CA

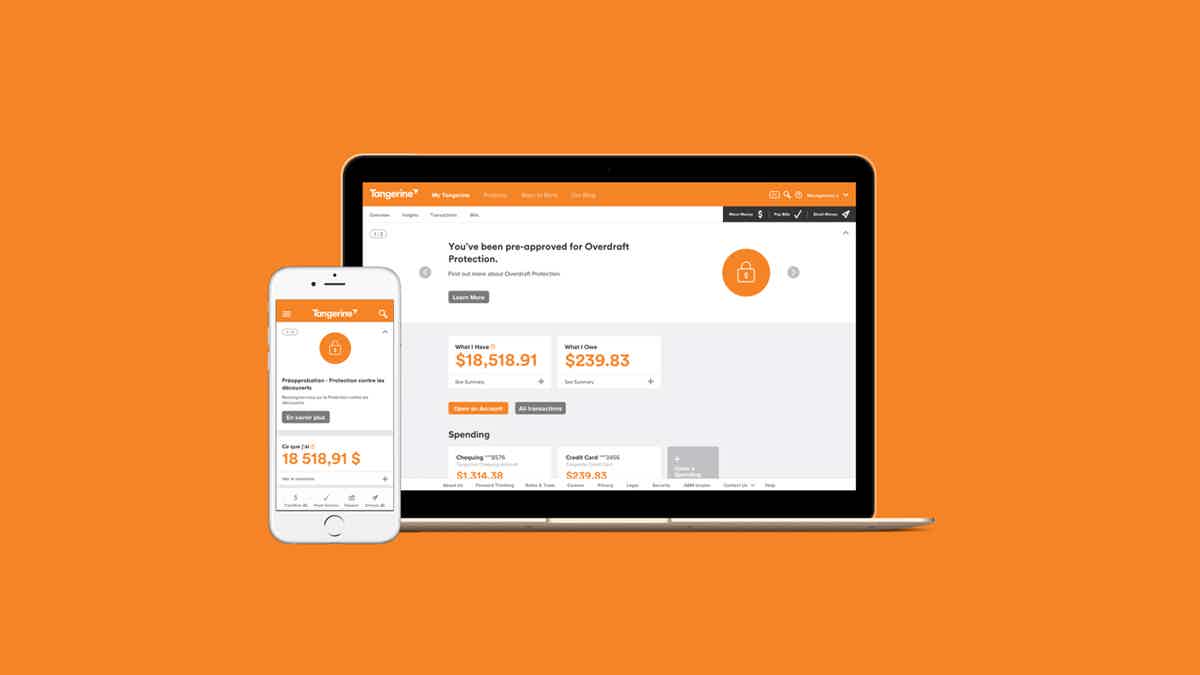

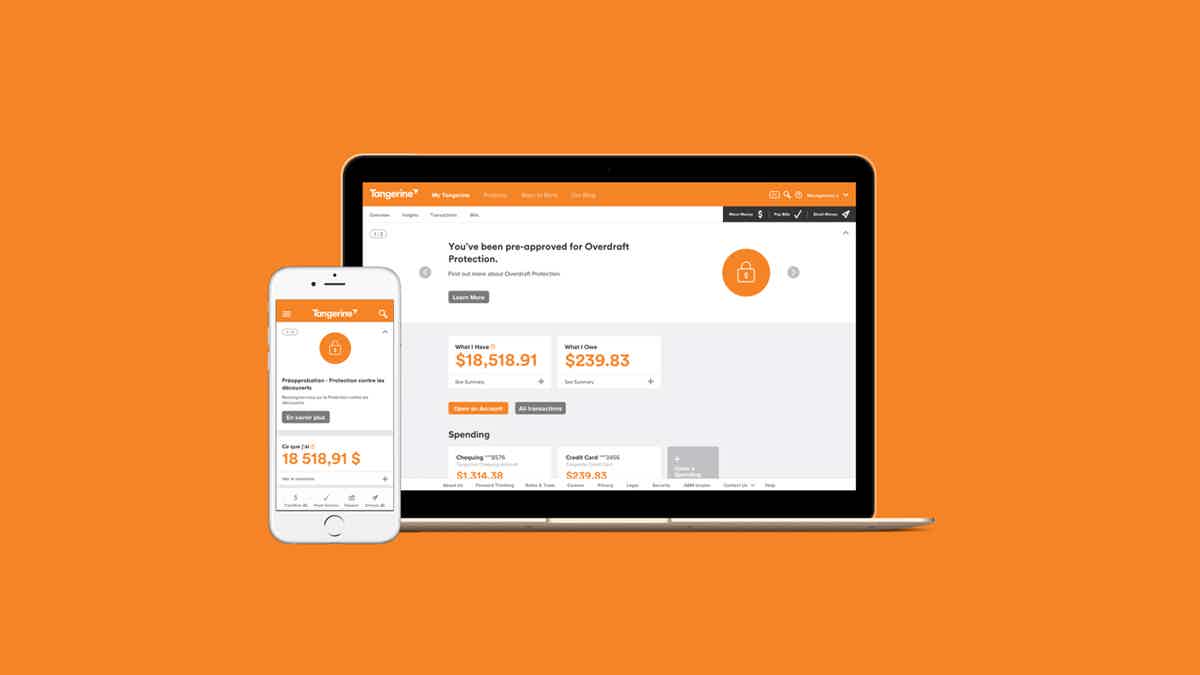

Tangerine World Mastercard card full review

Thinking of signing up for the Tangerine World Mastercard? We'll tell you about the rewards, benefits, and spending limits. So, read our Tangerine World Mastercard card review to decide if it's for you!

Tangerine World Mastercard card: get fantastic cash back rewards

If you’re looking for a great cash back card, the Tangerine World Mastercard is worth considering. Also, it offers several perks and benefits that can make your spending much more enjoyable. Plus, it comes with some pretty generous spending limits, which is perfect if you like to make everyday purchases. So, if you want a credit card that can give you extra rewards, this can be the one! Read our Tangerine World Mastercard card review to learn more!

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 19.95% variable APR after 6 months. |

| Welcome bonus* | Current welcome offer of extra 10% cash back on everyday purchases you make within the first 2 months (up to $1,000.) Recurring welcome offer of 2% cash back rewards on purchases in two categories of your choice. *Terms apply. |

| Rewards* | Earn 2% cash back in two categories you can choose. 0.50% back on every other everyday purchase. *Terms apply. |

How to apply for the Tangerine World Mastercard

If you love Tangerine services, you will love this new credit card! Read our post about the Tangerine World Mastercard card application!

How does the Tangerine World Mastercard card work?

The Tangerine World Mastercard offers 2% cash back in two categories of your choice. Your Tangerine card also offers 0.50% cash back on all other purchases. You can also earn extra rewards by depositing them into your Tangerine Savings Account. You can now choose one more 2% Money-Back category, for a total of three.

In addition, this credit card also offers travel rewards related to Mastercard. Also, you can earn cash back while traveling outside of Canada. Plus, as a cardholder, you will have access to the Mastercard® Airport Experiences Provided by LoungeKey. With this, you can access exclusive dining and other offers in more than 400 airports.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Tangerine World Mastercard card benefits

So many great cash back and travel rewards with the Tangerine card! For example, you can get 2% cash back in two categories. And this includes categories like groceries, furniture, restaurants, gas, drugstores, entertainment, and more! But, like all cards, this Tangerine card has some flaws. So, read on to find out the pros and cons.

Pros

- There is no annual fee.

- Great cash back rewards categories.

- There is mobile device insurance available for cardholders.

Cons

- The income requirement is a bit high. You need an annual income of at least $60,000 to qualify for this card.

How good does your credit score need to be?

To qualify for this credit card, you need to have at least a good or excellent credit score. Also, if you have a lower credit score, you might not qualify to even apply for the card. Plus, keep in mind that applying for a credit card like this may impact your score.

How to apply for Tangerine World Mastercard card?

The application process to get a Tangerine World Mastercard card can be very straightforward. Also, you can do it all online from your home. Therefore, read our post below to know about the details of applying for a Tangerine World Mastercard card!

