Loans (US)

Quickbridge review: what you need to know before applying

Quickbridge helps you grow your business. Check out how the lending options work!

Quickbridge: financing solutions for your business

Quickbridge focuses on offering financing solutions for small businesses. It was founded in 2011, and since then, it has been helping businesses to grow. That is one of the reasons why Quickbridge deserves this full review.

| APR | Quickbridge does not disclose its APR rates on its website. |

| Loan Purpose | Business loans: working capital loans, unsecured loans, short-term loans, bad credit business loans. |

| Loan Amounts | From $5,000 up to $500,000 |

| Credit Needed | Quickbridge has options for businesses with good credit but also for businesses with poor or fair credit too. |

| Terms | 4 months up to 10 years |

| Origination Fee | It does charge an Origination Fee. However, it is not specified on the company’s website. |

| Late Fee | This information is not available. |

| Early Payoff Penalty | Quickbridge does not inform of any early payoff penalty on its website. |

How to apply for Quickbridge?

Quickbridge offers many lending solutions for businesses. Check out how to apply!

In 2019, it achieved approximately $163 million in loan originations, which means it is a reliable company with fast growth.

Also, Quickbridge was recognized with the ELFA Operations and Technology Excellence Award and the BIG Innovation Award.

Keep reading this Quickbridge full review to understand how it works!

How does it work? Quickbridge benefits review

Quickbridge offers several lending options for small businesses. It has provided loans for over 9,000 companies in a wide range of industries, from retail stores to construction. Let’s review some of Quickbridge benefits.

Among the options of loans, this lender offers solutions for Contracting & Construction segments, Farmers Producing Agricultural Products, Food & Beverage Industry, Health & Wellness, Retail & B2B Service Companies, and Transportation.

Also, the solutions are designed according to the business moment, needs, and goals.

Basically, you can get up to $500,000 in funding received within days. There are no hidden fees, and the application takes only a few minutes.

Besides the traditional loans for small businesses, the company offers short-term loans, in which a borrower can get the fast funds they need to cover an immediate expense.

Furthermore, Quickbridge provides Work Capital Financing, one of the most popular options. It works as funds to cover temporary cash shortfall.

In addition, it is based on the short-term financing option regarding conditions. Moreover, there is the unsecured business loan alternative with no collateral attached, where Quickbridge will review your financial conditions and give you the best possible offer.

Finally, the application is simple, and the process is fast. The terms are flexible, and you can get good discounts in case of early payoff.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Pros

- Quickbridge attends a wide range of industries, from retail to construction;

- Quickbridge offers loans designed to each business’s needs and goals after a careful review of your financial conditions;

- It provides fast funding within days;

- The application is simple;

- It offers different lending options, including Small Business Loans, Short Term Business Loans, Working Capital, and Unsecured Lending;

- The terms are flexible and you can get up to $500,000;

- It provides excellent customer service;

- All credit scores are considered.

Cons

- It doesn’t display the fees and costs unless you complete the application.

What credit score do you need to apply for a loan at Quickbridge?

All credit scores are considered when you apply for a loan at Quickbridge, with all the benefits you saw in this review. However, the higher your score, the better your chances of getting approved.

How to apply for a loan at Quickbridge?

If you’re a business owner and you need some help with your finances. Quickbridge can give you a boost. Finding the perfect loan is not always easy, but Quickbridge will certainly have the right offer for you.

Now, learn how easy and fast it is to apply for a loan at Quickbridge after reading this review.

How to apply for Quickbridge?

Quickbridge offers many lending solutions for businesses. Check out how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

First National Bank eStyle Plus Checking account review

Looking for a checking account to help you control your money? Read our First National Bank eStyle Plus account review to know more!

Keep Reading

Celsius crypto review: how does it work? Get Started With Celsius Today!

Read our Celsius crypto review and start buying, borrowing and earning crypto through an amazing DeFi service with competitive rates.

Keep Reading

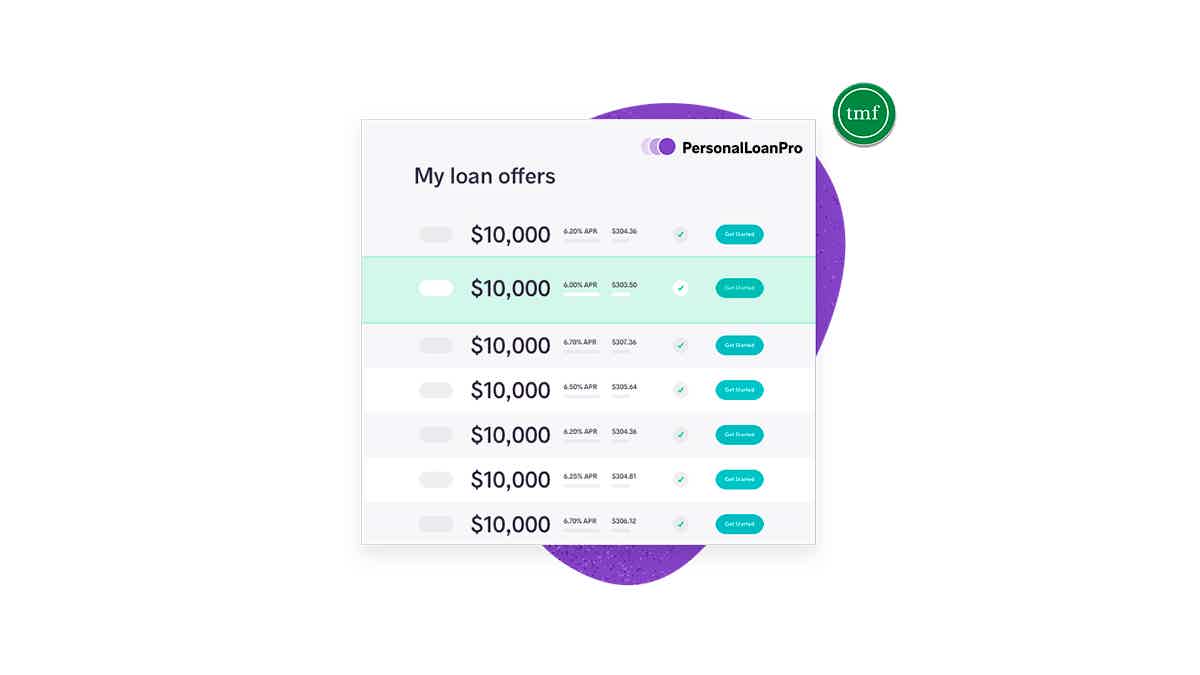

Personal Loan Pro review: learn about the best loans

Are you in need of a great credit selector for loan service providers? Read our Personal Loan Pro review and learn all about this product!

Keep ReadingYou may also like

U.S. Bank Triple Cash Rewards Visa® Business Card application

Business owners, here is the application for the U.S. Bank Triple Cash Rewards Visa® Business Card explained. $0 annual fee and reward on purchases!

Keep Reading

Delta SkyMiles® Platinum Business American Express Card application

Using the Delta SkyMiles® Platinum Business American Express Card it's the perfect way to upgrade any trip, no matter how far you're going. Read on to learn how to apply!

Keep Reading

Learn to apply easily for SpeedyNetLoan

Find out how to apply for a loan through SpeedyNetLoan, a wide network of online lenders that will get you the money for your projects in less than a day. Read on for more information!

Keep Reading