Earn 2.50% interest on every dollar you have and enjoy unlimited Interac e-Transfers®!

EQ Bank Savings Plus Account – No minimum balance requirements or monthly fees!

Are you looking for an easy and hassle-free way to earn a competitive rate of interest on your savings? EQ Bank’s Savings Plus Account might be the perfect solution! This online bank account has great features, from no monthly fees to high interest rates – plus all deposits are 100% guaranteed by the Canada Deposit Insurance Corporation (CDIC). Check our full review to learn more!

Are you looking for an easy and hassle-free way to earn a competitive rate of interest on your savings? EQ Bank’s Savings Plus Account might be the perfect solution! This online bank account has great features, from no monthly fees to high interest rates – plus all deposits are 100% guaranteed by the Canada Deposit Insurance Corporation (CDIC). Check our full review to learn more!

Are you looking for a high-yield savings account that works for your lifestyle? The EQ Bank Savings Plus Account could be the perfect solution. Check some of its incredible benefits below!

To become eligible for an EQ Bank Savings Plus Account, you must be a Canadian resident over the age of majority in the province where you reside and have a Social Insurance Number.

You can easily access your cash using EQ’s mobile app and/or online banking to deposit or transfer funds between your bank accounts. If you’d like to withdraw funds, you can use your EQ Bank Card for free in any ATM in Canada.

Interac e-Transfers® are a secure way to send and receive money electronically any time using channels such as a Canadian email or mobile number. Interac e-Transfers® under $250 are made instantly. Any transaction above $250 might take about 30 minutes to finalize. Interac e-Transfers® are 100% free of charge.

Are you looking to make the most of your savings? You’re in luck! EQ Bank’s Savings Plus Account is here to help you accomplish just that. Check the following link and learn how you can easily apply for it!

How to apply for an EQ Bank Savings Plus account?

Check out how to apply for this high-interest savings account by EQ Bank.

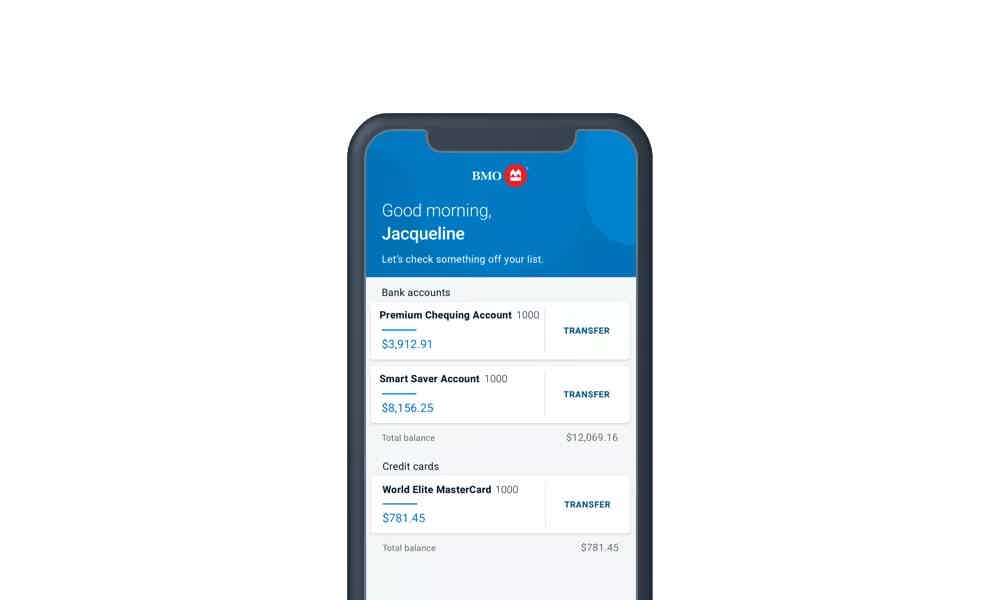

But if you’d like to check out an alternative, the BMO Performance Chequing Account is a great option! Check the following link to learn what it has to offer and how you can apply for it.

How to get a BMO Performance Chequing account?

Enjoy the benefits when opening a BMO Performance Chequing account! Check out how to apply for it!

Trending Topics

How to apply for the Scene+TM Student Banking Bundle?

Learn how to apply for the Scene+TM Student Banking Bundle and enjoy the limited offerings of up to 12,500 Scene+ points at no monthly fees.

Keep Reading

Royal Bank of Canada review: everyday banking with perks!

Do you need a bank with incredible and diverse financial options like loans and credit cards? Then, read our Royal Bank of Canada review!

Keep Reading

Canada Digital Adoption Program review: Business growth!

Are you looking for a business program to improve your company? If so, read our Canada Digital Adoption Program review!

Keep ReadingYou may also like

Southwest Rapid Rewards® Priority Credit Card application

Do you want to apply for the Southwest Rapid Rewards® Priority Credit Card, but have no idea where to start? Stay tuned, and we will show you the way. Keep reading!

Keep Reading

A 101 guide on how to invest your money: tips for beginners

Nowadays, the topic of investment is not just on Wall Street anymore. People across U.S. homes are learning how to make the best out of their hard-earned money. You can learn too! You'll find some tips in this article.

Keep Reading

70K bonus points: Apply for American Express® Business Gold Card

As a business owner, you can apply for the American Express® Business Gold Card. Earn points on purchases and enjoy exclusive travel benefits! Read on!

Keep Reading