Credit Cards (US)

Capital One SavorOne Rewards Credit Card review

Check out our Capital One SavorOne Cash Rewards Credit Card review and learn all about its perks, such as zero annual fee, cash back, and more!

Capital One SavorOne Rewards: Earn more on what you spend the most on!

Who doesn’t enjoy food and TV? Capital One knows it all, and thinking about it, launches a credit card that rewards you in these categories, the Capital One SavorOne Rewards Credit Card!

This card offers an unlimited 3% cash back on dining, entertainment, streaming services, and grocery stores (excluding superstores like Walmart® and Target®). So, if you spend time enjoying these categories, this card might be an option for you.

Even if you don’t spend time doing that stuff, you may be able to get it since it rewards all purchases, too.

Check out the full review right below!

| Credit Score | Good – Excellent |

| Annual Fee | $0 |

| Regular APR | Purchase APR: 19.74% – 29.74% (Variable); Balance Transfer APR: 19.74% – 29.74% (Variable); Cash Advance APR: 29.74% (Variable). |

| Welcome bonus | $200 after spending $500 on purchases in the first 3 months |

| Rewards | Up to 3% cash back on dining, entertainment, streaming services and grocery stores (excluding superstores like Walmart® and Target®). |

How to get a Capital One SavorOne Rewards?

Earn cash back on all purchases with Capital One SavorOne Rewards! See how to apply for it!

How does the Capital One SavorOne Rewards credit card work?

Firstly, let’s talk about the rewards. This credit card offers unlimited 1% cash back on all purchases, but the tier of 3% is focused on dining, entertainment, streaming services, and groceries.

Secondly, there is an even higher tier of 8% cash back when you purchase tickets at Vivid Seats, as well. The rewards earned don’t expire, and you can redeem them as you wish.

Plus, it gives you a welcome bonus in cash and an introductory APR of 0% on purchases and balance transfers for 15 months. Then, 19.74% – 29.74% variable APR after that

Also, it doesn’t charge any annual fees. And there are no foreign transaction fees, too.

Furthermore, as a Capital One cardholder, you can enjoy all its benefits, such as 24/7 complimentary Concierge Service, travel insurance and assistance, exclusive access to events and experiences, $0 Fraud Liability and security alerts, mobile app, and more.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One SavorOne Rewards benefits

A Capital One SavorOne Rewards comes with all you need from a credit card: rewards, bonuses, protection, convenience, agility, low fees, and more.

If you spend a lot of time and money with food, streaming services, groceries, and entertainment stuff, you should take a chance for this card as it will pay you back in cash back on every purchase you make in or out of those categories.

However, note that it requires at least a good credit score, which means you must have over 670 punctuations.

Pros

- Unlimited 3% cash back on dining, entertainment, some streaming services, and groceries

- 8% cash back on tickets at tickets at Vivid Seats

- 1% cash back on all other purchases

- No annual or foreign transaction fees

- Welcome bonus

- Intro APR

- Flexible redemption program

- Extended Warranty

- Travel insurance and assistance

- Complimentary Concierge Service

- Exclusive access to events and experiences

- Access to CreditWise

- Security alerts and $0 Fraud Liability

- Capital One mobile app available with 24/7 Customer Service

Cons

- It requires at least a good credit score

How good does your credit score need to be?

As you have read above, this card has plenty of features you can benefit from at a low cost. But the price you pay for all of it is the high credit score required for the application.

How to apply for a Capital One SavorOne Rewards?

I imagine that you got interested in getting your own Capital One SavorOne Rewards credit card. So, learn now how to apply for one!

How to get a Capital One SavorOne Rewards?

Earn cash back on all purchases with Capital One SavorOne Rewards! See how to apply for it!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

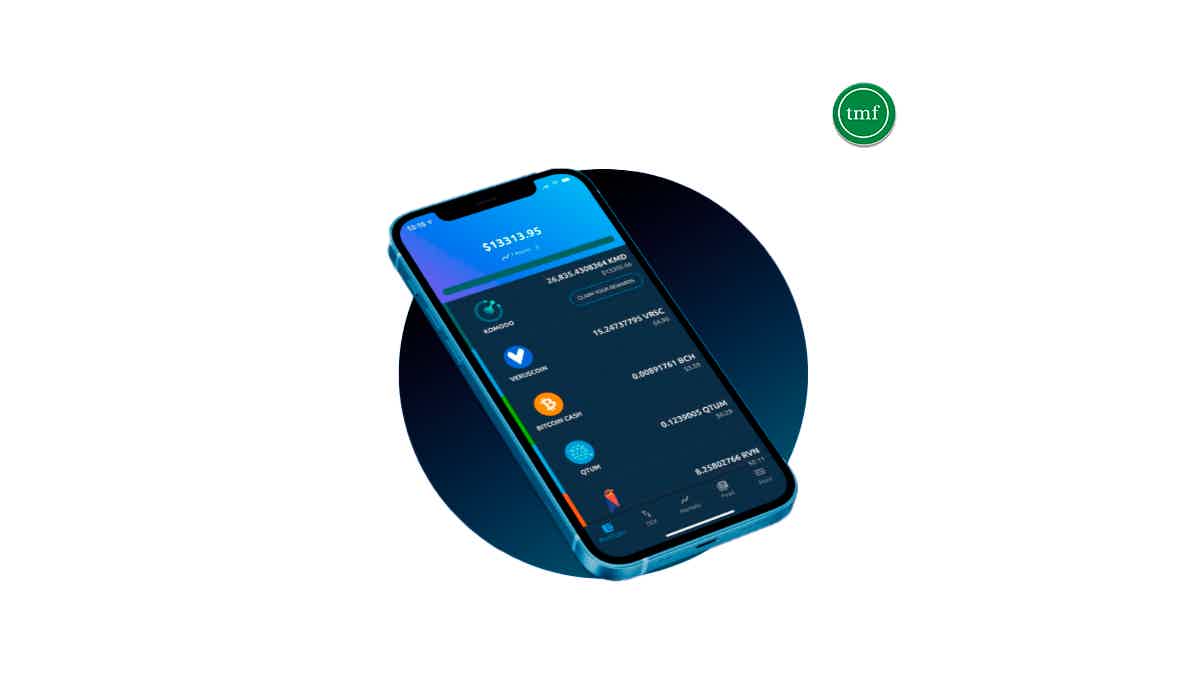

AtomicDEX crypto wallet full review: is it safe?

Check out this AtomicDEX crypto wallet review before deciding which wallet is the best for your investments. Learn all there is about it now!

Keep Reading

How to apply for the Flare Account® by Pathward, N.A.?

Check out how to apply for the Flare Account® by Pathward N.A. Enjoy convenience and cashback rewards using the mobile banking app!

Keep Reading

Food Distribution Program on Indian Reservations (FDPIR) review

Check out the Food Distribution Program on Indian Reservations (FDPIR) review article and learn how it works and the qualification process.

Keep ReadingYou may also like

Learn to apply easily for 247LoanPros

A personal loan can be a great way to handle any expenses that pop up unexpectedly. Here is how you can apply for one with 247LoanPros in just a few minutes. Read on!

Keep Reading

Upgrade Cash Rewards Visa® application: how does it work?

You can apply for an Upgrade Cash Rewards Visa® in a couple of minutes without leaving your house to do it. Learn how to apply online for your new credit card.

Keep Reading

Calm App review: Find relaxation to your anxious mind

If you're feeling overwhelmed and stressed, the Calm App review can help. In this post, we'll show you how it works and some of its best features. Stay tuned!

Keep Reading