Credit Cards (US)

Mercury Credit Card overview

If you need a credit card to help you improve your score, the Mercury Credit Card is a solid option! Learn more about its features, perks and benefits in our overview!

Mercury Credit Card: Get free access to your FICO score!

Are you looking for a resourceful tool to help you improve your credit score? Then check out this Mercury Credit Card overview to see if this is the right card for you.

Mercury is a card build to help people with fair credit scores to improve their scores in a responsible way. This is one of the few unsecured credit cards for people with fair credit that might not charge an annual fee.

The credit card company sends your payment reports to all 3 major credit card bureaus on a monthly basis. However, this card has some high fees and interest fees.

Therefore it is best to pay your balance in full each month to avoid additional costs. So, keep reading this post to know more about this card that can help you improve your score and finances.

How to apply for the Mercury Credit Card

If you need a card to help you improve your finances and build your credit score, learn how you can apply for the Mercury Credit Card!

| Credit Score | Fair – Good |

| Annual Fee | $0 – $79 (based on creditworthiness) |

| Regular APR | 29.99% – 30.99% variable based on creditworthiness. |

| Welcome bonus | There is current offer. |

| Rewards | You can automatically be enrolled in Mercury’s rewards program according to your creditworthiness, however the rewards are not disclosed. |

What is special about the Mercury Credit Card?

Mercury Credit Card

Get a card that can help you get your finances back on track!

You will be redirected to another website

This card can be very special to people who want to improve their scores but cannot get approved to get other unsecured credit cards.

The card company sends your monthly payment reports to all 3 major credit bureaus, and you can check your FICO score.

Also, as a cardholder, you can enjoy the benefits of owning a Mastercard, which is a widely accepted card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Who qualifies for the Mercury Credit Card?

People who qualify to get this card receive a reservation code as a pre-approvement by the credit card issuer, and then they can complete their application.

Also, those qualified do not need to have an extremely good score. They just need to want to improve their score and their personal finances. Moreover, they need to be able to pay for the fees this card charges.

Mercury Credit Card review

Check out the Mercury Credit Card review to learn more details about this card's features pros and cons and decide if it's the best fit for you!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to start banking with Discover Bank?

Discover Bank features a range of financial products with no fees, so you can choose which fits your needs better. See how to start banking!

Keep Reading

How to apply for Ent Credit Union Personal Loans?

Read how the Ent Credit Union Personal Loans application works and learn how easy and fast it is to get the money you need with low rates.

Keep Reading

Chime® Credit Builder Card review

Check out how you can build your credit free of fees and interest. Learn more about it with this Chime® Credit Builder card review article!

Keep ReadingYou may also like

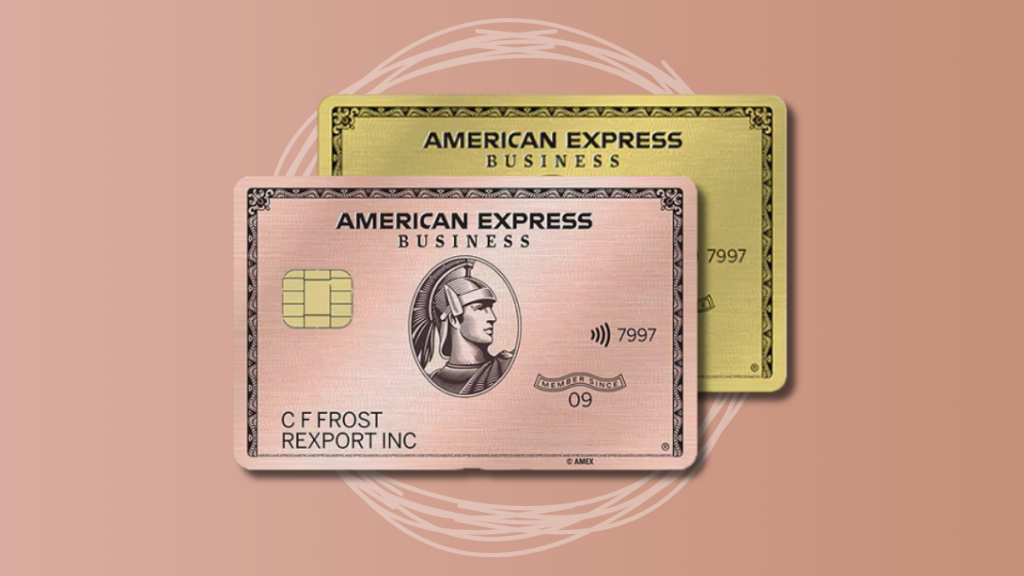

70K bonus points: Apply for American Express® Business Gold Card

As a business owner, you can apply for the American Express® Business Gold Card. Earn points on purchases and enjoy exclusive travel benefits! Read on!

Keep Reading

Chase Ultimate Rewards partners: complete list

Learn about the most popular Chase Ultimate Rewards partners and how you can redeem your points for maximum value.

Keep Reading

How to build credit with a secured credit card

Do you want to know how secure credit cards are perfect for building credit? Find out everything about it here, plus many more important things to take your credit out of scratch.

Keep Reading