Reviews (US)

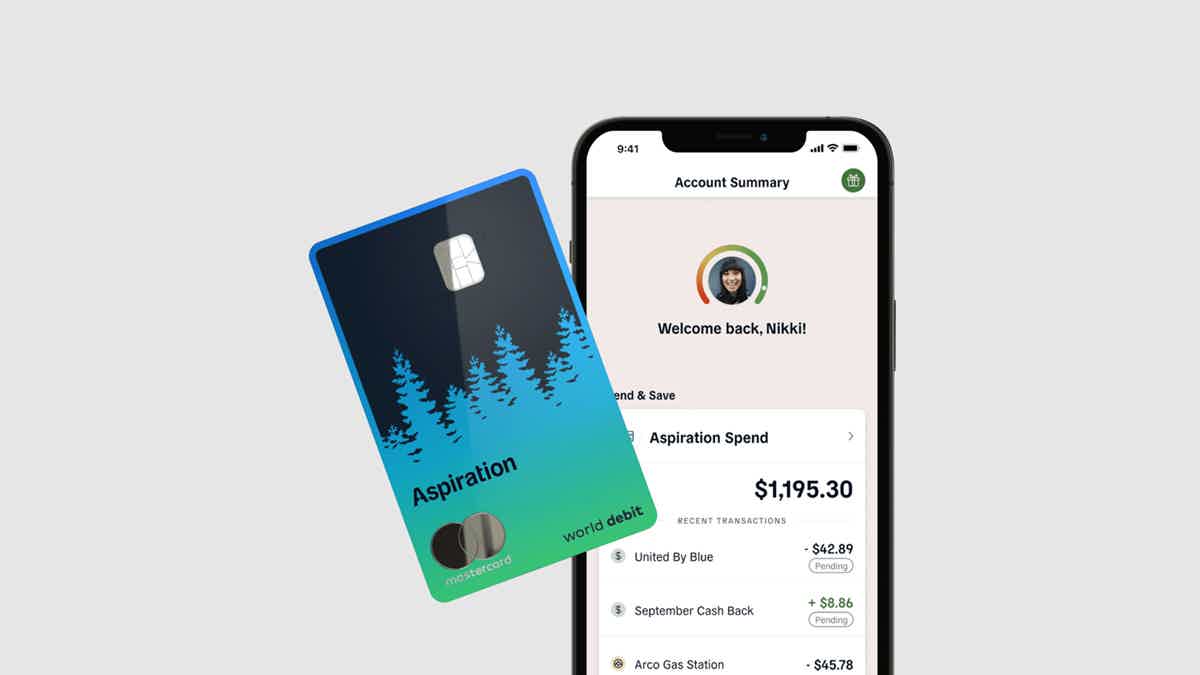

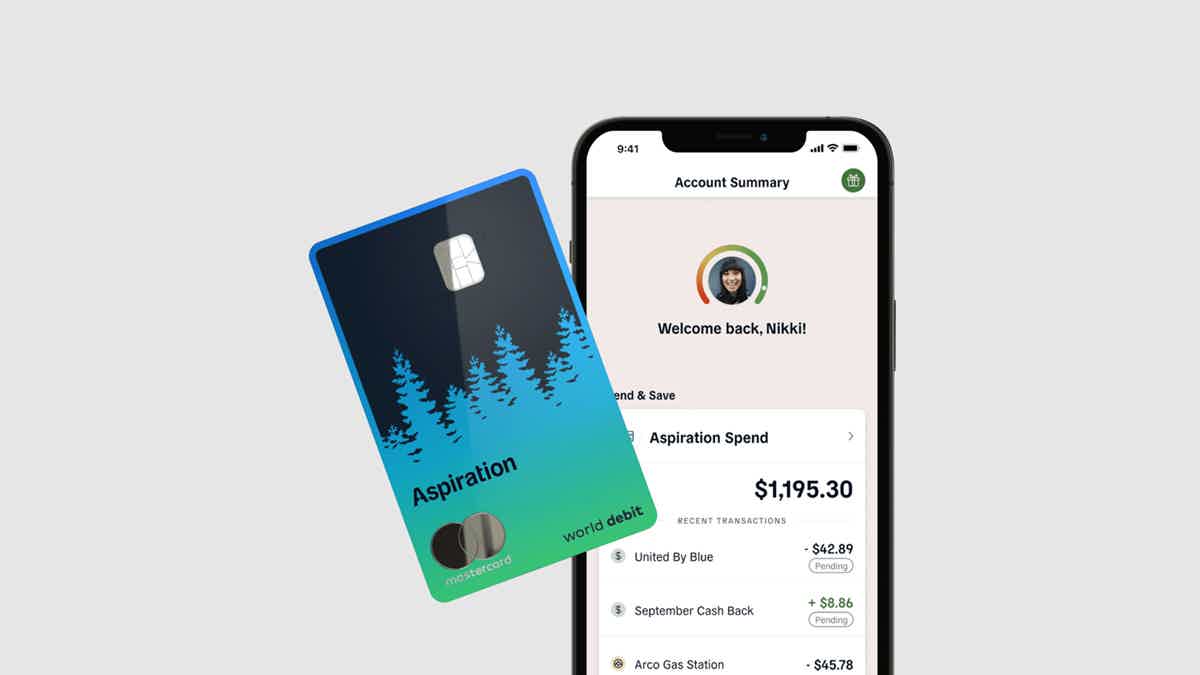

Aspiration Bank review: green new-world banking!

Interested in moving your money to an institution that will put it to investing in ethically-correct enterprises? Check our Aspiration Bank review!

Aspiration Bank: is it trustworthy?

The world sure has reinvented the meaning of the banking industry. Of course, the old agencies and institutions are still there. With their suits, ties, and the bureaucracy, some find it useful, while others forfeit it for more modern solutions. Check our Aspiration Bank review and learn how this bank has been recreating the banking formula!

| Financial products offered | Investment Fund, Debit Cards, Digital Accounts |

| Fees | From $0 to $7.99 per month / 3% to 5% APR |

| Minimum balance | $10 minimum deposit |

How to start banking with Aspiration Bank?

Want to check out a modern take on an old formula? Aspiration Bank will forward a new view in banking aiming investments toward sustainability! Check our review!

With the troubles modern life has given us, new and innovative solutions should be inbound. Aspiration Bank has sustainable actions as its main guideline for responsible money management and banking. Their motto, “an account for the planet,” summarizes their view on how money should be invested responsibly.

How is banking with Aspiration Bank?

As many different new banking solutions do, Aspiration Bank offers a digital account and other digital tools with more flexibility than the ones provided by the average bank. Also, it features a pay-what-is-fair model, where you choose the amount you want to pay for their basic account plan.

Its main enterprise is that of sustainability, featuring an investment fund that aims to encourage diversity and socially relevant investment projects. All this while also providing high-interest yields. In conclusion, a great new take on banking models.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Aspiration Bank highlights: accounts, credit cards, and more

Aspiration offers great banking solutions for those tired of the traditionally clunky way of banking of old institutions. It may be a great fit for you if you’re looking for an update or just an entity driven by an important agenda. So, it not only would apply to the young public but also many of the more experienced customers.

Pros

- High-interest yields for your savings.

