US

Lowe’s® Advantage Card full review: Choose your advantage!

Do you need to make home improvements and want some perks? If so, you can read our Lowe’s® Advantage Card review to learn more!

Lowe’s® Advantage Card: Welcome bonus for new cardholders!

Are you looking for a convenient way to help fund home improvement projects around the house? A Lowe’s® Advantage Card review might be just what you need!

How to apply for Lowe’s® Advantage Card?

Looking for a card to help you pay for your home improvements and get perks? If so, read on to apply for Lowe’s® Advantage Card!

| Credit Score | Good score. Also, you can prequalify. |

| APR* | 26.99% variable APR for purchases. *Terms apply. |

| Annual Fee | No annual fee. |

| Fees* | Late Payment fee: Up to $41. *Terms apply. |

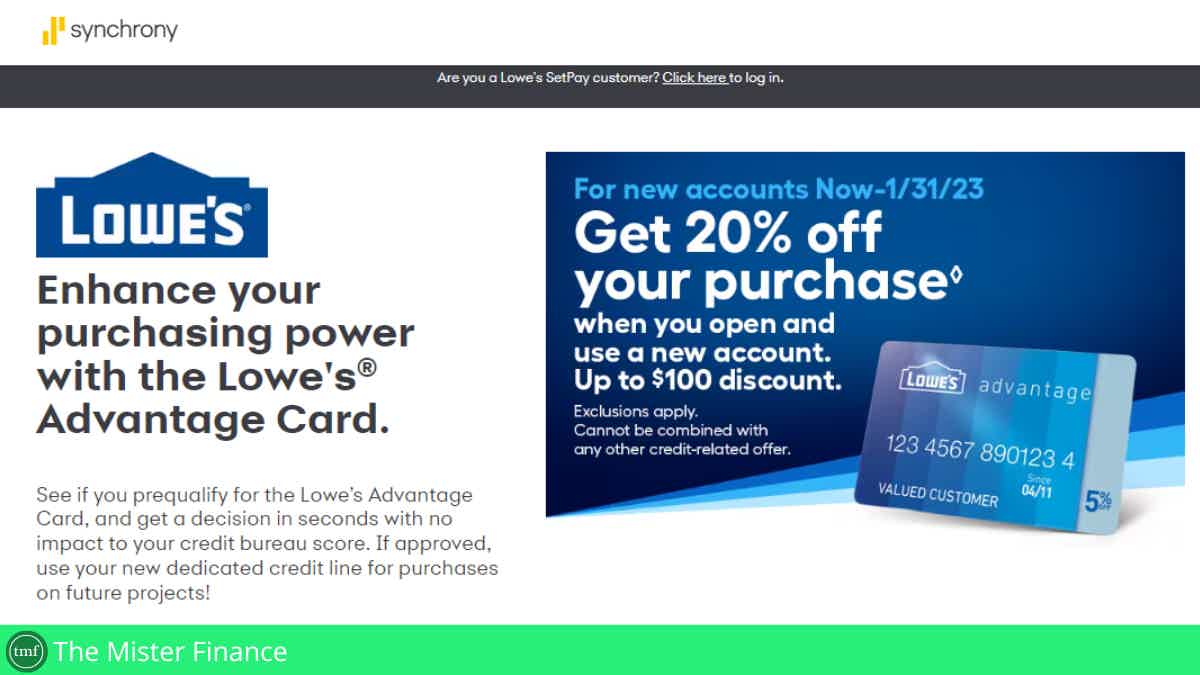

| Welcome bonus* | Get 20% off your purchase when you open your account (up to a $100 discount with a limited offer). *Terms apply. |

| Rewards* | 5% off or 6 months with special financing or 84 fixed monthly payments. You can choose one of these everyday advantages. *Terms apply. |

Also, this store-branded credit card can give you quick access to the funds needed for larger purchases, plus exclusive rewards and discounts.

Moreover, if you’re a new cardholder, there’s even more incentive: an impressive welcome bonus offer.

Therefore, in this post, we take an in-depth look at Lowe’s Advantage program to give our readers all the information they need before applying.

So, read our Lowe’s® Advantage Card review and jump-start your next project with confidence!

How does Lowe’s® Advantage Card work?

With Lowe’s® Advantage Card, you’ll be able to choose between 5% off every day, 6 months of special financing, or 84 fixed monthly payments.

So, you can get 5% off your eligible purchase or order charged to your Lowe’s Advantage Card.

Or you can choose to get 6 months of special financing. Or you can even choose to get 84 fixed monthly payments!

Moreover, this card offers other perks for those looking to make home improvements and purchase at Lowes! In addition, you can get all these perks for no annual fee!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Lowe’s® Advantage Card benefits

As you know, this credit card offers really good perks to its cardholders. Also, it can b an incredible card option for those looking to make home improvements!

Moreover, this card has no annual fee for you to worry about! However, it also has some downsides, as with any other credit card.

So, read our pros and cons list below to learn more and make the right decision!

Pros

- You can prequalify for this credit card;

- There is no annual fee;

- Good rewards for those looking for a card to make home improvements;

- You can choose between 5% off or 6 months of special financing, or 84 fixed monthly payments.

Cons

- The rewards are not so flexible.

How good does your credit score need to be?

This credit card company prefers those with a higher credit score. Also, this can be due to the high rewards and good perks the card offers.

Moreover, it can be best to wait to get a higher score before you think about applying for this credit card.

However, you’ll be able to prequalify for this card online before you start the official application process.

Therefore, you’ll be able to check if you can qualify with no impact on your credit score!

How to apply for Lowe’s® Advantage Card?

You can apply for this card online with no worries. Also, you’ll be able to prequalify with no credit score harm!

How to apply for Lowe’s® Advantage Card?

Looking for a card to help you pay for your home improvements and get perks? If so, read on to apply for Lowe’s® Advantage Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to buy and make money online through Celsius?

Celsius is a DeFi platform that allows you to buy crypto, borrow, receive or send payments, earn rewards, and more. Learn how to get started!

Keep Reading

How to buy Alaska Airlines tickets on sale?

Check out how to buy Alaska Airlines tickets on sale and enjoy one of the best services onboard in compliance with aviation high-standards.

Keep Reading

How to apply for the Buy On Trust Lending?

The Buy On Trust Lending is a great choice if you don’t have a good credit score and want flexibility on payments. See how to apply!

Keep ReadingYou may also like

R.I.A. Federal Credit Union Mastercard® Classic Card review

With a variable APR of 14.00%, no annual fee, and contactless payment technology, this card could be a solid choice for your financial needs.

Keep Reading

Blue Cash Everyday® Card from American Express: easily apply

Claim cash back on everyday purchases with the legendary Blue Cash Everyday® Card from American Express- Discover how to apply now.

Keep Reading

Chase Secure Banking℠ review: How is this account different from the others?

Ready to take control of your finances and earn a $100 sign-up bonus? Then, join us for a Chase Secure Banking℠ review!

Keep Reading