you need for your next adventure. Read on!

Keep Reading

Merrick Bank Double Your Line® Secured Credit Card review

In this Merrick Bank Double Your Line® Secured Credit Card Review, you'll learn more about this secured card that offers customers a low annual fee and double limit. Keep reading!

Keep Reading