SA

How to apply for the Spot Money Debit Card?

Do you need a debit card with benefits and no hidden fees? If so, read on to learn how to apply for the Spot Money Debit Card!

Spot Money Debit Card application: Get a free virtual card!

Are you looking to switch from your traditional bank debit card to something that has more flexibility and benefits? You can learn how to apply for the Spot Money Debit Card!

Also, Spot Money gives South Africans instant access to a virtual debit card that can be used at any retailer worldwide, even online!

Moreover, with Spot Money’s secure technology, apply for a free card within minutes using their easy app.

In addition, there are no hidden fees, so you know exactly what you’re paying for when it comes to purchases—just straight-up convenience.

Therefore, learn how this revolutionary debit card works and get started with an account today – now you can easily enjoy shopping! Read on to learn how to apply for the Spot Money Debit Card!

Online Application Process

You can only apply for this debit card through the official mobile app. Moreover, you’ll need to open your account before you can get your card.

Also, once you open your account, you’ll be able to start using your virtual debit card. And if you want a physical card, you’ll need to order it for an R29 fee.

You will be redirected to another website

Application Process using the app

The best way to apply for this debit card is through the mobile app. So, you start by downloading the app, which is available on Google Play, AppGallery, and App Store.

Then, you can start providing the personal information required and complete your application to open your account.

After that, you’ll be able to use your virtual card and account right away with no foreign transaction or common transaction fees!

Another recommendation: Absa Gold Credit Card

We have an incredible recommendation for you if you’re also interested in credit cards! Learn more about the Absa Gold Credit Card!

With this Absa credit card, you’ll be able to earn up to 1.15% cash back when using your card for eligible purchases. Also, there are 57 days interest-free and up to 30% real cash back for eligible purchases!

Moreover, you can get access to Absa Rewards and Absa Advantages to earn even more perks! Also, you’ll get incredible travel and airport lounge benefits!

Therefore, check out our table below to learn more about this card and see if this is the best option for your finances!

| Requirements* | R4 000 monthly income requirement; Documents: South African ID book or smart card, proof of residence, and others; Age: 18 years or older. *Terms apply. |

| Initiation fee | N/A. |

| Monthly fee* | R23.20 for Absa rewards membership; R55 credit facility account fee. *Terms apply. |

| Rates* | Up to 57 days interest-free (valid for eligible transactions). *Terms apply. |

| Rewards* | Up to 1.15% cash back when paying with an Absa credit card or others; Up to 30% real cash back for eligible purchases and more. *Terms apply. |

If you like what you see above, check the link below to learn how to apply for this card.

How to apply for the Absa Gold Credit Card?

Do you need a rewards card with travel benefits? If so, read our post to learn how to apply for the Absa Gold Credit Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Absa Student Credit Card review: zero monthly service fees

If you want a card designed for students to build stable financial credit records, this Absa Student Credit Card review is worth reading!

Keep Reading

How to apply for the Savvy Bundle Platinum Account?

Looking for an account with travel features and other platinum perks? If so, read on to apply for the Savvy Bundle Platinum Account!

Keep Reading

Child Support Grant full review: Help for needy families!

Are you looking for a government benefit to raise your child? If so, check out our Child Support Grant review to learn more!

Keep ReadingYou may also like

Next Day Personal Loan review: how does it work and is it good?

If you need money for an emergency, Next Day Personal Loan has an online and free process. Check out our review to learn more!

Keep Reading

When should you consider a secured credit card?

If you're suffering from a bad credit score, you should consider getting a secured credit card to improve it. Read this content to see if it's the right option for you.

Keep Reading

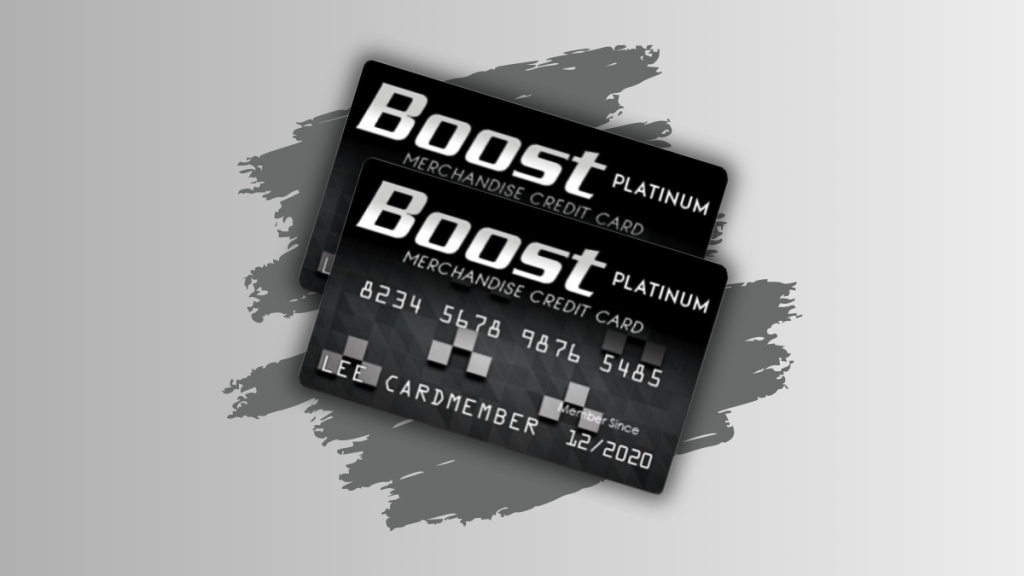

Application for the BOOST Platinum Card

Learn how to apply for the BOOST Platinum Card, perfect for consumers looking for an easier way to shop. This card offers no interest on purchases, a $750 credit limit, and no credit checks.

Keep Reading