Credit Cards (US)

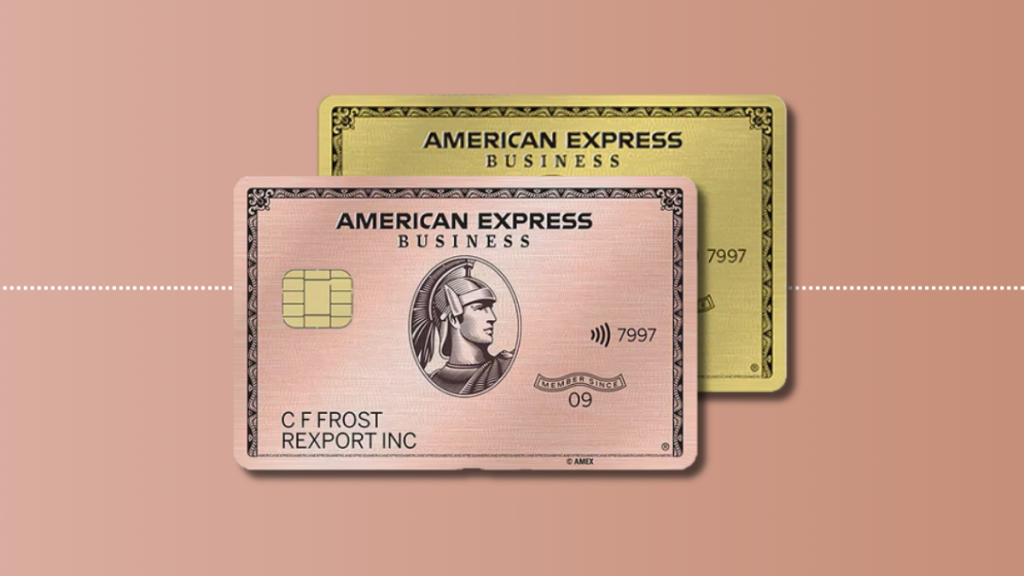

American Express® Gold Card overview

The American Express Gold card has amazing dining and travel benefits and a generous welcome bonus. Learn more about this great rewarding card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

American Express® Gold Card: get exclusive dining perks!

The American Express Gold credit card can be a great choice for people who frequently spend a considerable amount of money on food. The card is also a good option for those who like to travel and would like to earn Membership Rewards points. In this American Express® Gold Card overview, we’ll look over its main features.

This card has a very generous welcome offer with Membership Rewards. Some people might worry about the cost of credit card annual fees, but the many amazing benefits of this card can make up for its fee.

Of course, if you are looking for one of the best rewarding cards for dining and also traveling purchases, you should keep reading to know more about this great credit card option.

How to apply for the American Express® Gold Card

If you want to know how to get your American Express® Gold Card, here is some important information to guide you!

| Credit Score | Good (690) to excellent (850) |

| Annual Fee | $250 Rates & Fees |

| Regular APR | Purchases APR: See Pay Over Time APR. Cash Advance APR: 29.99% Variable. Rates & Fees |

| Welcome bonus | 60,000 MR points after spending $4,000 on eligible purchases in the first 6 months *Terms apply |

| Rewards | 3 points per dollar spent on flights booked with the airline or Amex Travel; 4 MR points per dollar spent at restaurants; 4 points per dollar spent at supermarkets (U.S.) on $25,000 in purchases per year, then 1x; 1 point per dollar spent on all other eligible purchases; Up to $120 Uber Cash on Amex Gold; Up to $120 on dining credit, and more. * Terms apply |

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What is special about the American Express® Gold Card?

This is an incredible card for people who love to eat out and buy food. The card offers amazing Membership Rewards points. It has special rewards, like 4 MP points per dollar for restaurants purchases and 1 point per dollar spent on eligible purchases (Terms apply).

In addition to having some good flight rewards and other perks, this card gives their cardholders the option to choose between the Gold or Rose Gold version. Want to see if you qualify? Keep reading our American Express® Gold Card overview.

Who qualifies for this card?

In the first place, to qualify for the Amex Gold card, you need a good to excellent credit score, from 690 to 850. Additionally, you have to be someone with good spending power to spend with dining and travel.

