Credit Cards (US)

How to apply for the OakStone Gold Secured Mastercard® credit card?

Looking for a card which you don’t need to prove how good your credit score is? Maybe, OakStone Gold Secured Mastercard® credit card is for you! See how to apply for it now!

OakStone Gold Secured Mastercard® credit card application.

To begin with, the great deal about OakStone Gold Secured Mastercard® credit card is not only the low APR or the chance to rebuild your credit score.

It is, also, the simple, fast and easy application process. And, you can apply for it right now! So, keep reading and find out more information about it!

Apply online

The application process to get this card is really simple and fast, and you just have to follow some simple steps.

First, access the OakStone Card Now website and fill in the information in the application form. Then, submit it and wait for the approval.

Once you get approved, you will receive your secured credit card and get a chance to a fresh start.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Unfortunately, there is no mobile app available for this credit card. So, it is not possible to manage your account through an app.

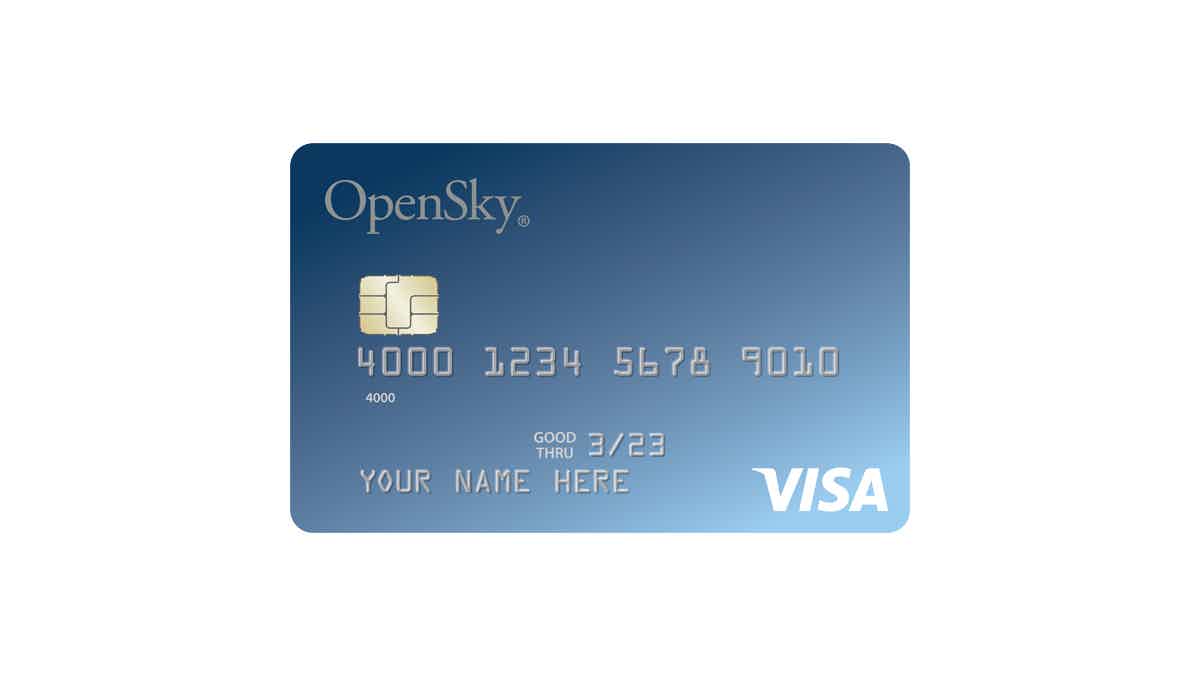

OakStone Gold Secured Mastercard® vs. OpenSky® Secured Visa® card

Secured cards are like other credit cards. The difference between them is that secured credit cards need a secured deposit and don’t have rewards programs. But, the great advantage is that they give you an opportunity to apply without credit score.

So, which is the best? Check out the comparison chart below and learn more about another great option available on the market, the OpenSky® Secured Visa® card. That way, you can choose the best card for your financial needs!

| OakStone Gold Secured Mastercard® card | OpenSky® Secured Visa® card | |

| Credit Score | None | None |

| Annual Fee | $39 | $35 |

| APR | Regular APR: 14.74% – variable; Cash Advance APR: 20.74% – variable. | 20.39% (variable) on purchases 20.39% (variable) on cash advances |

| Welcome bonus | None | None |

| Rewards | None | None |

How to apply OpenSky® Secured Visa® card?

The OpenSky® Secured Visa® credit card is an option for people who don’t have a good credit score or even a bank account. See how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Citi Custom Cash℠ Card overview

Read this Citi Custom Cash℠ Card overview to learn how this card grants you access to an amazing rewards rate on daily purchases!

Keep Reading

How to apply for a Capital One Platinum credit card?

Check out how easy and fast it is to apply for a Capital One Platinum and start building a credit score while enjoying a package of perks!

Keep Reading

Pension loan: how it works!

Learn what a pension loan is and how it works. Check out if it is trustworthy and the alternative ways you can get money fast if you need it!

Keep ReadingYou may also like

Learn to easily apply for the PenFed Credit Union Personal Loans

Do you have questions about how to apply for the PenFed Credit Union Person Loans? Here you'll find the answers to make the application without hassles. Keep reading!

Keep Reading

Apply for Delta SkyMiles® Blue American Express Card easily

Get the latest guide to apply for the Delta SkyMiles® Blue American Express Card and make your travels more rewarding. Keep reading to master the process!

Keep Reading

Neo Credit Card review: Up to 15% cashback on first-time purchases!

The Neo Credit Card offers an exceptional blend of benefits for modern consumers: high cashback rewards, no annual fees, and a user-friendly digital platform. Perfect for those seeking value and convenience.

Keep Reading