CA

Capital One Guaranteed Mastercard® Credit Card review

Do you want a credit card that can help you build your credit score? If so, read our Capital One Guaranteed Mastercard® Credit Card review to learn more about it!

Capital One Guaranteed Mastercard® Credit Card: build credit with travel benefits

Are you looking for a credit card that can help you build or rebuild your credit history? Check out our Capital One Guaranteed Mastercard® Credit Card review to learn more about this excellent Capital One card!

| Credit Score | Poor score. |

| APR | 19.8% (variable for purchases and balance transfers). |

| Annual Fee | $59. |

| Fees | There is an APR of 21.9% (variable for cash advances). |

| Welcome bonus | There is no welcome bonus. |

| Rewards | There is no rewards program. |

How to apply for Capital One Guaranteed Mastercard

Do you need a card to build credit that guarantees approval? Learn about the Capital One Guaranteed Mastercard® Credit Card application!

The Capital One Guaranteed Mastercard® Credit Card comes with some incredible benefits for those who need to build or rebuild credit.

This Capital One credit card reports to all three major credit bureaus. Also, if you fit the requirements, you can even get travel benefits and other perks! So, keep reading our review to learn more about this card!

How does the Capital One Guaranteed Mastercard® Credit Card work?

With this Capital One credit card, you can build or rebuild your credit score. This way, even if you have a very poor score, you can get approved and start using the card.

Also, if you fit the requirements, you can get access to travel benefits. Moreover, you can get Common Carrier Travel Accident Insurance, travel assistance, and more!

However, to get some of these additional benefits, you’ll need to get approved to get the Gold card.

But you don’t need to worry because if you can’t get approved for the gold card, you’ll just get a Secured version of the card!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One Guaranteed Mastercard® Credit Card benefits

As we mentioned, this Capital One card offers incredible benefits to its cardholders. Also, you can try to get approved for the Gold card version. And if you are, you can get travel benefits and purchase perks!

However, if Capital One does not approves you for the Gold card, you’ll get the Secured card, which can be incredible as well.

With the Secured card, you can get a credit limit and send your payment reports to all three major credit bureaus. This way, you’ll rebuild your credit and get the chance to apply for a regular unsecured card.

Pros

- With the Secured version, you can get travel and purchase benefits.

- The Secured version allows you to rebuild credit.

Cons

- You may not get approved for the Gold version of the card, which has the best benefits.

- There is Zero Liability Protection.

How good does your credit score need to be?

You don’t need a high credit score to qualify for this card. If you don’t have a high score, you’ll get the Secured version.

How to apply for Capital One Guaranteed Mastercard® Credit Card?

You can easily apply online for this credit card. All you need to do is click on the link below and check out our post to learn all about the application process!

How to apply for Capital One Guaranteed Mastercard

Do you need a card to build credit that guarantees approval? Learn about the Capital One Guaranteed Mastercard® Credit Card application!

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Retirement Planning in Canada: a guide to start

Retirement planning is a very important part of life. So, read more to learn about retirement planning in Canada and get other tips!

Keep Reading

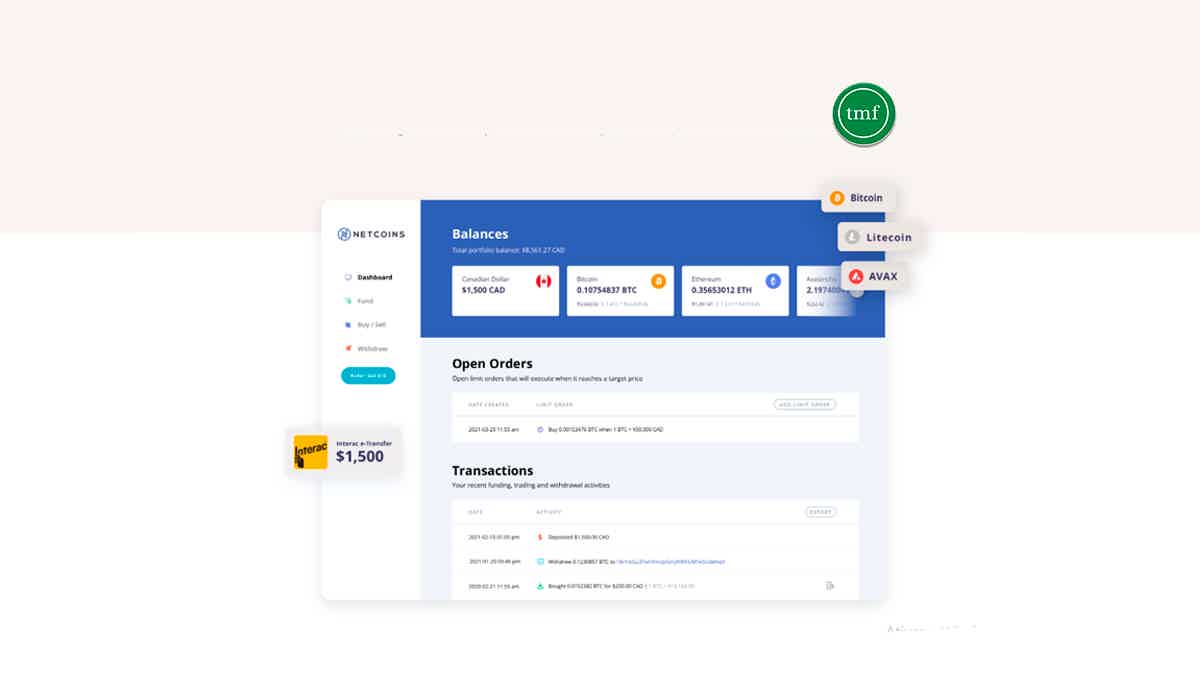

Netcoins wallet review: no funding fees

Looking for a crypto wallet with no funding fees and free cash withdrawals? Check out our Netcoins wallet review to learn more!

Keep Reading

BMO InvestorLine full review

BMO offers a self-directed investment account for you to have the freedom to invest your money. See the BMO InvestorLine full review!

Keep ReadingYou may also like

Mogo Prepaid Card Review

By getting a Mogo Prepaid Card, you can save money while reducing your environmental impact. Check our Mogo Prepaid Card review to learn all that this product can do for you and for the planet.

Keep Reading

Veterans United Home Loans review: how does it work and is it good?

Veterans United Home Loans could help finance your dream home. Enjoy no down payment loan options and more! Keep reading!

Keep Reading

OneMain Financial Personal Loan review: how does it work and is it good?

Our ultimate OneMain Financial Personal Loan review will help you discover what makes them unique. Borrow up to $20,000!

Keep Reading