Loans (US)

How to apply for BadCreditLoans?

BadCreditLoans can provide access to loans up to $10,000 even if you are in a bad credit score situation. Learn how to apply for it today!

Applying for BadCreditLoans

BadCreditLoans is a 100% free platform that can help figure out emergency financial situations in just a few quick and easy steps followed in their online website.

The application for BadCreditLoans is made through their online platform and can be sent any time of the day, any day of the week.

You can apply by providing personal and financial information in a quick quiz.

After that, BadCreditLoans platform will connect you to a lender partner that should send you the terms and conditions of the loan.

If you agree to the specific terms and conditions, the cash will be deposited directly into your bank account, as soon as next the business day.

You should also know that there are a few requirements to apply to BadCreditLoans, such as:

- Have a source of income that can be proved

- Being a citizen or regular resident of US

- Be 18+ years old

- Have a banking account

- Have an e-mail and phone

Apply online

It is very easy to apply to BadCreditLoan using their website platform.

You will be required to fill out a simple online form and provide information about you, your finances, and the specifications of the loan you need, and the loan process starts instantly

BadCreditLoan will connect you with a broad range of reputable lenders options willing to lend you up to $10,000.

The lenders will send you the terms and conditions according to your financial profile and you can compare the options available that are best for you.

When approved, the cash money will be deposited directly into your account within one business day.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

BadCreditLoans vs. Plain Green Loans

But if you’re still not sure about the best option for your financial needs, check out our comparison table below to learn more about another great alternative available: Plain Green loans!

| BadCreditLoans | Plain Green Loans | |

| APR | From 5.99% to 35.99% | 210% – 428% |

| Loan Purpose | Any purpose | Any purpose |

| Loan Amounts | from $500 to $10,000 | from $500 to $5,000 |

| Credit Needed | No minimum credit required | No minimum credit required |

| Terms | From 3 to 60 Months | From 10 to 26 months |

| Origination Fee | Depend on the lender | Depend on the lender |

| Late Fee | Depend on the lender | Depend on the lender |

| Early Payoff Penalty | Depend on the lender | Depend on the lender |

If you think Plain Green Loans suits you the best, check out how to apply now!

How to apply for Plain Green loans?

Check out how to apply for Plain Green loans to help you with your needs and goals.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

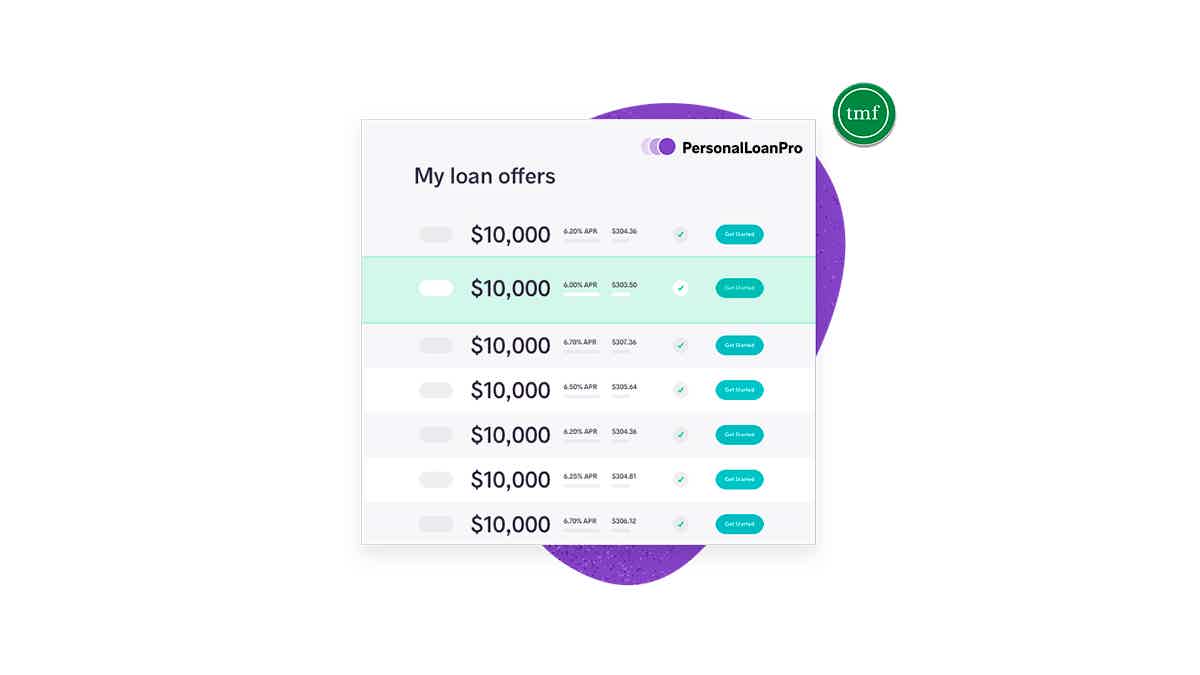

Personal Loan Pro review: learn about the best loans

Are you in need of a great credit selector for loan service providers? Read our Personal Loan Pro review and learn all about this product!

Keep Reading

HSBC Premier Checking Account full review

Check out our review of the HSBC Premier Checking Account and learn how to manage your money through a bank that attends the entire world.

Keep Reading

Delta SkyMiles® Reserve Business American Express Card review

Read this Delta SkyMiles® Reserve Business American Express Card review to learn how to get a great travel elite status with this card.

Keep ReadingYou may also like

Unsecured and secured loans: all you need to know before applying

If you're in the market for a loan, it's important to know the difference between secured and unsecured loans. Here's what you need to know before applying. Keep reading!

Keep Reading

How to buy cheap Allegiant Air flights

Are you ready to soar in the sky? Uncover exclusive discounts and know how and where to buy cheap Allegiant air flights. You can get flights from $34.

Keep Reading

Upstart Personal Loan review: how does it work and is it good?

Do you want to get a loan but don't meet the old traditional requirements? Check out our Upstart Personal Loan review. Up to $50K with fast funding.

Keep Reading