CA

BMO InvestorLine full review

If you are a self-directed investor in Canada, you should take a look at this review. The BMO InvestorLine gives you the freedom to invest on your own and tools to help you through this process!

BMO InvestorLine review

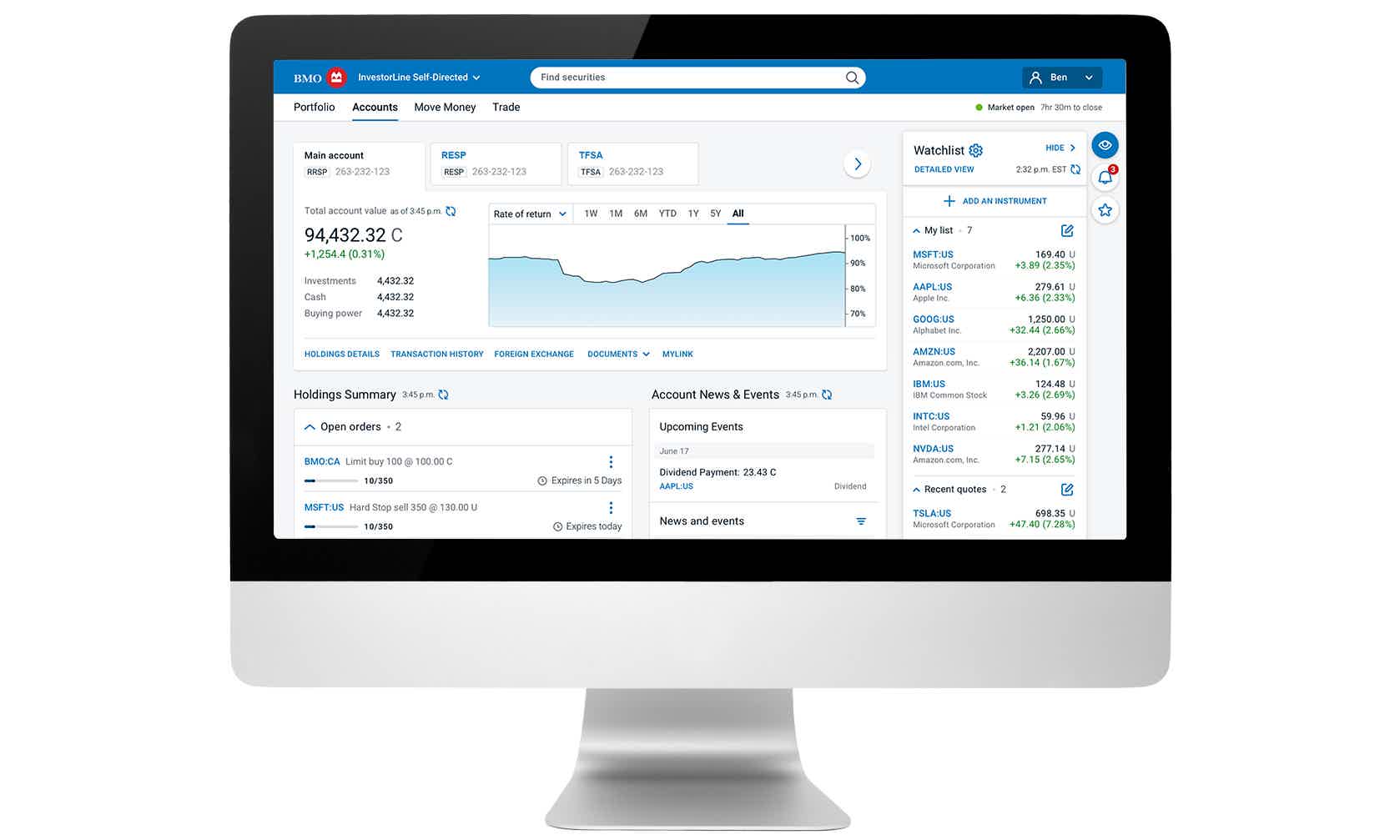

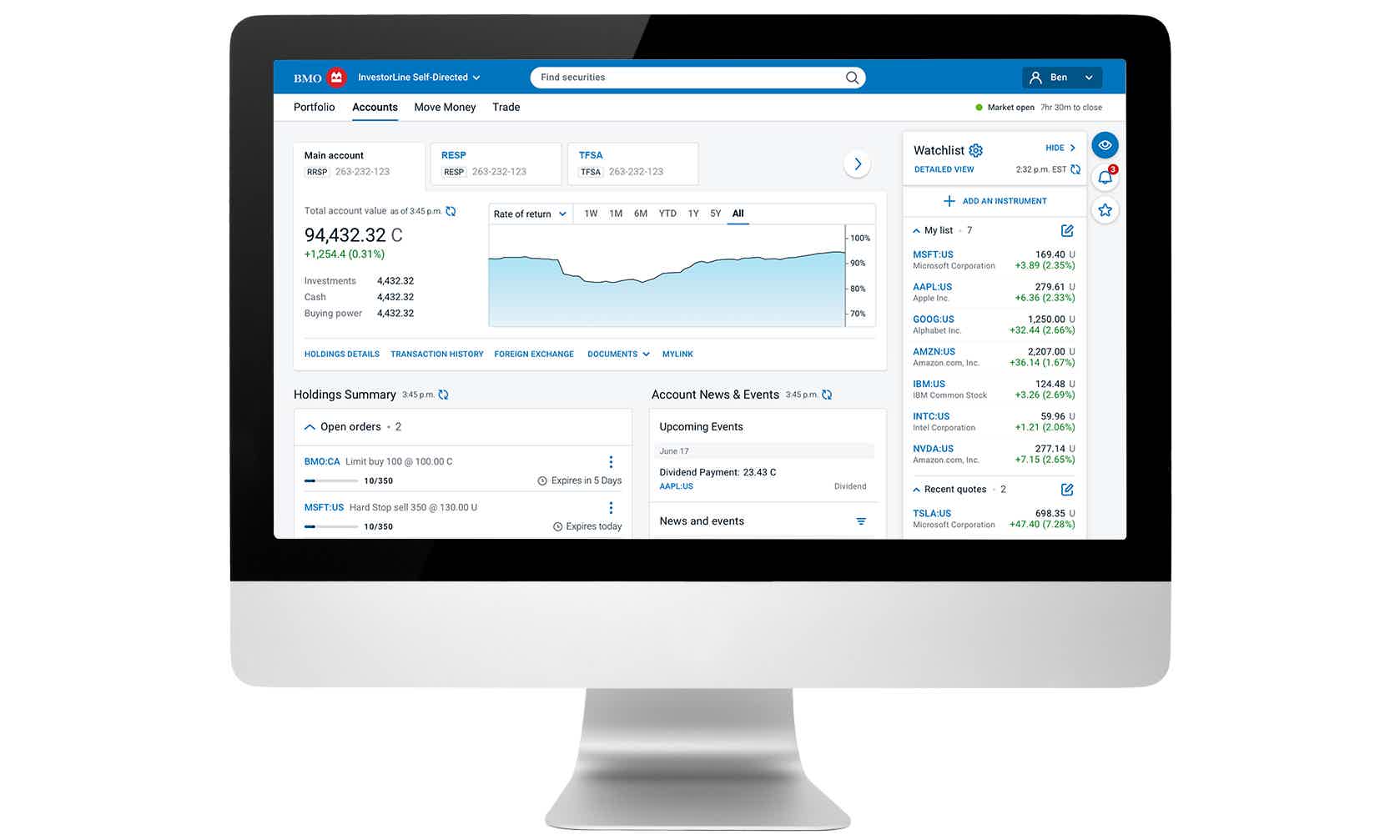

The BMO features an online investing platform where you can access real-time data and invest on your own. And in this BMO InvestorLine review, you’ll learn all about it!

This self-directed account offers support and service when you need it, so you don’t need to worry about being left alone while investing as you want.

Also, it gives you investment choices with low trading fees.

Plus, you can get a special promotion of cash back when opening the account.

| Trading fees | $9.95 per trade, plus terms apply for others investment choices |

| Account minimum | $0 |

| Promotion | Get up to $2,000 cash back when opening the account |

| Investment choices | Stocks, ETFs, Fixed Income Assets, Options, Mutual funds |

How to join the BMO InvestorLine?

BMO InvestorLine offers you a self-directed account with reasonable trading fees. Learn how to join it!

How does BMO InvestorLine work?

If you search for popular ETFs in Canada with commission-free, BMO InvestorLine can help with that. It selects some ETFs so you can invest in them with no trading fees.

But, the regular fees are $9.95 per trade, plus $1.25 per options contract.

On the other hand, there is no account minimum required, plus you can get a promotion by joining BMO.

Even though it is self-directed, it offers professional support when you ask for it. Plus, it provides you with research and performance tracking tools so you can invest with confidence.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

BMO InvestorLine benefits

This investment account is an option for those who want reasonable fees for different choices of investment.

Also, you don’t need to be an expert since it gives you the support you need. Plus, the platform seems pretty robust and focused on user experience.

But, it charges fees per trade and other account fees, a little higher than average in the market.

Pros

- A good and robust online platform with performance tracking and research

- You can get a promotion when opening the account

