Finances (US)

Best banks for business loans: 4 options!

When looking for a business loan, finding a bank that understands your needs is important. So, read our post to see a list of the best banks for business loans!

See how the best banks for business loans work!

Do you need access to capital to grow your business? If so, you’re likely considering obtaining a loan from a bank. And you probably want to know which are the best banks for business loans.

How to apply for the OnDeck Business Loans?

Learn how the OnDeck Business Loans application works so you can borrow a good amount of money with flexible terms to help your small business finally grow.

But how do you know which bank is the best for business loans? This blog post will explain how the best banks work and what you can expect when applying for a loan.

So, read on to learn more about the best banks for business loans, whether you’re just starting out or looking to expand!

Find out which are the best banks for business loans: 4 amazing options!

We all know that getting the best loan for your business can be definitive when trying to grow. So, that’s why we created a list with information about the business loans offered by the best banks.

So, if you want to grow your business even more than ever, read our list below of the best banks for business loans!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Kabbage®

With this bank’s line of credit, you’ll be able to grow your business just the way you need. Also, if you want to make early payments, there will be no prepayment fees.

In addition, you’ll get repayment terms ranging from 6 to 18 months! Plus, you’ll only need to pay fees for the amount you actually use as a line of credit! So read the table below to learn more about this option!

| APR* | There are monthly payments of 2% to 9% for loans of 6 months, 4.5 to 6.75% for loans of 12 months, and 6.75 to 27% for loans of 18 months. *Terms apply. |

| Loan Purpose | Business lines of credit. |

| Loan Amounts* | Anywhere from $2,000 to $250,000 (depending on the condition of your company). *Terms apply. |

| Credit Needed | Good to excellent. |

| Terms | 6, 12, or 18 months. |

| Origination Fee | N/A. |

| Late Fee* | The amount of interest added to the total amount due for a late payment ranges from $10 to $100. *Terms apply. |

| Early Payoff Penalty | N/A. |

And if you’re interested in learning more about this bank option, you can read our post below about how to apply for their business line of credit!

How to apply for Kabbage Funding™ from Amex?

Are you in the market for a flexible business loan? If so, read our post to learn how to apply for Kabbage Funding™ from American Express!

Bank of America

This bank can offer some of the best business loans on the market. With Bank of America, your small business can get the money it needs to grow.

Moreover, you can get many options for your business, such as an unsecured line of credit, secured lines of credit, and loans with no collateral!

Plus, you can choose these options based on your business needs and time of business. For example, for the unsecured option and the loans with no collateral, you’ll only need 2 years in business.

However, if you want the secured credit line, you’ll need to have six months in business. Therefore, this option allows you to get what you need for your company.

Read our table below to understand more about the main options available!

| APR* | Business credit line: Minimum of 7.50% interest rate; Secured line of credit: $150 annual fee; Unsecured business loans: Minimum of 6.75% fixed rates. *Terms apply. |

| Loan Purpose | Business credit lines, secured lines of credit, unsecured business loans, and more. |

| Loan Amounts* | Business credit line: From $10,000; Secured line of credit: From $1,000; Unsecured business loans: From $10,000. *Terms apply. |

| Credit Needed | Good. |

| Terms | Business credit line: Annual renewal; Unsecured business loans: From 12 to 60 months. |

| Origination Fee* | Secured line of credit: No origination fee; Unsecured business loans: $150 (if approved). *Terms apply. |

| Late Fee | N/A. |

| Early Payoff Penalty | N/A. |

Read the following content if you’d like to learn how to join Bank of America and get a business loan.

How to join Bank of America?

Learn how to join Bank of America so you can have access to plenty of financial products and services. All in one place. It is easy, and you can start right away.

Wells Fargo

This bank offers incredibly good business loan options and lines of credit. Whether you have a small or larger business, you’ll find the money you need for your company.

Moreover, you can check out our table below to see more about this bank’s business loans!

| APR* | SBA loans: Fixed or variable rates available; Business lines of credit: Prime rate + 1.75% (minimum); Small business advantage line of credit: Prime rate + 4.50% (minimum); *Terms apply. |

| Loan Purpose | SBA loans, business lines of credit, and more. |

| Loan Amounts* | SBA loans: Up to $5,000,000; Business lines of credit: From $10,000 to $100,000 (revolving credit line); Small business advantage line of credit: From $5,000 to $50,000 (revolving credit line). *Terms apply. |

| Credit Needed | It depends on the business loan type. |

| Terms* | SBA loans: Up to 25 years (commercial real estate) and up to 10 years (any other purpose). *Terms apply. |

| Origination Fee | N/A. |

| Late Fee | N/A. |

| Early Payoff Penalty | N/A. |

If you’re interested in getting a Wells Fargo loan for your business, you’ll want to learn how to apply for a personal loan from the same bank. So, read our post below to find out how to apply!

How to join Wells Fargo Bank?

Learn how to join Wells Fargo bank and take advantage of everything this traditional banking institution has to offer!

Chase

This bank offers incredible financial products to its customers. And one of these products is business loans. Chase offers varied business loans and business lines of credit for you to grow your business.

