Loans (US)

How to apply for National Debt Relief?

Are you looking for ways to get rid of debt? If so, read our post to learn how to apply for the National Debt Relief program!

National Debt Relief application: Get a free consultation!

Are you struggling to pay debts? Are collection agencies calling you? You’re not alone. Millions of people are in the same situation. But there’s hope. You can learn how to apply for National Debt Relief!

This program can help you get out of debt for good. Also, you’ll only need to pay the program fees after you’ve settled the debt with their help.

You’ll get access to incredible professionals to build a debt relief program. So, read on to learn how to apply for a National Debt Relief free consultation today, and see how much money you could save!

National Debt Relief Online Application Process

Before you start the application process to get help from the National Debt Relief program professionals, you need to understand a few things.

For example, you need to know the difference between debt relief and debt consolidation.

With debt consolidation loans, you can use the money to pay for your debt and then keep paying for the loan later.

However, it’s different with the debt relief programs because they help you reduce the amount of money you owe.

So, debt relief reduces the total amount of money you owe over time. By negotiating with your creditors, you may be able to lower the total amount you owe.

When two parties settle a debt, the debtor pays nothing, and the creditor writes off the whole total. Debt consolidation is obtaining a new loan with the express purpose of paying down old loans.

This often necessitates a better-than-average credit score. However, with the National Debt Relief program, you don’t need to have a high score to get a consultation.

And you only need to start your application with a free consultation with their professionals. Also, if you like the consultation, you can start the plan to get your debt relief!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

There is not much information about a mobile app to help you apply for debt relief in this program. So, you need to go through the steps on the topic above to apply!

Another recommendation: Upgrade Personal Loans

Now, if you’re unsure about enrolling in the National Debt Relief program, we can help you by giving you information about a different option. So, you should get to know about the Upgrade Personal Loans.

With this lender, you’ll be able to find incredible personal loan options. Also, debt consolidation loans can allow you to borrow up to $50,000.

Plus, you can even get your funds in no time. And there are no prepayment fees if you need to include these payments on your debt consolidation and financial plans.

However, you’ll get a loan to consolidate debt and not get debt relief. As we mentioned, these can be different tools to help you with your debt.

Therefore, consider your options before you start applying for any of these lenders’ programs.

Upgrade Personal Loans full review

The Upgrade Personal Loans can help you pay off your debt or other large purchase. So, if you want to know more, keep reading our full review!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Merrick Bank Recreation Loans full review: what you need to know before applying

If you're looking for a loan specifically to fund your outdoor adventures, read our Merrick Bank Recreation Loans review!

Keep Reading

Delta SkyMiles Reserve or Delta SkyMiles Reserve Business?

Delta SkyMiles Reserve or Delta SkyMiles Reserve Business? Keep reading if you want to find out which one of these travel cards is the best!

Keep Reading

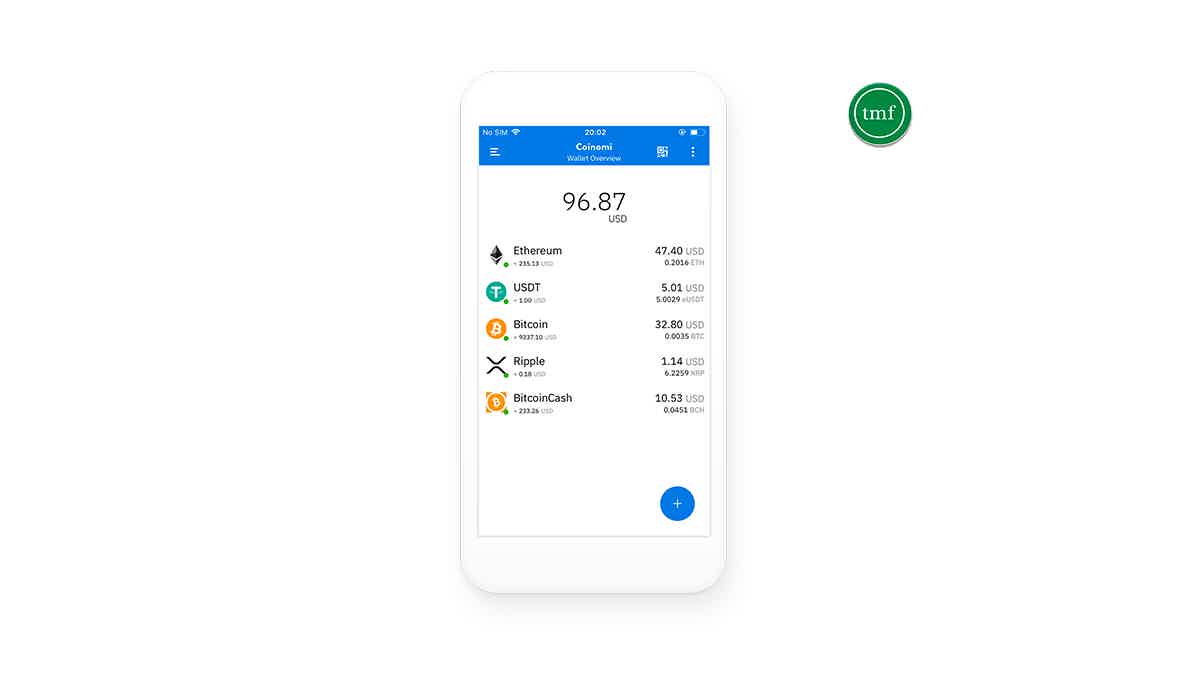

Coinomi crypto wallet full review

This Coinomi crypto wallet review will show you how this wallet works and how you can manage over 1,770 blockchain assets via an amazing app!

Keep ReadingYou may also like

You can save money even when interest rates are low: learn how

Learn what interest in savings accounts are and how they affect your savings. Read on to find our how to save money with low interest rates!

Keep Reading

What Is a Jumbo Loan? Demystifying High-Value Mortgages

Learn "What is a jumbo loan" and unlock the keys to upscale homeownership. Understand the unique details of jumbo loan financing.

Keep Reading

Achieve Personal Loan (formerly FreedomPlus) review

Check out this Achieve Personal Loan review and find out why it could be the perfect way to get your finances back on track! Enjoy rate discount and more!

Keep Reading