Credit Cards (US)

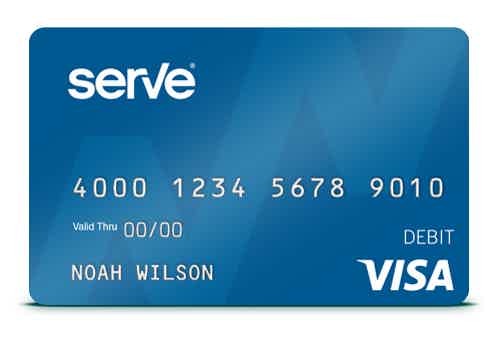

How to apply for the Serve® Pay As You Go Visa® Prepaid card?

You already must know that this card is a very safe and reliable option for those seeking to spend money wisely and without worry! Check our Serve® Pay As You Go Visa® Prepaid card application post and learn more!

Serve® Pay As You Go Visa® Prepaid card application: see all there is to apply to a safe way to make purchases

The application process is sometimes rough, being one of the main reasons people fail to get their cards, as they get daunted by the many different questions and links to get through to create an account. Rest assured, we’ve been there, and in our experience, we can tell you which is the best way to approach these applications! Want to learn more about this card and its application process? See our Serve® Pay As You Go Visa® Prepaid card application post!

Apply online

Serve’s application process is as straightforward as its fee policy! Check their website and click on Open an Account. This will redirect you to a safe environment with further instructions and disclosures about how they handle your information. For example, this is where Serve lets you know they won’t perform a credit score check on you for your application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After you get access to your Serve® Pay As You Go Visa® Prepaid card, you will also have access to Serve’s online banking platform. This is a convenient tool to load balance into your card and to be in control of your account’s management. All for your convenience and appreciation!

Serve® Pay As You Go Visa® Prepaid card vs. Serve® Free Reloads card

If you don’t know if you want to get the Serve® Pay As You Go Visa® Prepaid card, we can give you a different option, such as another Serve card. For example, the Serve® Free Reloads card that also does not require a credit score check to apply! So, check out our comparison table below to help you decide!

| Serve® Pay As You Go Visa® Prepaid card | Serve® Free Reloads | |

| Credit Score | No credit score check required. | No credit score check required. |

| Bank and ATM Fees | No monthly fees. Variable fees per transaction still apply. See Serve’s Cardholder Agreement to learn all about them. *Terms apply. | $6.95 monthly fee. |

| Cash Withdrawals | $2.25 per transaction. *Terms apply. | N/A. |

| Welcome bonus | This card features no welcome bonus. | This card features no welcome bonus. |

| Rewards | Provides access to your Tax Refund up to 2 days faster. *Terms apply. | This card features no rewards package. |

Serve® Free Reloads Debit Card

Debit cards can be a fantastic option for those who are trying to get back on track when it comes to finances. Learn how to get the Serve FREE Reloads debit card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Mastercard® Luxury Gold credit card?

The Mastercard® Luxury Gold credit card is a great option for those who have a luxurious lifestyle. See how to apply for it now!

Keep Reading

15 best online brokerage accounts of 2021

Are you thinking of starting to invest or already an investor? We have come up with a list of the best online brokerage accounts!

Keep Reading

How to get the HBO Max Streaming?

Interested in getting access to some of the greatest movies and TV shows available today? Check how to get the HBO Max Streaming today!

Keep ReadingYou may also like

A simple process: Apply for the PayPal Prepaid Mastercard®

Ready to apply for your own PayPal Prepaid Mastercard®? Learn about all the steps required in detail - simplify your finances quickly!

Keep Reading

Learn to apply easily for ClearMoneyLoans.com

Learn how to quickly and easily apply for a loan with ClearMoneyLoans.com - we simplify the process for you. Read on!

Keep Reading

10 best credit cards with cashback rewards: reviews and offers 2022

If you like to get cashback as a reward, take a look at these credit cards. They have some of the best performances on the market, and their benefits will surely suit your needs. Learn more about each one of them to choose yours.

Keep Reading