SA

Standard Bank Gold Credit Card full review: Travel benefits!

If you're looking for a credit card with gold status and travel perks, read our Standard Bank Gold Credit Card review!

Standard Bank Gold Credit Card: Find insurance benefits!

Are you looking for a card that offers great leisure benefits and travel insurance? If so, the Standard Bank Gold Credit Card review may be the right card for you!

How to apply for the Standard Bank Gold Card

Looking for a card with good rates and travel insurance? If so, read our post to apply for the Standard Bank Gold Credit Card!

| Requirements | You need to earn R5,000 monthly and have a Standard Bank account. |

| Initiation Fee | R180 initiation fee. |

| Monthly Fee* | R60 monthly fee. *Terms apply. |

| Fees* | 0% interest rate when you choose the six-month budget plan (valid when you choose to pay for your in-store or online purchases); Up to 55 days interest-free (when your account is paid in full); *Terms apply. |

| Rewards* | Find offers related to dining, leisure, and others; 10% off when you spend R300 or more (valid for ProGifts purchases); Up to 5% cashback (valid when you book any domestic or international hotel and more); Find flight discounts with Emirates with automatic travel insurance; 15% off wine, coffee, olive oils, and more when you make purchases online at the Wine-of-the-Month Club; There are other rewards and perks available. *Terms apply. |

With this credit card in your pocket, South Africans can enjoy various exclusive rewards and discounts on various activities such as shopping sprees, travel, wine, and more!

Therefore, read our Standard Bank Gold Credit Card review to find out why this is one of the best cards for keeping your wallet full and your mind at ease while traveling!

How does the Standard Bank Gold Credit Card work?

This credit card is great for those who love to travel and have fun! Also, it’s full of an impressive range of travel insurance options! And these are sure to come in handy when setting off on an overseas trip!

You will be redirected to another website

Standard Bank Gold Credit Card benefits

As we mentioned, this credit card offers incredible perks to its cardholder. Especially if we’re mentioning travel and leisure perks.

Also, you can even get up to 4% cash back when booking domestic or international hotel and more!

However, this card also has some downsides, as with any other credit card. Therefore, you can read our advantages and disadvantages list below to learn more!

Pros

- You can get free prequalification for this credit card;

- You’ll find personalized interest rates;

- There is a relatively high credit limit available;

- You’ll find incredible Emirates flights discounts;

- There are many travel and general leisure offers and perks.

Cons

- The rewards and perks could be easier to follow;

- The monthly fee can be relatively higher;

- You’ll need to receive an offer to apply and have a Standard Bank account.

How good does your credit score need to be?

There is no official information about the credit score you need to get this credit card. Therefore, you should only follow the requirements to be able to qualify.

For example, you’ll need to have an R5,000 minimum monthly income to open an account.

How to apply for the Standard Bank Gold Credit Card?

You can apply for the Standard Bank Gold Card if you already have a Standard Bank account.

Therefore, you can easily go to the official website and complete your information to apply for this card!

How to apply for the Standard Bank Gold Card

Looking for a card with good rates and travel insurance? If so, read our post to apply for the Standard Bank Gold Credit Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Best credit-building low-interest rate cards: 6 options!

If you're in the market looking for the best credit-building low-interest rate cards, you're in the right place! Read on to learn more!

Keep Reading

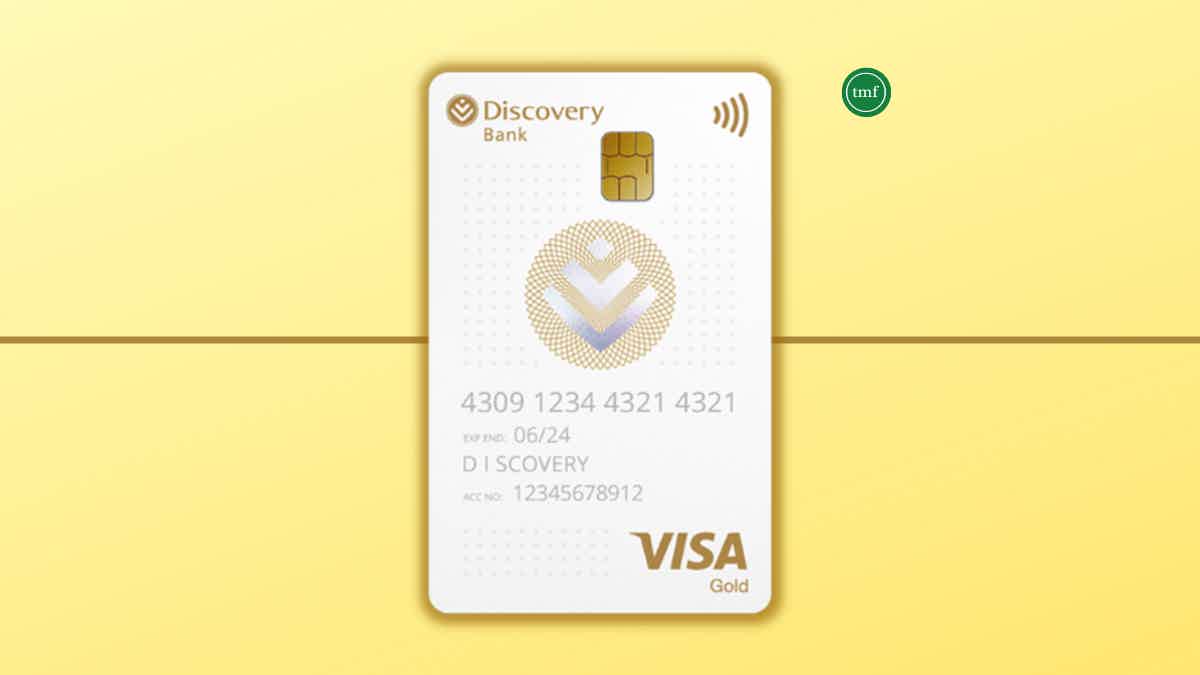

How to apply for the Discovery Bank Gold Card?

Looking for a card with cashback for everyday purchases and discounts? Read on to learn how to apply for the Discovery Bank Gold Card!

Keep Reading

How to apply for a Woolworths Silver Credit Card?

Learn how simple it is to apply for a Woolworths Silver Credit Card and enjoy earning cash back on all of your purchases at a very low cost.

Keep ReadingYou may also like

Buy On Trust Lending review: how does it work and is it good?

Read our Buy On Trust Lending review to know how you can get up to $5,000 in credit limits to buy your favorite electronic brands – even if you have a limited credit history!

Keep Reading

PenFed Credit Union Personal Loans review: how does it work and is it good?

Here's a PenFed Credit Union Personal Loan review to determine if it is right for you. Learn the requirements, who can apply, and why this may be your best option to get a personal loan. Read on!

Keep Reading

The Centurion® Card or The Platinum Card® from American Express: choose the best!

American Express has two great options for travel cards. The Centurion® Card from American Express is the top ultra-exclusive black card. On the other hand, one of the most reliable credit cards is The Platinum Card® from American Express. This article is a full review comparing both travel credit cards by Amex!

Keep Reading