CA

How to apply for the Walmart Rewards Mastercard?

Check out how the Walmart Rewards Mastercard application works and how to earn unlimited rewards while paying a $0 annual fee.

Walmart Rewards Mastercard application: join online within minutes

Today, you will learn how to apply for the Walmart Rewards Mastercard credit card to enjoy all of its benefits.

This card is a fantastic option for those who regularly purchase at Walmart. It offers a welcome bonus of $45, rewards ranging from 1% to 1.25% on every purchase you make, and many other extras and optional benefits.

Also, there is no annual fee, zero liability protection, and Mastercard Global Services.

Furthermore, you access preferred rates varying from 19.89% to 22.97%. Plus, a 21-day grace period of interest-free.

Moreover, earning Walmart Reward Dollars when using your credit card allows you to redeem the rewards when purchasing at Walmart, whether in-store or online.

Managing your account is easy, and applying is even easier.

Then, continue reading to learn how easy and fast it is to apply for a Walmart Rewards Mastercard.

Online Application Process to get your Walmart Rewards Mastercard

Applying for a Walmart Rewards Mastercard is easy and fast. All you must do is access the official Walmart website and choose the card you want.

Also, it is important to mention that this card may approve average credit scores. But, this information is not fully disclosed.

This is only a recommendation. In addition, you must provide your personal and contact information when applying for it.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

After applying for this card through the official Walmart website, as mentioned above, you can download the mobile app to manage your newest card.

Walmart Rewards Mastercard vs. CIBC Aventura® Visa Infinite* Card

As you have probably noticed, a Walmart Rewards Mastercard is a fantastic option for those who want unlimited rewards when regularly purchasing at Walmart.

However, if you are not a regular Walmart client, you may find it helpful to learn more about an amazing alternative.

Check out the comparison!

| Walmart Rewards Mastercard | CIBC Aventura® Visa Infinite* Card | |

| Credit Score | Not disclosed | Good – Excellent |

| APR | From 19.89% to 22.97% | 20.99% on purchases and from 21.99% (Quebec residents) to 22.99% (non-Quebec residents) on cash advances |

| Annual Fee | $0 | $139 (it is rebated in the first year) |

| Fees | Cash Advance at teller or bank machine: $4; Cash-like transactions: $4; $20 fee for Dishonoured Payment / NSF Over Credit Limit: $29; Copy of previous account statement: $5; Replacement card fee (in a rush): $25. | Up to 3 additional cards: $50 |

| Welcome bonus | $45 (limited offer) | Up to 35,000 Aventura Points in the first year: 20,000 Aventura Points when making the first purchase; 5,000 Aventura Points when spending at least $1,000 per monthly statement in the first year; Over $190 value on the Visa Airport Companion Program; NEXUSTM Application Fee rebate |

| Rewards | 1.25% Walmart Reward Dollars at walmart.ca and Walmart stores;1% on gas and everything else | 2 points for each $1 spent on travel via CIBC Rewards Centre; 1.5 points at eligible grocery stores, gas stations, and drug stores; 1 point on everything else |

If you are interested in learning more about the CIBC Aventura® Visa Infinite* Card, learn how to apply now!

How to apply for CIBC Aventura Visa Infinite?

The CIBC Aventura Visa Infinite credit card offers exclusive benefits for travelers. Check out how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Capital One Guaranteed Mastercard® Card review

Check out this Capital One Guaranteed Mastercard® review post and learn how it can be a powerful tool for you to rebuild your credit history.

Keep Reading

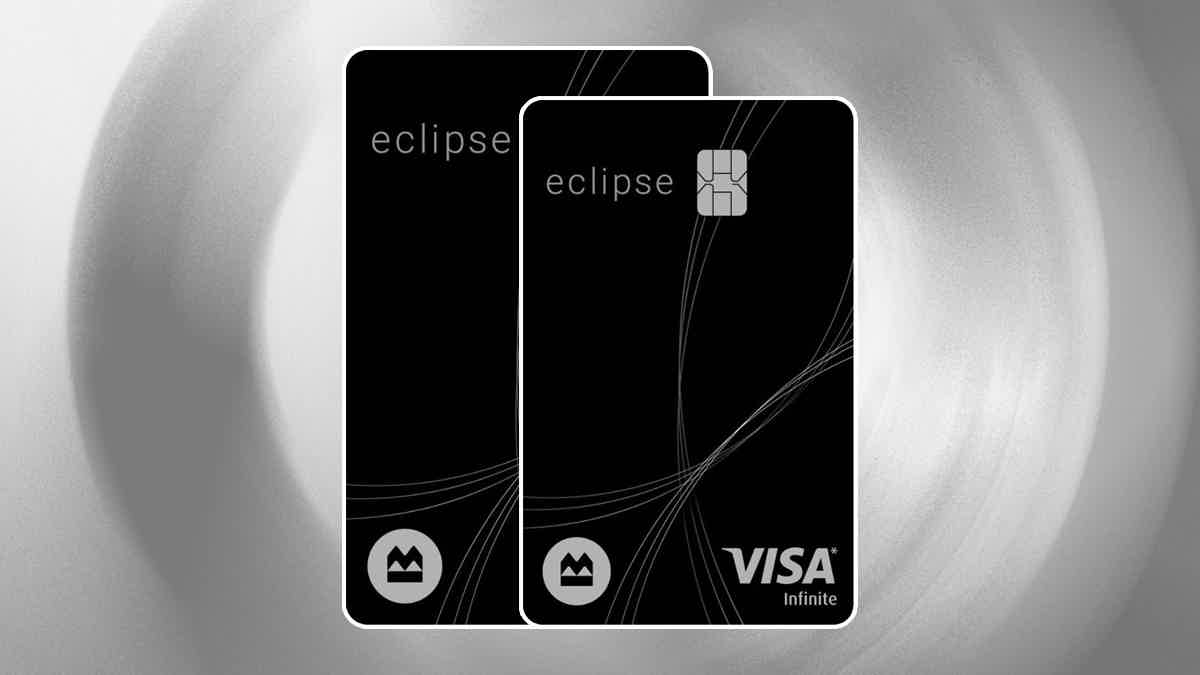

BMO eclipse Visa Infinite credit card full review

Do you need a card with great travel perks and rewards? Read our BMO eclipse Visa Infinite credit card review to learn more!

Keep Reading

Canada Digital Adoption Program review: Business growth!

Are you looking for a business program to improve your company? If so, read our Canada Digital Adoption Program review!

Keep ReadingYou may also like

Stimulus Check: see how to apply

Stimulus checks are all the rage right now! Learn everything you need to know about this government program, including who's eligible and how to apply.

Keep Reading

Chase College Checking℠ review: Get a $100 bonus

Learn more about the Chase College Checking℠ account and its features with our review! From student benefits to flexible banking options, it offers great solutions for college students!

Keep Reading

The US economy could enter a state of stagflation soon

Mohamed El-Erian, the chief economic adviser at Allianz, warns that stagflation is likely unavoidable even if the Federal Reserve manages to avoid a full-fledged recession. Read more below.

Keep Reading