- Good reward plan for credit options.

- Environmentally-guided investment fund.

- Digital banking solutions make it for versatile money-management.

- Secure and safe to use.

- Pay what fair policy for the basic account is.

Cons

- Digital banking has somewhat unconnected relationships with their customers.

- No option for deposits.

How to start banking with Aspiration Bank?

Therefore, Aspiration Bank can be a great solution for those looking to improve the versatility of their bank accounts. In addition to the perks we’ve mentioned, it offers many new ways to see money and corporate investment. Equally important to the benefits banks award you, the way they handle your money is also very important.

Consequently, we wouldn’t blame you for being interested in banking with them from now on! Check out our next post to learn how to start money-managing true green money with Aspiration Bank!

How to start banking with Aspiration Bank?

Want to check out a modern take on an old formula? Aspiration Bank will forward a new view in banking aiming investments toward sustainability! Check our review!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Cadence Bank Loans review: find the loan you need!

Are you in the market for a personal loan or line of credit? If so, read our Cadence Bank Loans review to learn about this lender!

Keep Reading

How to apply for the American Express® Preferred Rewards Gold Credit Card?

Check out how to apply for the American Express® Preferred Rewards Gold Credit Card and earn rewards on all purchases plus travel benefits.

Keep Reading

How to apply for the Vitality American Express® Credit Card?

See how to apply for the Vitality American Express® Credit Card and earn cashback on purchases while enjoying travel benefits and protection.

Keep ReadingYou may also like

No annual fee: Apply for U.S. Bank Visa® Platinum Card

Learn how to apply for the U.S. Bank Visa® Platinum Card, a 0% intro APR card with no annual fee. Keep reading and learn more!

Keep Reading

Freedom Gold credit card review: is it legit and worth it?

Have you heard about the Horizon outlet? You can enjoy exclusive benefits with the Freedom Gold credit card at this website. Let's talk more about it in this review.

Keep Reading

Apply for the Shop Your Way Mastercard®: $0 annual fee

Ready to apply for the Shop Your Way Mastercard®? Then read on! Earn up to 5% cash back on all your purchases + exclusive benefits!

Keep Reading