- Self-directed account with support

- It doesn’t require an account minimum

- Some ETFs are commission-free

Cons

- It charges trading fees

- According to some clients, the mobile app is not that responsive and integrated

Should you join BMO InvestorLine?

BMO InvestorLine is an option for those who are self-directed investors looking for a robust online platform that offers tools and support.

Can anyone open an account?

To open an account, you need to be a Canadian resident with a valid Social Insurance Number. Also, you will need an electronic signature and an investor profile.

How to open a BMO account?

Are you a self-directed Canadian investor searching for an online platform with tools and support to make your own investment decisions? Then, check out how to join BMO.

How to join the BMO InvestorLine?

BMO InvestorLine offers you a self-directed account with reasonable trading fees. Learn how to join it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

RBC Bank review: is it trustworthy?

Whether you are a newcomer, a student, or a permanent resident looking for retirement planning, this RBC Bank review is for you! Check it out!

Keep Reading

Alpine credits full review: get a loan for your home

If you're looking for a loan for an emergency, Alpine Credits can help you out! So, read our Alpine Credits review to learn more about it!

Keep Reading

How to trade in the Bitbuy wallet?

Do you need to start trading with little money? You can learn how to trade with the Bitbuy wallet with as little as $50! So, read on!

Keep ReadingYou may also like

Learn how to download the Breathwrk App and manage your anxiety and stress

If you want to improve your anxiety and well-being, learn how to download the Breathwrk app. Here's the complete guide. Read on!

Keep Reading

Milestone® Mastercard® - Less Than Perfect Credit Considered review

If you've been struggling with your low credit, the Milestone® Mastercard® - Less Than Perfect Credit Considered may be the perfect solution for you!

Keep Reading

U.S. Bank Smartly™ Checking application: how does it work?

Applying for U.S. Bank Smartly™ Checking just got easier! Discover all the ways to apply, whether through our website or with your phone - and we will provide every step of the way. Read on!

Keep Reading