Moreover, you can find credit lines of up to $500,000 and much more to help you follow your business dreams. So, check out our table below to see the main perks of getting a loan or lines of credit through Chase!

| Loan Purpose | Business line of credit, small business loans, commercial real estate financing, and more. |

| Loan Amounts* | Business line of credit: Up to $500,000; Small business loans: Minimum of $5,000; Commercial real estate financing: Minimum of $50,000. *Terms apply. |

| Credit Needed | It depends on the business loan amount and type. |

| Terms* | Business line of credit: Five years (revolving terms); Small business loans: As long as 7 years; Commercial real estate financing: Flexible terms of up to 25 years (with amortization). *Terms apply. |

| Origination Fee | It depends on the business loan type and amount. |

| Late Fee | It depends on the business loan type and amount. |

| Early Payoff Penalty | It depends on the business loan type and amount. |

You can read the following content to learn how to join Chase Bank and enjoy all of these benefits.

How to start banking with Chase Bank?

Chase Bank is also known as JPMorgan Chase Bank and offers a complete package of financial products, services, and solutions for every need.

After checking out the options in our list of the best banks for business loans, you’ll be able to apply for the loan that best fits your business needs.

This way, you’ll use the loans to get your business plans off the paper once and for all!

And if you’d like to check one more option, we have one more recommendation. Lendio has loans for small businesses with low rates. Read the full review to learn more about it.

Lendio Small Business Loans review

Are you looking for a loan to grow your business? If so, read our post with a Lendio Small Business Loans review to see how this website works!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Capital One SavorOne Rewards vs Bank of America® Unlimited Cash Rewards card: Which is the best?

Who doesn't love cash back? Read more to know which one is best: Capital One SavorOne Rewards or Bank of America® Unlimited Cash Rewards!

Keep Reading

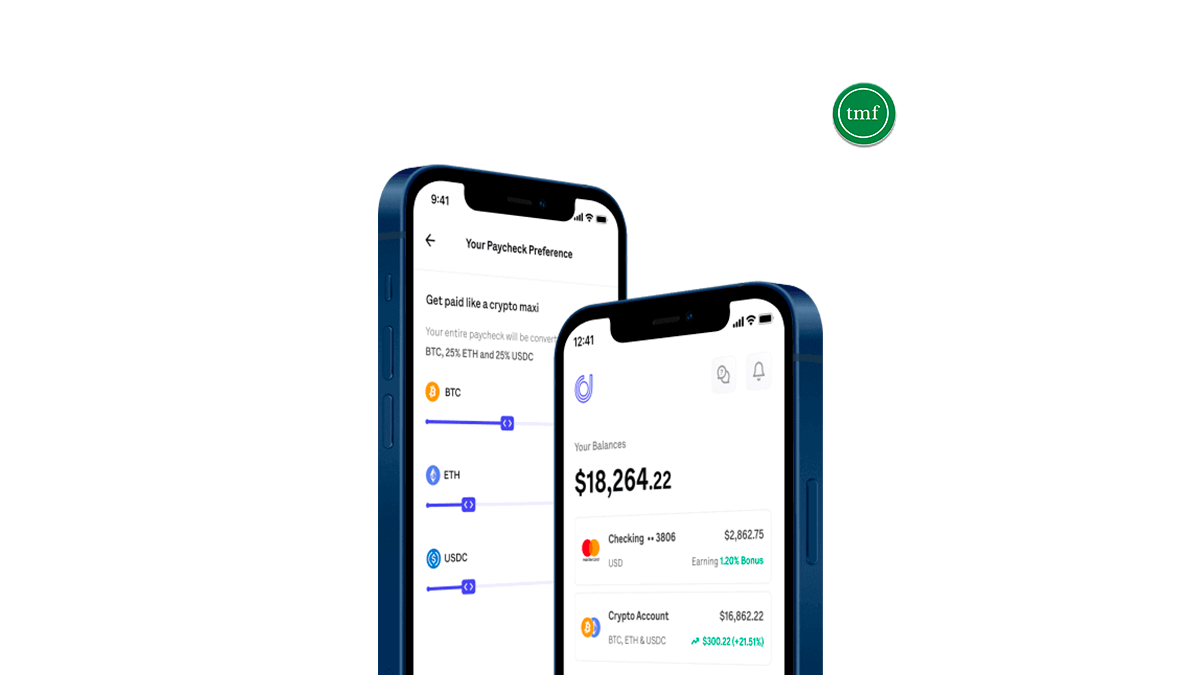

Juno Checking Account review: make investments!

Are you looking for a checking account that will let you get your money in crypto? If so, read our Juno Checking Account review!

Keep Reading

My Best Buy® Visa® Credit Card review: 5% cash back rewards!

If you're a fan of shopping at Best Buy, then you'll want to check out our My Best Buy® Visa® Credit Card review to learn all about it!

Keep ReadingYou may also like

Application for the Assent Platinum Secured credit card: how does it work?

If you are looking to improve your credit score, check how to apply to this great option - Assent Platinum Secured, a card designed for people with poor credit.

Keep Reading

Bank of America Customized Cash Rewards vs. Capital One Venture Rewards: card comparison

When it comes to picking a new credit card, there are a lot of options to choose from. Bank of America and Capital One offer great rewards cards, but which one is right for you? Take a look at our comparison to help you decide between Bank of America Customized Cash Rewards or Capital One Venture Rewards!

Keep Reading

Plain Green Loans Review: Financial Relief or Pitfall?

Get a same-day funding loan for your emergencies. Here is a Plain Green Loans review to understand the APR, loan amounts, and potential pros and cons. Stay tuned!

Keep Reading