Credit Cards (US)

Avant® Credit Card application: how to apply online?

Check out how easy and fast the Avant® Credit Card application is, and start building a solid financial path right away!

Avant® Credit Card application: simple 3-step process

This post will tell you more about the Avant® Credit Card application process. This card might be your next powerful tool for you to build credit. If you click below, we will direct you to the official landing of the product, and there you can start the application process.

Avant offers an easy and fast application process, and you can check your eligibility without worrying about harming your credit. Find out more about it right below!

Online Application Process

In case you have a fair credit score, an Avant credit card might be worth considering. It reports to all three major credit bureaus, and if you use the card responsibly, you can re-establish a good financial path.

So, the application process only takes a few minutes. Firstly, you can check your eligibility. It doesn’t harm your credit.

You will be asked to fill in your personal information, including First & Last Name, Social Security Number, Phone, and email.

The decision takes only 60 seconds.

After getting approved, your card will be issued, and you can start using it and reestablishing your good financial path.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

After getting approved by following the step-by-step above, you can download the Avant mobile app to manage your finances.

Avant® Credit Card vs. Capital One Platinum Secured

Avant Credit Card allows you to build credit while you enjoy buying power. It proactively runs credit reviews and offers the Mastercard package of benefits.

On the other hand, if you want an alternative, a Platinum Mastercard from Capital One might be worth considering. Check out the comparison below before applying!

| Avant® Credit Card | Capital One Platinum Secured | |

| Credit Score | Fair | Fair |

| APR | 27.24% – 29.99% (variable) | 26.99% (variable) |

| Annual Fee | $0 – $59 | $0 |

| Fees | Cash advance: $10 or 3% of the amount of a transaction, whichever is greater Foreign transaction: NoneLate fee: up to $39 | Balance transfer: 3% of the amount of each transaction; and none for balances transferred at the Transfer APR Cash advance: $10 or 3% of the amount of a transaction, whichever is greater. Foreign transaction: None Late fee: up to $40 |

| Welcome bonus | None | None |

| Rewards | None | None |

Check out how to apply for Platinum Mastercard® from Capital One!

Capital One Platinum Secured review

Rebuild your credit with the help of a Capital One Platinum Secured. Check out the full review!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Plains Commerce Bank card?

Do you need a debit card with online and mobile banking and a digital option? Read more to know how to get the Plains Commerce Bank card!

Keep Reading

How to apply for the U.S. Bank Visa® Platinum Card?

If you need a card with no annual fees and a great intro APR period, read on to learn how to apply for the U.S. Bank Visa® Platinum Card!

Keep Reading

RescueLoans review: what you need to know before applying

In this RescueLoans review article, you will learn how they work and how you can get your funds in as little as one business day.

Keep ReadingYou may also like

Capital One Platinum Mastercard® Card application: how does it work?

If you are new to credit or want to rebuild yours, The Capital One Platinum Mastercard® might be what you need. You won't have to worry about a secured deposit and can apply anywhere online. Read on!

Keep Reading

Luxury Black credit card review: is it worth it?

This review will show you the benefits you'll get with the Luxury Black credit card. Is this the ideal travel credit card for you? You'll find out reading this content.

Keep Reading

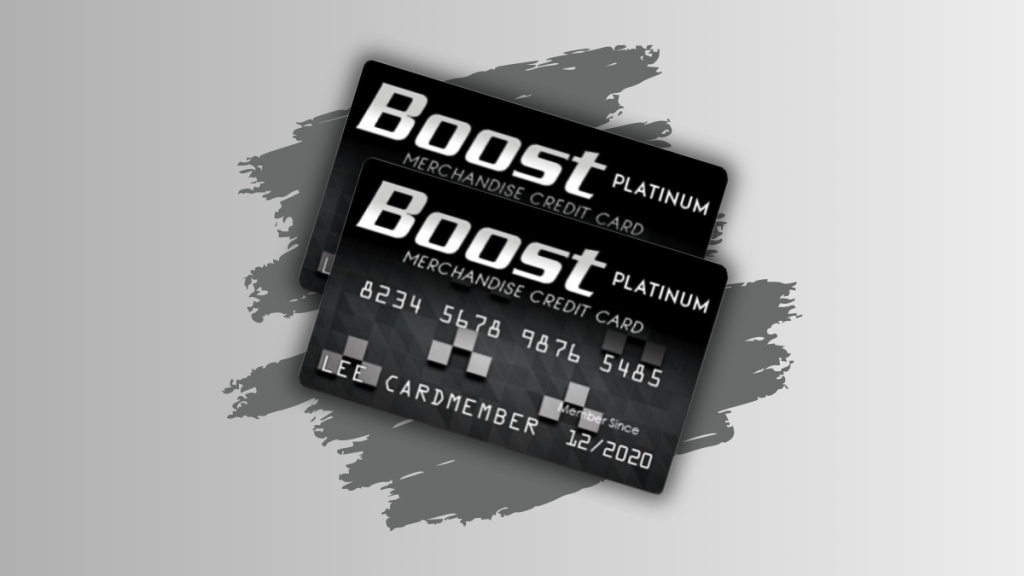

Application for the BOOST Platinum Card

Learn how to apply for the BOOST Platinum Card, perfect for consumers looking for an easier way to shop. This card offers no interest on purchases, a $750 credit limit, and no credit checks.

Keep Reading