Uncategorized

Barclaycard Rewards Card full review: cashback and no fees abroad

Check out how to earn cashback on all purchases while paying no annual fee and no fees abroad on this Barclaycard Rewards Card review.

Barclaycard Rewards Card: earn 0.25% cashback on everyday spending

This Barclaycard Rewards Card review will show you how this card works and how much it costs for you to earn cashback among other perks.

How to apply for the Barclaycard Rewards Card?

Learn how to apply for a Barclaycard Rewards Card and start earning 0.25% cashback on your everyday spend and other perks at no annual fee.

Basically, this Visa is a reasonable credit card for everyone. First, check out the summary below!

| Credit Score | Not disclosed |

| APR | 25.9% (variable)Other rates apply |

| Annual Fee | None |

| Fees | Cash transaction fee: 0.00% (£0.00 minimum) fee on sterling and non-sterling cash transactions; Balance transfer and purchase plans: fees depend on the offer; Copies of statements and transactions: none; Late payment: £12; Over credit limit: none; Returned payment: none; No fees abroad |

| Welcome bonus | None |

| Rewards | 0.25% cashback on everyday spending |

Now, continue reading to find out all the details about this card!

How does the Barclaycard Rewards Card work?

If you are looking for a credit card that offers cashback at low costs, this Barclaycard Rewards Card review is worth reading.

Firstly, this Visa features 0.25% cashback on your everyday spending, which means you get rewards on all of your purchases.

Secondly, there are no annual fees and no fees abroad. So, this card allows you to withdraw cash or purchase something overseas without charges.

In addition, Visa offers competitive exchange rates making this credit card a good option for travelers.

Thirdly, as a Barclaycard member, you access various benefits, including:

- Free Apple subscriptions (up to five months);

- 15% cashback on eligible purchases at participating retailers (by registering in the Barclaycard Cashback Rewards program);

- Exclusive offers and discounts through the Barclaycard Entertainment program;

- 24/7 Fraud Protection.

And you can get one free additional card for someone close to you.

However, it is important to mention that other fees apply. Also, Barclaycard allows you to calculate interest. So, before applying, find out your estimated rates to decide if this card is a good choice for you.

You will be redirected to another website

Barclaycard Rewards Card benefits

As can be seen on this Barclaycard Rewards Card review, this Visa is a fantastic option for consumers who want to save on fees while enjoying cashback on all everyday spending.

But, before getting one for you, take a look at the pros and cons!

Pros

- It offers 0.25% cashback on your everyday spending;

- It doesn’t charge an annual fee and fees abroad;

- It provides you with protection on purchases over £100 and 24/7 Fraud Protection;

- It features up to five months of Apple subscriptions for free;

- You can get access to the Barclaycard Cashback Rewards and Barclaycard Entertainment programs;

- It allows you to get one free additional card.

Cons

- Other fees apply, and rates are calculated based on your information.

How good does your credit score need to be?

Unfortunately, this information is not disclosed. On the other hand, you will be able to get approved if maintain a good credit score.

How to apply for a Barclaycard Rewards Card?

Then, learn how to apply for a Barclaycard Rewards Card if you are interested in earning cashback on all purchases.

How to apply for the Barclaycard Rewards Card?

Learn how to apply for a Barclaycard Rewards Card and start earning 0.25% cashback on your everyday spend and other perks at no annual fee.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What is home refinancing, and how to use it?

What is home refinancing? If you want to learn how home refinancing can change your financial life, keep reading our post!

Keep Reading

How to get Paramount Plus Streaming?

Are you looking to watch incredible shows in your free time? If so, read on to learn how to get Paramount Plus Streaming!

Keep Reading

How to apply for the American Express® Platinum Edge Credit Card?

Looking for a card with travel perks and rewards points? Read on to learn how to apply for the American Express® Platinum Edge Credit Card!

Keep ReadingYou may also like

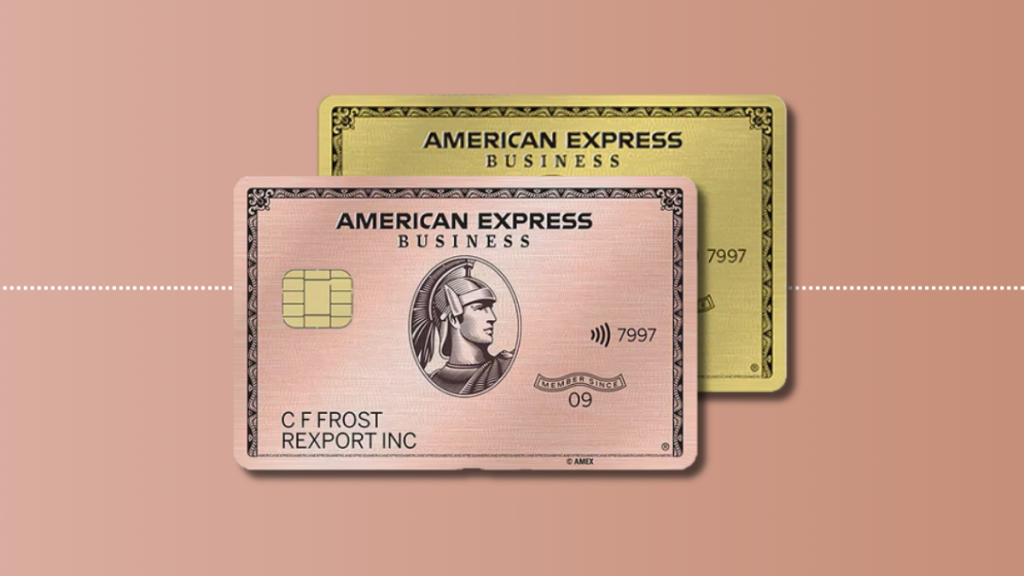

Gold benefits: American Express® Business Gold Card review

Looking for a card to help manage your business expenses? Here's the American Express® Business Gold Card! Earn points on every purchase and more!

Keep Reading

Indigo® Mastercard® for Less than Perfect Credit review: Get a card with no deposit

Check the review for the Indigo® Mastercard® for Less than Perfect Credit and what it can do to help improve your credit score. Keep reading!

Keep Reading

Buy On Trust Lending review: how does it work and is it good?

Read our Buy On Trust Lending review to know how you can get up to $5,000 in credit limits to buy your favorite electronic brands – even if you have a limited credit history!

Keep Reading