Credit Card (UK)

How to apply for the American Express® Rewards Credit Card?

If you need a card with travel perks and more for no annual fee, read on to learn how to apply for the American Express® Rewards Credit Card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

The American Express® Rewards Credit Card application: Get a response in 1 minute!

Shopping in the UK can be fun, but why not make it even more enjoyable by taking advantage of the rewards and discounts you can get by learning how to apply for the American Express® Rewards Credit Card?

Also, with access to exclusive offers, rewards points, and no annual fee, you’re sure to love everything this card has to offer.

Therefore, we’ll be here to show you how you can apply for the American Express® Rewards Credit Card so that you know exactly what to expect. So, read on!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Online Application Process

Before you apply online for this credit card, you’ll need to check the requirements. So, for example, you probably won’t be able to apply if you have a bad credit history.

Moreover, you’ll need to be at least 18 years old, have a permanent UK home address, and other requirements.

So, after you know you can apply, you can go to the official website and provide the personal information required. After that, you’ll get a response in as little as one minute!

Application Process using the app

You can use the Amex mobile app to manage your credit card’s features and finances. Moreover, you’ll be able to keep track of your credit card balance and much more!

However, the best way to complete the application process to get this card is through the official website.

The American Express® Rewards Credit Card vs. British Airways American Express® Credit Card

If you’re not sure about getting this Amex rewards card, you can try applying for the British Airways American Express® Credit Card!

Therefore, check out our comparison table below to learn more about the cards and see which is the best one for your needs!

| The American Express® Rewards Credit Card | British Airways American Express® Credit Card | |

| Credit Score | Good to excellent. | Excellent or good |

| APR* | 28.8% representative variable APR. Rates & Fees | representative variable APR 28.8%; variable APR for purchases 28.8%. Rates & Fees |

| Annual Fee* | No annual fee. Rates & Fees | Zero annual fee Rates & Fees |

| Fees* | Non-sterling transaction fee: 2.99% of the amount (after covering the transaction into Pounds Sterling); Late payment fee: £12; Also, returned payment fee: £12. Rates & Fees | Late payment fee: £12; Returned payment fee: £12; Also, cash advance fee: 3% or £3 minimum. Rates & Fees |

| Welcome bonus* | 10,000 Membership Rewards® points when spending £2,000 three months *Terms Apply | 5,000 bonus Avios after you spend £1,000. *Terms Apply. |

| Rewards* | 1x points on purchases for each £1 you spent on eligible purchases; Also, you can earn 4,000 points when you invite a friend if they are approved (up to 90,000 a year); *Terms Apply | 1x Avios on purchases for each £1 you spend; You can earn at least 4,000 Avios (up to 90,000 a year) if you invite a friend to get the card and they are approved. *Terms Apply. |

Therefore, you can read all about British Airways American Express® Credit Card application process.

How to apply for the British Airways Credit card?

If you need a card with travel perks and no annual fee, read on to apply for the British Airways American Express® Credit Card!

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Can you get denied after pre approval: see if pre-approval is a guarantee

Are you applying to get a mortgage loan? If so, read our post to know all about if you can get denied after pre approval!

Keep Reading

Wells Fargo Reflect℠ credit card review

This Wells Fargo Reflect℠ credit card review post will take you on a tour of how this card works and if it could be yours! Check it out now!

Keep Reading

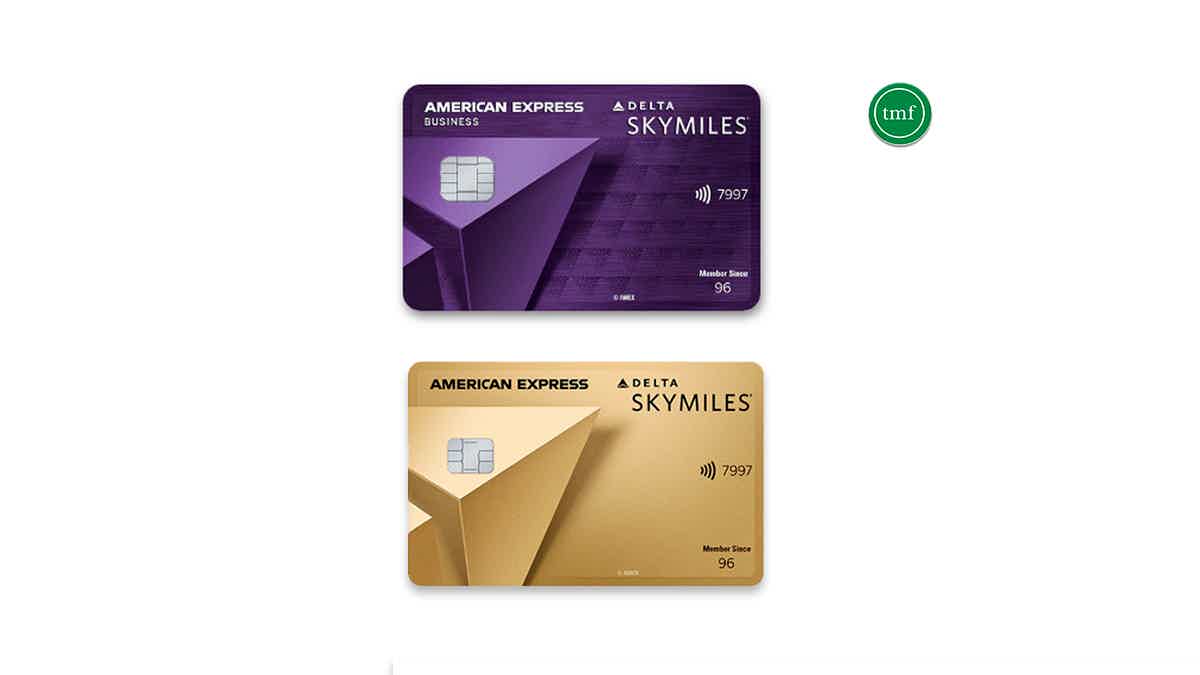

Delta SkyMiles® Gold American Express Card vs Delta SkyMiles Reserve Business: card comparison

Delta SkyMiles® Gold American Express Card or Delta SkyMiles Reserve Business? They both offer amazing benefits, such as insurance and miles!

Keep ReadingYou may also like

Commodity Supplemental Food Program (CSFP): see how to apply

Are you a low-income senior looking for affordable and nutritious food? Then keep reading and learn how to apply for the CSFP program!

Keep Reading

Up to $15,000: VivaLoan review

Uncover the details of VivaLoan, a short-term loan option that can help you get funds quickly. Get the money you need with any type of credit!

Keep Reading

How many credit cards should I have?

This article will help you answer the question "how many credit cards should I have?". Also, you'll learn what are the pros and cons of having multiple credit cards. Keep reading!

Keep Reading