Credit Cards (US)

Citi Chairman Amex application: how to do it?

The Citi Chairman American Express card is an exclusive product for affluent customers. Here, you'll learn about the application process and what you need to qualify.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

Citi Chairman American Express Card: Get dedicated service and all the benefits you need!

Many people would want to have the Citi Chairman American Express card. This is a product that offers many amazing rewards, from personalized concierge services to access to private jets. However, the Citi Chairman Amex application process is a little different from all other credit cards.

Note: The Citi Chairman card was discontinued, and cardholders were transferred to the Citi Prestige credit card.

Citi Prestige® Card application: how to apply?

The Citi Prestige® Card from Citibank offers great welcome bonuses, in addition to having a simple signup process. See below for the application process!

If you like feeling exclusive and having special benefits as a cardholder, you will probably want to have this elite card. Keep reading to know more about the Citi Chairman Amex application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply online

Unfortunately, the Citi Chairman Amex application is not available through any of their online channels. The credit card company has to find you eligible to be selected and get an invitation.

Apply using the app

You can manage all your credit card expenses and other functions through Citi’s mobile app. However, you cannot fill a Citi Chairman Amex application through it.

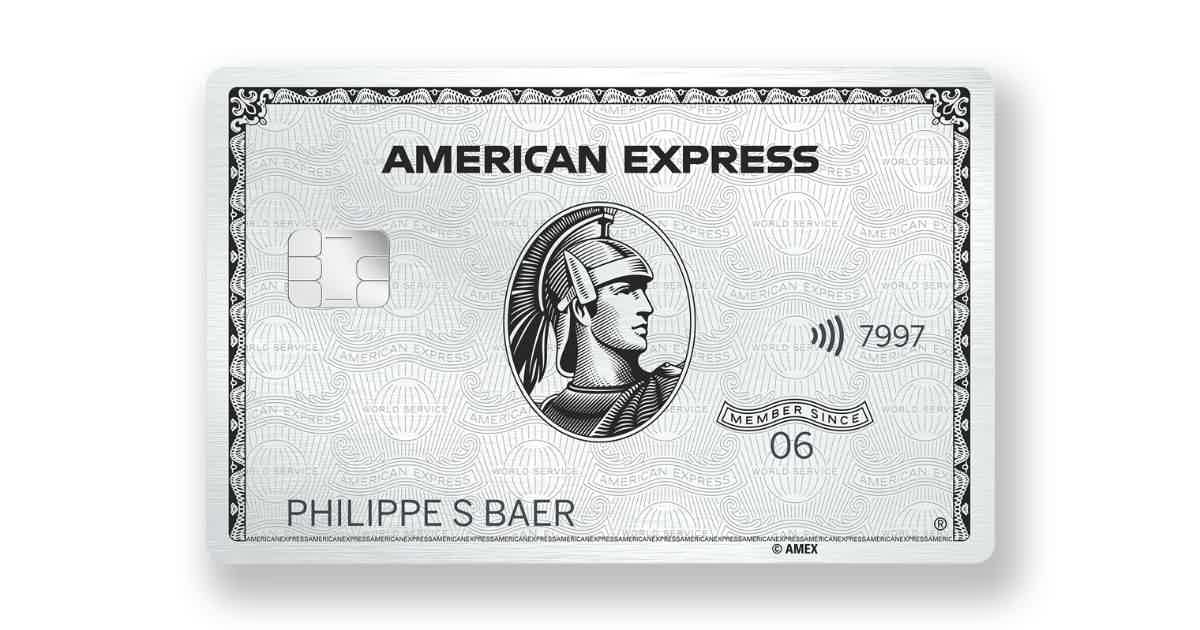

Citi Chairman American Express credit card vs. American Express Platinum credit card

Now that you’ve read all about the Citi Chairman Amex application process, do you still feel unsure about getting this card? If yes, you can compare this credit card with the American Express Platinum credit card. If you already like American Express’ services, you will also find that this other card has many benefits. So, here is a comparison with the two card’s main characteristics.

| Citi Chairman American Express card | American Express Platinum card | |

| Credit Score | Excellent | Good (690) to excellent (850) |

| Annual Fee | $500 | $695 Rates & Fees |

| Regular APR | 11.24% variable APR | 17.49% to 24.49% variable APR on eligible charges Rates & Fees |

| Welcome bonus | N/A | 100K MR points 10x points on eligible purchases *Terms apply |

| Rewards | Travel rewards program Free 24/7 concierge services Private jet programs, and more | 10 MR points at gas stations and supermarkets 5 MR points per dollar spent on flights 5 MR points per dollar spent on prepaid hotel purchases 2 MR points per dollar spent on other travel expenses 1 MR point per dollar spent on all other spendings Uber Rides with Platinum, Shop Saks with Platinum, and more *Terms apply |

How do you get Amex Platinum credit card?

If you are ready to obtain your American Express Platinum card, here are some information that can guide you through the process. Check it out!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Partner Offer through CreditCards.com

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the MBNA Money Transfer Credit Card?

Read how to apply for an MBNA Money Transfer Credit Card and transfer funds to your account with flexibility, protection, and affordability.

Keep Reading

Gemini Credit Card review: get the best crypto rewards!

If you need a great credit card with crypto rewards and no annual fee, check out our Gemini Credit Card review to learn more about it!

Keep Reading

City National Bank Personal Loan review: easy and safe loans!

If you need a safe and reliable loan, check out our City National Bank Personal Loan review to understand this bank!

Keep ReadingYou may also like

Student credit cards for no credit: top 4 options

Find out the difference between a regular and a student credit card for no credit. See the benefits of student cards to pick one. Keep reading!

Keep Reading

Discover it Student Chrome credit card review: is it worth it?

If you're a student looking for a credit card, the Discover it Student Chrome credit card is definitely worth considering. It comes with some great features. Read this article to see which benefits it has to offer.

Keep Reading

Delta SkyMiles® Platinum Business American Express Card review

If you want a business card with miles, you should read this Delta SkyMiles® Platinum Business American Express Card review!

Keep Reading