Investing (US)

Ally Investing review

Whether you are an expert or a beginner investor, check out the Ally Investing review and start growing your earnings right away!

Ally Investing: invest with lower fees!

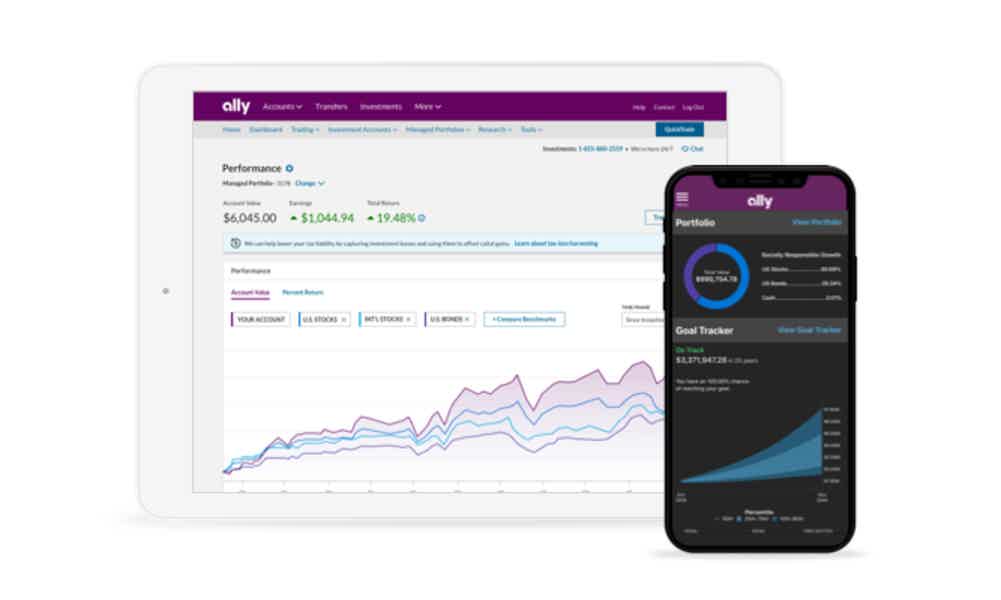

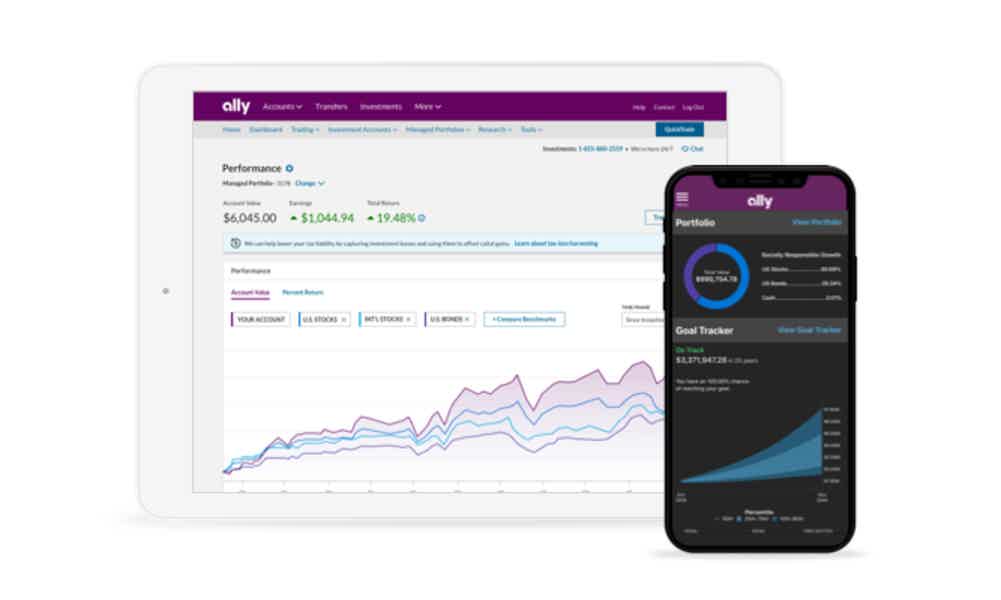

Ally Investing offers Self-Directed Trading for those investors who want the freedom to work on their portfolio and Robo Portfolios for those who wish for professional recommendation with no advisory fees, and you’ll learn all about it in this review!

