Credit Cards (US)

Capital One Quicksilver Rewards for Students full review

Capital One features a credit card full of perks and rewards with no annual or foreign transaction fees whatsoever. Readout the Capital One Quicksilver Student Cash Rewards Credit Card review!

Capital One Quicksilver Rewards for Students: no annual fee and unlimited 1.5% cash back!

Capital One is one of the largest banks in the U.S., specializing in credit cards. You may find the right one for you, and we are here to help you with it! Today, we have brought to you the Capital One Quicksilver Rewards for Students review, a card that gives you rewards with no annual fee.

Also, it helps you build your credit history as you responsibly use this card.

Keep reading this article to find out more about its features and perks!

| Credit Score | No credit history. |

| Annual Fee | $0 |

| Regular APR | Purchase APR: 19.74% – 29.74% (Variable); Balance Transfer APR: 19.74% – 29.74% (Variable); Cash Advance APR: 29.74% (Variable). |

| Welcome bonus | $50 when you spend $100 in the first three months |

| Rewards | 5% cash back on hotel and rental car bookings through Capital One Travel. 1.5% cash back on all purchases |

How to get a Capital One Quicksilver Student card?

Earn unlimited 1.5% cash back on eligible purchases with Capital One Quicksilver Rewards for Students card! Check out how to apply for it today!

How does the Capital One Quicksilver Rewards for Students credit card work?

First of all, this Capital One card offers 5% cash back on hotel and car rentals. And 1.5% cash back on all other purchases.

Also, those rewards don’t expire while your account is active, and there is no minimum amount to redeem them.

And you can redeem them for cash, cover purchases, or get gift cards.

Third of all, by being a Capital One cardholder, you get the following benefits:

- Extended Warranty;

- Travel Accident Insurance and assistance services;

- Complimentary Concierge Service;

- Special culinary, sports, and music access;

- $0 Fraud Liability;

- Security Alerts;

- Credit reports and free access through CreditWise;

- 24/7 Customer Service;

- Capital One mobile app.

Plus, all of those perks with no annual or foreign transaction fees whatsoever.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One Quicksilver Rewards for Students benefits

Let’s review the upsides of getting this card. Firstly, you don’t need a perfect credit history to apply for it. In fact, it helps you build your credit score when you use it responsibly.

Moreover, you earn cash back on all purchases you make.

Furthermore, there are no hidden fees.

Also, it offers an intro bonus of $50 after spending $100 in your first three months, and the APR is relatively high compared to the market.

Pros

- Earn up to 5% cash back on hotel and rental car bookings through Capital One Travel;

- 1.5% cash back on eligible purchases;

- Get security, protection, warranty, travel insurance, and more;

- Feel peace of mind with $0 Fraud Liability;

- It helps you re-establish a good credit score;

- There are no annual or foreign transaction fees;

- Get outstanding customer service;

- Access special events;

- Get free access to your credit score through CreditWise.

Cons

- The APR is relatively high.

How good does your credit score need to be?

This card helps you build your credit history. So, it requires no credit history for application.

How to apply for Capital One Quicksilver Rewards for Students?

If you want to start the year earning cashback and paying a $0 annual fee, check out how to apply for a Capital One Quicksilver Rewards for Students right away!

How to get a Capital One Quicksilver Student card?

Earn unlimited 1.5% cash back on eligible purchases with Capital One Quicksilver Rewards for Students card! Check out how to apply for it today!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Wells Fargo Reflect℠ credit card review

This Wells Fargo Reflect℠ credit card review post will take you on a tour of how this card works and if it could be yours! Check it out now!

Keep Reading

First Savings Credit Card vs Fit Mastercard card: Which is the best?

Do you have bad credit score and need a card? If so, read more to know which one is best: First Savings Credit Card or Fit Mastercard!

Keep Reading

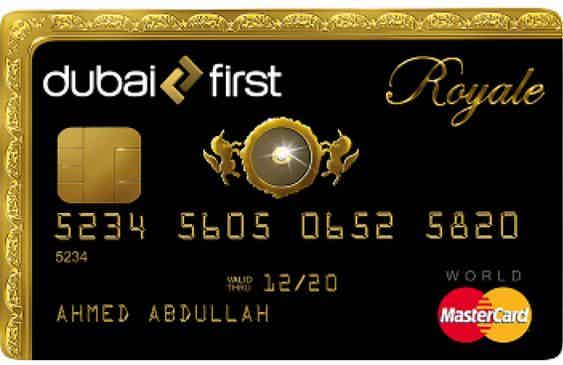

Dubai First Royale credit card full review

The Dubai First Royale credit card is made for the most exclusive people in the world. Learn more about this luxurious card.

Keep ReadingYou may also like

Apply For the OpenSky® Plus Secured Visa®

Achieving financial stability and freedom requires building credit, but it can be tough with limited or poor credit history. Discover how to apply for the OpenSky® Plus Secured Visa® Credit Card today!

Keep Reading

How to buy cheap Spirit Airlines flights

If you want to buy cheap Spirit Airlines flights, we've got you covered. Check out our tips on getting the best airfare deals! Keep reading!

Keep Reading

Milestone® Mastercard® - Less Than Perfect Credit Considered review

If you've been struggling with your low credit, the Milestone® Mastercard® - Less Than Perfect Credit Considered may be the perfect solution for you!

Keep Reading