Credit Cards (US)

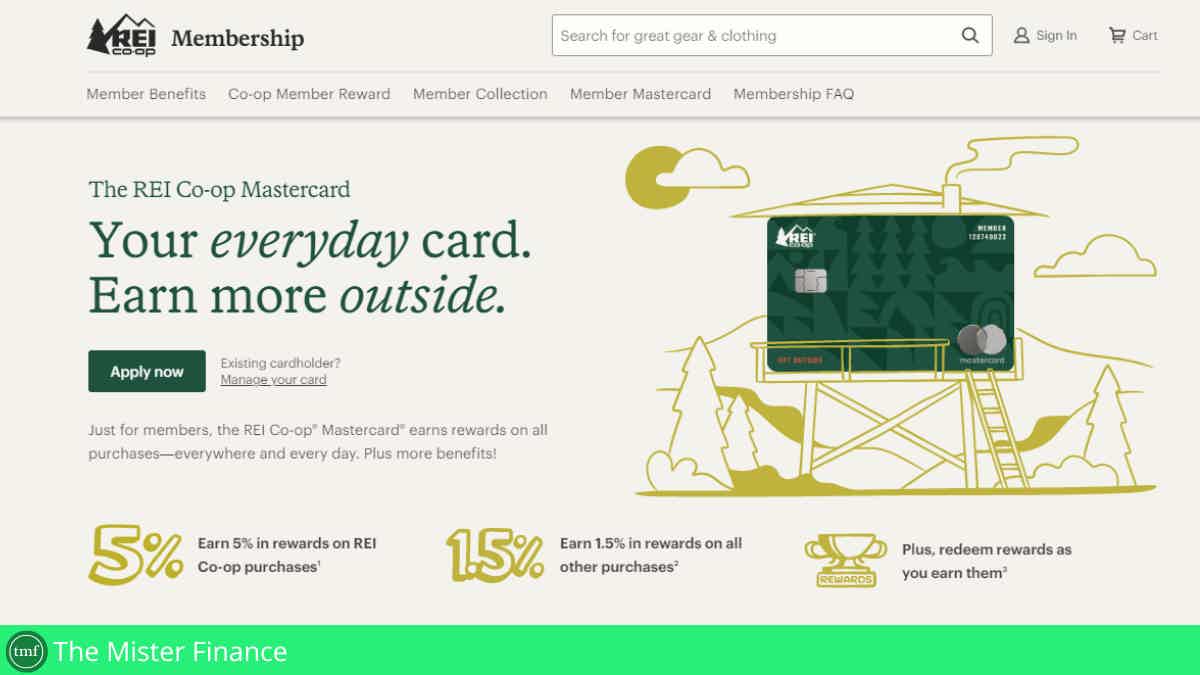

REI Co-op® Mastercard® full review: rewards in or out REI store

If you are a regular REI client and want to become a member, you will love to know that there is a card designed for maximizing rewards on purchases. Then, read this REI Co-op® Mastercard® review.

REI Co-op® Mastercard®: up to 5% back in rewards on purchases

This REI Co-op® Mastercard® review will show you the advantages and disadvantages of becoming an REI member and applying for this Mastercard.

How to apply for the REI Co-op® Mastercard®?

Learn how to apply for an REI Co-op® Mastercard® and enjoy a complete range of exclusive benefits at no annual or foreign transaction fees.

Firstly, there are no annual or foreign transaction fees associated with it.

Therefore, you will be able to maximize rewards without worrying about high costs.

| Credit Score | Good – Excellent |

| APR | 18.74%, 25.74%, or 29.74% (variable and based on the creditworthiness) |

| Annual Fee | $0 |

| Fees | Foreign transaction fee: none; Membership fee (one-time): $30; Cash Advance: $3 or 3% of the amount of each transaction, whichever is greater; Late Payment: up to $40 |

| Welcome bonus | $100 REI gift card after being approved and making the first purchase within 60 days |

| Rewards | 5% in rewards on REI Co-op purchases; 1.5% in rewards on everything else |

Additionally, even though there is a membership fee, you will only pay for it once.

Continue reading to find out the details about this credit card.

How does the REI Co-op® Mastercard® work?

As shown before on this REI Co-op® Mastercard® review, this card suits REI consumers who want to maximize rewards at a very reasonable cost.

In fact, the card doesn’t charge any annual or foreign transaction fees. And it is a Mastercard, which means you will be able to use it outside of REI, even when traveling abroad.

Also, it features an amazing reward rate, considering it is designed for specific store members. Check out the program below:

- Earn 5% in rewards on REI Co-op purchases;

- Earn 1.5% in rewards on everything else.

A quite good welcome bonus is offered as well. You will earn a $100 REI gift card after being approved and making the first purchase within 60 days, then.

Not to mention other benefits, including:

- $50 annual credit toward REI Co-op Experiences program;

- Rewards doubled on the yearly REI event;

- Access to Mastercard World Elite benefits;

- Flexible redemption.

Of course, there is a fee of $30 for becoming a member. However, this fee is applied only once the moment you apply for the REI Co-op Members program.

Certainly, a great option for regular REI clients.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

REI Co-op® Mastercard® benefits

Unquestionably, this Mastercard is a good choice for REI members who want to maximize rewards and experiences.

However, there is a one-time fee.

Pros

- The card doesn’t charge annual or foreign transaction fees;

- You will earn up to 5% back in rewards on purchases;

- The redemption plan is flexible;

- There is a $50 annual credit plus a $100 REI gift card as a welcome bonus;

- You will access Mastercard World Elite benefits.

Cons

- You must become a member to apply for the card;

- There is a one-time membership fee.

How good does your credit score need to be?

Even though this information is not fully disclosed, Capital One usually requires good creditworthiness for its best credit cards.

How to apply for an REI Co-op® Mastercard®?

If you want to become an REI member, check out how to apply for an REI Co-op® Mastercard®.

How to apply for the REI Co-op® Mastercard®?

Learn how to apply for an REI Co-op® Mastercard® and enjoy a complete range of exclusive benefits at no annual or foreign transaction fees.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Who are the Capital One airline partners?

Are you a Capital One customer looking for ways to enjoy the benefits of Capital One airline partners? Read on to learn more about them!

Keep Reading

Crypto.com Visa card full review

Are you looking for a prepaid card with great benefits, including streaming options? Read our Crypto.com Visa card review!

Keep Reading

How to apply for The Key Rewards Visa?

Check out how easy it is to apply for The Key Rewards Visa credit card from Capital One and enjoy rewards and other perks at no annual fee.

Keep ReadingYou may also like

Apply for Marriott Bonvoy Business® American Express® Card today

Discover how to apply for the Marriott Bonvoy Business® American Express Card. Earn up to 6x points on purchases and more!

Keep Reading

Learn to apply easily for LoanPionner

Follow this guide to apply for LoanPionner in just 3 steps. Borrow up to $5K for any purpose. Keep reading to learn more!

Keep Reading

Discover it® Balance Transfer Credit Card review: 0% intro APR

Learn all about the Discover it® Balance Transfer Credit Card! Pay no annual fee and enjoy several perks! Stick with us and find out more!

Keep Reading