Finances (US)

Spring Bank Review: is it trustworthy?

This Spring Bank review will show you all about this first B Corp bank in New York. Check it out to understand all, and decide if starting banking with it is suitable for your finances.

Spring Bank: the first B Corp in New York

A B Corp certification is only given to those companies which comply with high standards in transparency, performance, and accountability, on the whole chain. Spring Bank is certified and you can be part of a new way of banking, focused on ethics and commitment to communities. So to learn more, check out our Spring Bank full review!

| Financial products offered | Personal Checking, Personal Savings, Personal Lending, Business Checking, Commercial Lending, and Small Business Lending |

| Fees | Accounts feature waived fees if you maintain minimum balance |

| Minimum balance | From $100. Each type of account requires a minimum balance in order to waive maintenance fees |

Spring Bank offers a wide range of accounts for both personal and business needs and goals. If you are a resident of New York, it might be worth considering starting banking with this new way of thinking about finances. Check out how it works right below!

How is banking with Spring Bank?

Spring Bank is a B Corp, which means it is certified as a company that focuses on delivering products and services with transparency, performance, and accountability on the complete chain, considering communities, too.

It offers a wide range of products, including accounts and lending options for both personal and business needs and goals.

On personal, this bank offers checking and lending options.

First of all, on the checking option, Spring Bank provides a Money Market account for you to earn interest and access the benefits of checking and savings.

Also, it offers a basic option, an Interest Checking, and a Green Checking for those concerned with the planet.

The accounts with interest have APYs ranging from 0.25% to 0.65%.

All accounts require a minimum to open and a minimum balance. But, if you manage to maintain this minimum, you will be able to waive maintenance fees.

As for savings, the bank offers CDs, Club/Vacation for specific goals, IRA Savings, and a basic option. All accounts require a minimum to open, except Interest on Lawyer Accounts, which feature the lowest rate.

And the APYs on savings options is 0.75%. On the other hand, CDs have competitive rates that range from 0.65% to 2.50%, according to the terms chosen.

Furthermore, Spring Bank offers business checking accounts, from a basic option to Money Market and Nonprofit Banking.

Moreover, you may enjoy the variety of loans and lines of credit featured, from personal to commercial lending.

Finally, Spring provides 24-hour support and easy access to ATMs for free in the MoneyPass and Citibank networks and branches.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Spring Bank experience: highlights

Besides the whole package of checking and savings accounts for personal and business banking, the rates are relatively competitive compared to other banks.

Spring Bank also offers many lines of credit and lending options for many purposes and flexible terms.

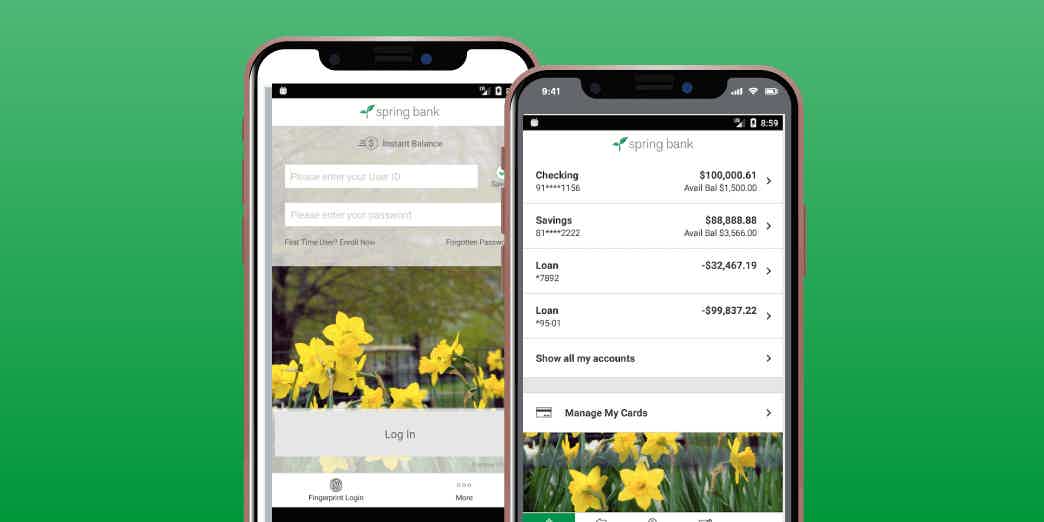

The app is easy-to-use and designed for those who want convenience. Although it is mostly an online bank, you can access the 24-hour-a-day support if needed.

Also, you can access your money through a vast network across the country.

Advantages

- The bank offers a wide range of products and services for personal and business banking;

- It provides competitive rates on interest accounts and CDs;

- You get a 24-hour day of support;

- It features a great mobile app;

- It offers many lending options;

- You can access ATMs for free nationwide.

Disadvantages

- Accounts have fees, and you need to maintain a minimum balance to avoid them;

- Most products have a minimum to open.

Why should you choose Spring Bank?

If you like convenience, you may enjoy this bank. Besides its commitment to transparency, accountability, performance, and community, Spring Bank offers many products and services with competitive rates for both personal and business banking.

How to start banking with Spring Bank?

Now, learn how to open an account or borrow some money at Spring Bank! Keep reading right below!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Plains Commerce Bank debit card full review

The Plains Commerce Bank debit card offers 24/7 fraud monitoring and online and mobile banking access! Keep reading to know more!

Keep Reading

Quick Cash Capital review: working capital solutions to small businesses

Check out the Quick Cash Capital review article and learn how to get great working capital solutions to grow and expand your small business.

Keep Reading

Can you get denied after pre approval: see if pre-approval is a guarantee

Are you applying to get a mortgage loan? If so, read our post to know all about if you can get denied after pre approval!

Keep ReadingYou may also like

Quontic Bank High Interest Checking application: how does it work?

Not sure where to start with opening a Quontic Bank High Interest Checking account? We're here for you! Get all the necessary information and details today!

Keep Reading

$0 annual fee: Apply for Navy Federal Platinum Credit Card

Apply for the Navy Federal Platinum Credit Card to enjoy a 0.99% intro APR offer on your purchases and balance transfers. Read on and learn more!

Keep Reading

Learn to apply easily for the Bad Credit Loans

Have you been struggling because of your bad credit score? Here is how you can apply for a loan with Bad Credit Loans to forget any hassles. Read on!

Keep Reading