Also, it provides you with many tools and resources, such as calculators and educational articles, so that you can invest with wisdom and confidence. And it gives you access to brokers whenever you need help with excellent customer support. So, please find out more about it by reading our Ally Investing review post!

| Trading fees | $0 for stocks, ETFs, and options (plus 50¢ per contract fee); Commissions for: – mutual funds: load – Purchases: $0 / Sale: see terms & conditions; – bonds: $1.00 per bond ($10.00 minimum, $250.00 maximum) per transaction; – treasuries: $1.00 per bond ($10.00 minimum, $250.00 maximum) per transaction; – CDs: $24.95 per transaction |

| Account minimum | $0 |

| Promotion | Up to $3,000 in bonus cash when you open an invest account |

| Investment choices | Stocks, ETFs, Options, Bonds, Mutual Funds, Forex |

How to join the Ally Investing?

Invest on your way with Ally Investing! Check out how to open an account!

How does Ally Investing work?

Firstly, you can choose between a self-directed trading account or Robo portfolios. The main difference between them is that a self-directed one is better for those hands-on investors. And the Robo portfolios are monitored by Ally.

Secondly, there are no commission fees charged for the self-directed account for U.S. listed stocks and ETFs. Plus, no commissions on option trades and the cost per contract is just 50¢.

On the other hand, there are no advisory fees for the Robo plan, and you can start investing with $100.

Thirdly, Ally provides you with outstanding customer service, an excellent platform including a mobile app, educational resources and tools like calculators, and effortlessly transfers.

Finally, Ally Invest is a SIPC member, which means you are covered and protected.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Ally Investing benefits

Both types of accounts offered are low-cost and feature a full range of investment choices. The Self-Directed one allows you to manage your own portfolio with free fee-commission for stocks and ETFs and no account minimums.

The Robo plan offers automated portfolios managed by specialists, with no advisory fees, annual charges, or rebalancing fees. However, it requires a minimum of $100 to get started.

In general, Ally is a great online brokerage with excellent tools and educational resources so you can invest more intelligently and better.

Pros

- Ally offers excellent tools and resources, including the trading platform, mobile app, calculators, and educational articles;

- It features low costs and affordable fees;

- It provides a full range of investment choices;

- There are no account minimums for Self-Directed Trading account;

- You get up to $3,000 in bonus cash when you open an investment account.

Cons

- Ally doesn’t offer fractional shares and crypto;

- It lacks no-transaction-fee mutual funds.

Should you join Ally Investing?

Whether you are an expert investor or a beginner, Ally offers a range of investment choices, tools, and resources, so you can open an account, start investing at low cost, and watch your money grow right away!

Can anyone open an Ally Investing account?

To open an account, you don’t need an account minimum. However, note that choosing a Robo portfolios account requires a $100 initial minimum deposit. And Self-directed brokerage margin accounts require a minimum of $2,000.

How to open an Ally Investing account?

It doesn’t matter if you are an expert investor or a beginner; Ally is here to help you out. Then, learn how to open a Self-directed Trading account or start planning a Robo portfolio.

How to join the Ally Investing?

Invest on your way with Ally Investing! Check out how to open an account!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to buy and make money online with Bitcoin?

If you want to participate in this digital currency world, read this article to learn how to buy Bitcoin, receive, store, spend, and more!

Keep Reading

How to get a Quick Home Insurance quote?

Learn how to get a Quick Home Insurance quote and access a free quotation to estimate several policies at affordable prices.

Keep Reading

Bitcoincasino.us: how to join it?

Learn all about how to join the Bitcoincasino.us crypto betting platform! Read more to find out about its excellent welcome bonuses and more!

Keep ReadingYou may also like

Cheap Avelo Airlines flights: fares from $29

Here is a complete guide to getting the best deals with them. Find multiple discounts and flight on a budget with Avelo Airlines! Keep reading!

Keep Reading

Indigo® Mastercard® for Less than Perfect Credit review: Get a card with no deposit

Check the review for the Indigo® Mastercard® for Less than Perfect Credit and what it can do to help improve your credit score. Keep reading!

Keep Reading

Upgrade credit card review: a credit card that works like a personal loan

The Upgrade Card has a unique offer for you. Don't worry about your credit score and use this card for big purchases with no worries about your card balance. Keep reading to understand why.

Keep Reading