CA

How to apply for the Disability Tax Credit?

Learn how the Disability Tax Credit application works and what you need to do to get the tax credit to reduce your income tax.

Disability Tax Credit application: learn how to receive the benefit

Now that you know everything about the DTC, it is time to learn how to apply for the Disability Tax Credit.

But, let’s review some of the main points about this benefit.

In summary, the Disability Tax Credit is a non-refundable tax credit for individuals with disabilities and their family members.

Therefore, the objective is to reduce the income tax people with impairments may have to pay.

Also, it is important to address what a disability is. So, disabilities are mental or physical conditions that impact the way people with them see and interact with the world.

In the case of government benefits, disabilities must be severe or prolonged impairments that follow some eligibility criteria.

In addition, only a medical practitioner can certify a person is eligible for the benefit. Then, the Canada Revenue Agency (CRA) approves it.

Before applying, you can check the eligibility criteria on the CRA website.

Keep reading to learn how to apply for the Disability Tax Credit to claim the benefit.

Online Application Process

First of all, you must apply and then claim the DTC.

Also, it is essential to have a medical practitioner fill out the Disability Tax Credit Certificate through DTC digital application – part B.

The medical practitioner will certify your impairment, and you can apply for the benefit at any time of the year.

But, it is better to apply before filing your tax return. Part A of the online form (Individual’s section) must be filled by you or a representative person.

After sending your application, whether online or by paper by mail, you can follow the CRA’s decision on the website.

Finally, after the approval, you can claim the tax credit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

General questions

For general questions or any further doubt, you can call 1-800-959-8281.

Recommendation: Child Disability Benefit (CDB)

The Disability Tax Credit (DTC) is non-refundable and provided by the Canada Revenue Agency (CRA) for those with disabilities – severe or prolonged impairments.

It is a way to reduce the costs of living for those who already spend much on medical and other types of assistance.

The DTC opens other doors to access benefits and government programs, such as the Child Disability Benefit (CDB), Canada Workers Benefit, and Registered Disability Savings Plan.

Keep reading the next post to learn how the Child Disability Benefit (CDB) works!

How to apply for the Child Disability Benefit?

Everything you need to know about the Child Disability Benefit in Canada.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

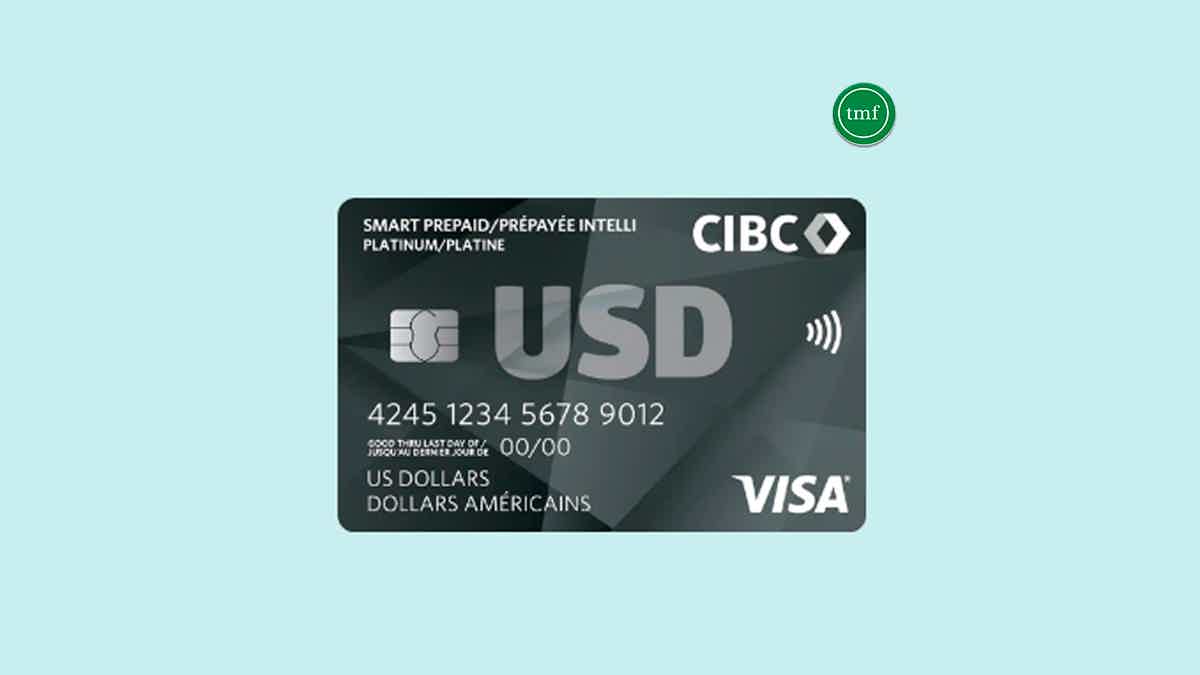

How to apply for the CIBC Smart Prepaid Travel Visa Card?

Want the versatility of having a prepaid balance in the currency you need? Read our CIBC Smart Prepaid Travel Visa Card application post!

Keep Reading

My Next Pay Loans review: all you need to know

Are you looking for the best payday loan for you? If so, read our My Next Pay Loans review post to learn more about this platform!

Keep Reading

Capital One Aspire Travel™ Platinum Mastercard® credit card: How to apply?

Capital One Aspire Travel™ Platinum Mastercard® credit card offers unlimited rewards and convenient benefits with no annual fee. Apply now!

Keep ReadingYou may also like

Apply for the Chase Slate Edge℠ and Improve your Finances!

Need to consolidate your credit card balances or make a big purchase without paying interest? If so, you might want to apply for the Chase Slate Edge℠!

Keep Reading

Application for the Destiny Mastercard®: how does it work?

The application process for Destiny Mastercard® is simple. Stay here and read this article to learn about the application.

Keep Reading

BMO CashBack® Business Mastercard®* Review

Discover the benefits of the BMO CashBack® Business Mastercard®*, tailored for business owners. Enjoy cash back on purchases, exclusive offers, and financial flexibility to boost your business success.

Keep Reading