How to apply for the Tangerine World Mastercard

If you love Tangerine services, you will love this new credit card! Read our post about the Tangerine World Mastercard card application!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

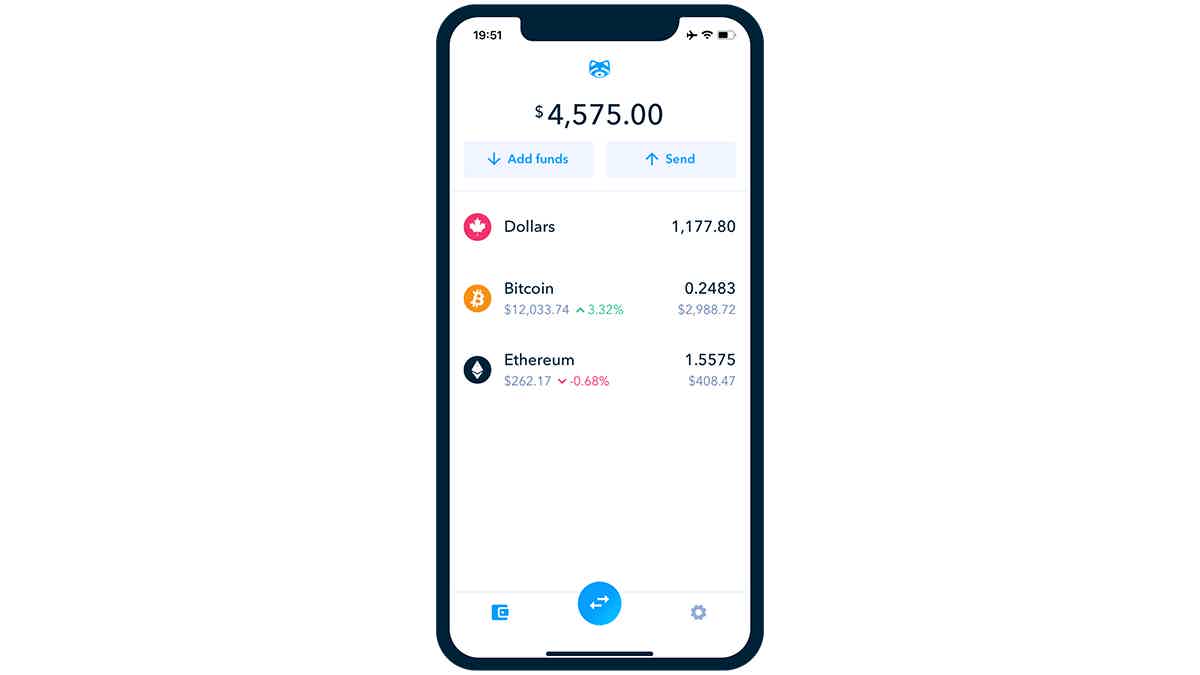

Shakepay review: how does it work?

Check out this Shakepay review and start buying and selling bitcoin & ethereum commission-free. Join more than 1 million Canadians now!

Keep Reading

Canadian Pension Plan investments: what is it invested in?

Canadian Pension Plan Investments have global range, created to manage and capitalize the capitals underwritten to the Canada Pension Plan.

Keep Reading

CIBC Air Canada® AC conversion™ Visa Prepaid card full review

Multiple currencies in a safe way for you to enjoy your travels! Check our CIBC Air Canada® AC conversion™ Visa Prepaid card review!

Keep ReadingYou may also like

Learn to apply easily for the Upstart Personal Loan

Apply for Upstart Personal Loan in a couple of minutes with these valuous 3 tips. Enjoy free financial education and competitive rates! Find out more here!

Keep Reading

Cheap Sun Country Airlines flights: find flights from $39,99!

Learn about the different aspects of Sun Country Airlines' cheap flights. Find multilple deals for destinations in the Americas!

Keep Reading

United Vacations®: explore the world for less

Uncover all the benefits of booking your travel with United Vacations®. From exclusive deals to personalized packages, get informed on how to save money and explore the world!

Keep Reading