Finances (US)

How to apply for Porte Mobile Banking?

Today, we bring you an innovative way of managing your money. Then, check out how the Porte Mobile Banking application works.

Porte Mobile Banking application: get the app!

You can apply for Porte Mobile Banking online, and it couldn’t be easier and faster.

We know you don’t have much time to waste gathering various documents to send to a bank to open an account.

Thus, Porte has launched to allow you access to an innovative way of banking.

Even though you are probably already used to mobile banking, Porte promises to do it in a better way.

In short, there are no minimums and no fees with qualifying direct deposits. Also, it offers both checking and savings accounts.

The checking comes with a Visa debit card that offers cash back on eligible retailers. On the other hand, the savings comes with up to 3% APY, which is way higher than the national average.

Additionally, the checking account provides essential features, including Check Capture, automated alerts, fast Direct Deposit, Contactless payment, card lock, EMV Chip, Touch ID, and more.

Finally, even though Porte doesn’t provide physical branches for your convenience, it offers over 37,000 ATM locations for free.

And for those who want to make a difference in the world, Porte features a Charitable Giving program at no additional cost, in which part of your spending goes to support charity.

Apply online

Since Porte is a mobile app, the only way to apply for Porte Mobile Banking is by downloading the app.

Therefore, continue reading below to access a new way of managing your money.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Firstly, download the Porte mobile app on the App Store or Google Play.

Secondly, enter your personal information, including your contact info.

Finally, fund your account and start managing your money!

Porte Mobile Banking vs. Upgrade Rewards Checking

Porte fintech offers an innovative way of banking. Although you are probably already familiar with apps, Porte tries to deliver something extra.

So, Porte provides security, features, and accessibility through over 37,000 ATM locations for free.

Also, it offers a Visa debit card to get cash back on your favorite retailers like Starbucks, Dunkin, Airbnb, Hulu, Life Time, and Five Guys.

On the other hand, in case you want cash back on all of your debit charges and no fees at all, you can take a look at our review of the Upgrade Rewards Checking.

In essence, Upgrade also offers checking and savings. On the other hand, it provides you with better rates and conditions.

You earn unlimited rewards while paying zero fees on overdrafts, transfers, ATMs, and maintenance. Besides that, Upgrade has several good reviews on the web, which makes it reliable.

Both Upgrade and Porte are partnered with FDIC-insured banks, as well. If you’d like to learn how to apply for the Upgrade Rewards Checking Accounts, read the following content.

How to apply for an Upgrade Rewards Checking?

You can apply for your Upgrade to Rewards Checking Account online and earn rewards at no fees. This post will tell you how to do it.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Health Savings Account: should you get one?

A health savings account is a way to be in control of your medical expenses. But it contains many requirements. Find out more about it!

Keep Reading

How to apply for the Capital One Quicksilver Rewards for Students card?

Capital One Quicksilver Rewards for Students card rewards all purchases and doesn’t charge you an annual fee. Check out how to apply for it!

Keep Reading

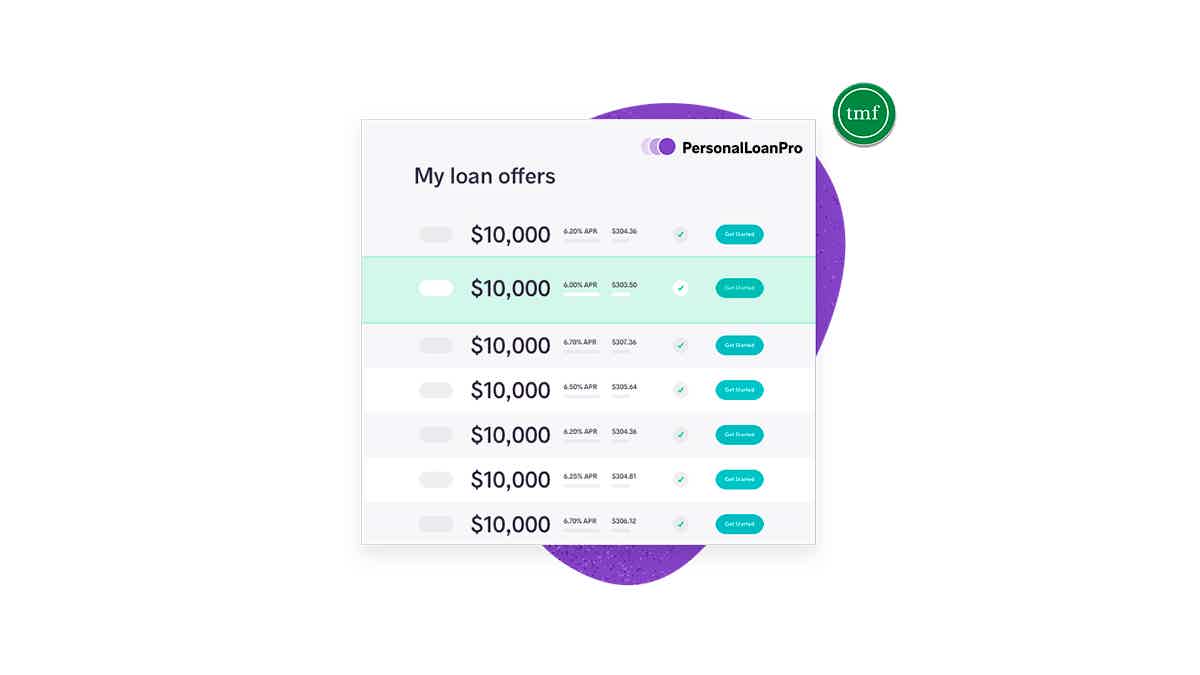

Personal Loan Pro review: learn about the best loans

Are you in need of a great credit selector for loan service providers? Read our Personal Loan Pro review and learn all about this product!

Keep ReadingYou may also like

Another bad week for Tesla’s stock prices

Tesla's stock had a rough week, with shares falling more than 10% on Friday. Find out why and how it could impact Elon Musk's deal to buy Twitter.

Keep Reading

Luxury Titanium credit card review: is it worth it?

If you're looking for a premium travel credit card, take a look at the Luxury Titanium. It has great benefits for travelers and will turn your trip into a VIP experience. Please, keep reading to find out why.

Keep Reading

OpenSky® Secured Visa® Credit Card review

A secured credit card that doesn't require a bank account or a credit check? The OpenSky® Secured Visa® Credit Card is perfect for consumers looking to build or boost their credit.

Keep Reading