Therefore, those who own an Amex Gold credit card are people with very good financial health that like to spend money on food and travel.

American Express® Gold Card review

Learn more about the American Express® Gold Card, a card full of incredible rewards and dining and travel benefits!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Tesco Bank Foundation Credit Card?

Check out how to apply for a Tesco Bank Foundation Credit Card and build credit while earning points on purchases and paying no annual fee.

Keep Reading

15 best and surprising money habits of financially successful people

Think like a wealthy person and you might become one. No, it will not be easy. But we are here to give you a hand. Check it out!

Keep Reading

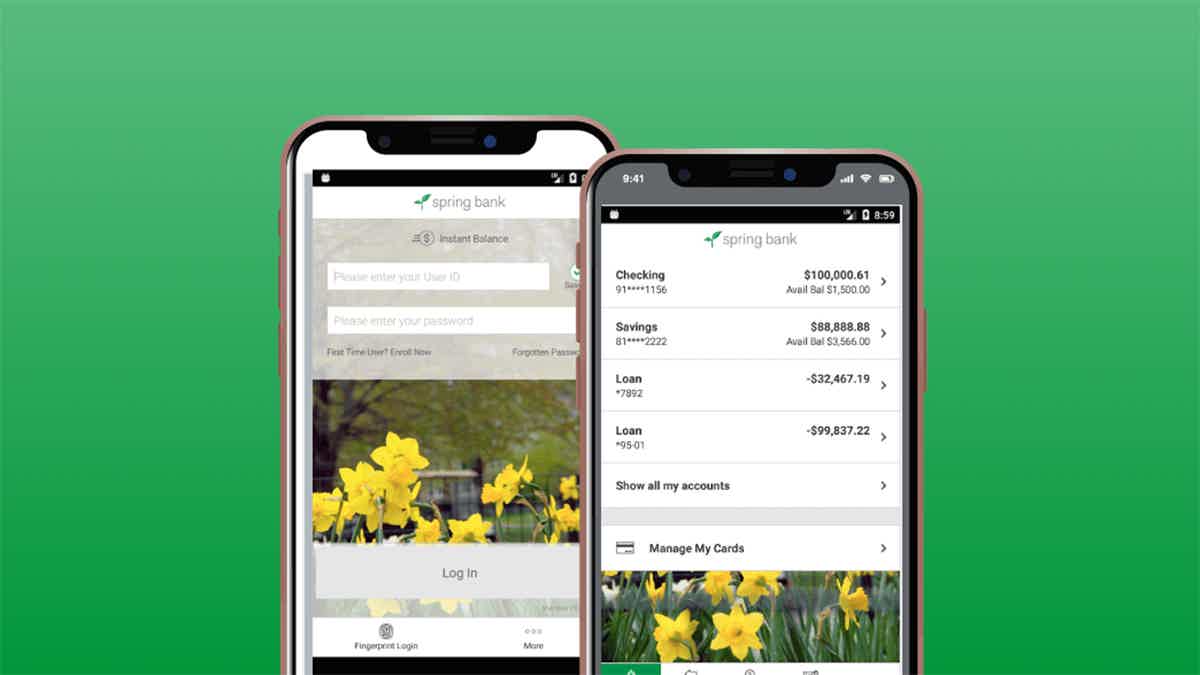

Spring Bank Review: is it trustworthy?

The Spring Bank review shows you how it can help you achieve sustainable financial health with services for personal and business banking.

Keep ReadingYou may also like

123 Money Loans Review: Payday Loans for All Credit Scores

Looking for quick cash? Dive into our 123 Money Loans review to uncover the ins and outs of this payday loan marketplace. Up to $5K for you!

Keep Reading

Gold benefits: American Express® Business Gold Card review

Looking for a card to help manage your business expenses? Here's the American Express® Business Gold Card! Earn points on every purchase and more!

Keep Reading

CarLoans.com review: how does it work and is it good?

Make your dream car a reality, even with less-than-perfect credit! Follow our comprehensive CarLoans review for all the details. Keep reading for more!

Keep Reading