Read on to learn how this credit card can make your business finances management easier while giving you valuable perks!

The Hilton Honors American Express Business Card – earn 165,000 Hilton Honors Bonus Points and up to 12X Points on eligible purchases!

The Hilton Honors American Express Business Card offers a spectacular range of benefits for business owners and managers, especially for those who regularly travel and stay at Hilton Hotels. Besides the generous welcome bonus and rewards, it features insurance, amazing customer service, and tools for better business finances management.

The Hilton Honors American Express Business Card offers a spectacular range of benefits for business owners and managers, especially for those who regularly travel and stay at Hilton Hotels. Besides the generous welcome bonus and rewards, it features insurance, amazing customer service, and tools for better business finances management.

The Hilton Honors American Express Business Card is an amazing tool for business owners and managers who usually travel to expand their goals. Check out the main points before applying!

The Hilton Honors American Express Business Card offers a complete range of valuable benefits, including: A generous welcome bonus of 165,000 Hilton Honors Bonus Points after spending $5,000 within three months of Card Membership; Up to 12X Hilton Honors Bonus Points at Hilton per dollar spent on eligible purchases; A free night reward from the Hilton Honor Hotel after eligible spending of $15,000 within a year, and a second night for free after eligible spending of $60,000; Ten complimentary visits at over 1,200 airport lounges through enrolling in Priority Pass™ Select Membership; Possibility to upgrade to Diamond Status after eligible spending of $40,000 within a year; Fantastic customer service and travel insurance; Employee cards and account manager. Furthermore, AMEX provides you with an extended warranty and purchase protection, among other perks.

The Hilton Honors American Express Business Card doesn’t charge a foreign transaction fee. However, other fees apply, as follows: Cash advance: $5 or 3% of the amount of each transaction, whichever is greater; Foreign Transaction: $0; Late Payment: up to $39; Overlimit: $0; Returned Payment: $39. Additionally, the card comes with an annual fee of $95.

It is important to have good creditworthiness. Also, you must have handy your business and personal information, including annual income and documents that describe how your business works.

You can apply for a Hilton Honors Business Card by accessing the official American Express website at https://www.americanexpress.com/.

If you are interested in getting The Hilton Honors American Express Business Card, learn how to apply for it now!

How to apply for the Hilton Honors Business Card?

Learn how to apply for a Hilton Honors Business Card and enjoy the fantastic benefits this AMEX card offers for business owners or managers!

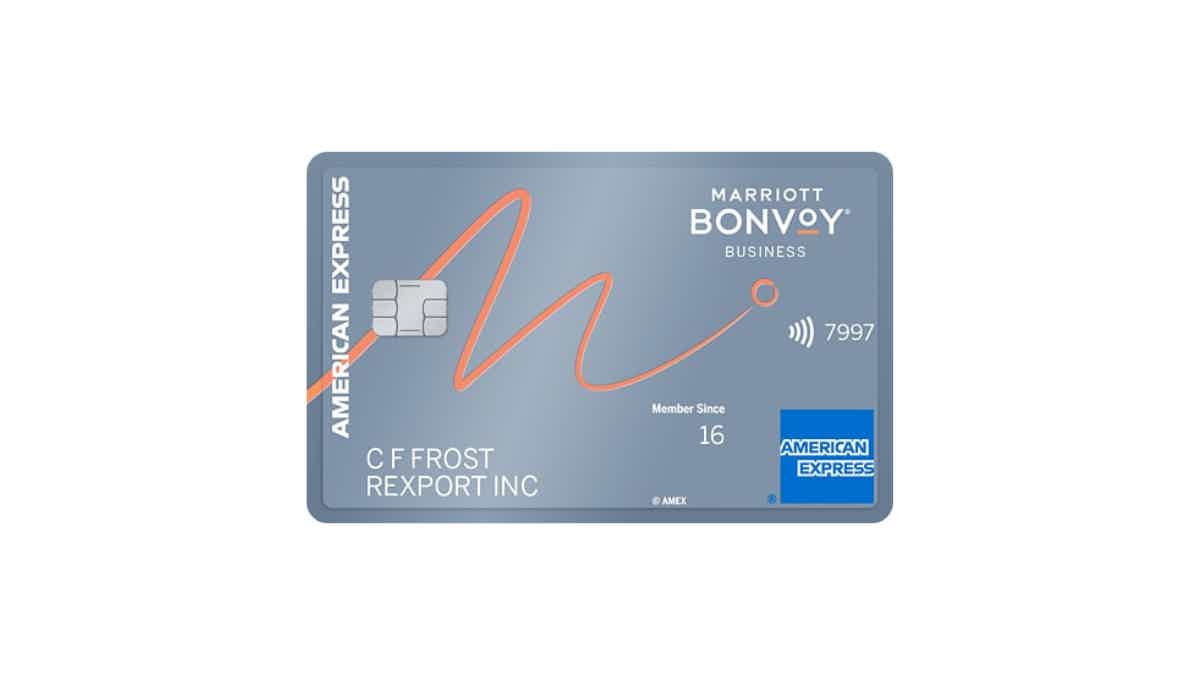

Now, if you are interested in a similar alternative, check out the Marriott Bonvoy Business® Credit Card review and learn how to apply!

How to get a Marriott Bonvoy Business Credit Card?

Marriott Bonvoy Business Credit Card offers points, discounts, and Elite Status in the Marriott Bonvoy® program. Find out more on this full review!

Trending Topics

AAdvantage® Aviator® World Elite Business Mastercard® full review

Check out this AAdvantage® Aviator® World Elite Business Mastercard® review article and learn how this card can help you with your business.

Keep Reading

JetBlue Flight Deals review: from flights to hotel stays!

If you're looking for a great way to save on your next vacation, you can read our JetBlue Flight Deals review to learn about this airline!

Keep Reading

How to apply for a loan at Quickbridge?

Check out how easy and fast it is to apply and get a loan at Quickbridge and start growing your business with the specialized help you need.

Keep ReadingYou may also like

How to build credit fast from scratch with our tips for beginners!

Are you new to credit and wish to build a strong one? We can help you. Just follow these tips, and your score will skyrocket.

Keep Reading

Next Day Personal Loan review: how does it work and is it good?

If you need money for an emergency, Next Day Personal Loan has an online and free process. Check out our review to learn more!

Keep Reading

Learn to apply easily for the Happy Money Personal Loan

Discover the step-by-step process to apply for a Happy Money Personal Loan here. Check it out!

Keep Reading