SA

FNB Private Wealth Credit Card review: a very exclusive card

If you have a unique lifestyle and want a card that fits that, this FNB Private Wealth Credit Card review is worth reading because it summarizes the pros and cons of it!

FNB Private Wealth Credit Card: complete solutions for a unique lifestyle

As can be seen below on this FNB Private Wealth Credit Card review, this metal card is worth considering if you earn at least a minimum annual income of R1.8 million or have assets worth R15 million.

How to apply for the FNB Private Wealth Card?

Check out the different ways you can apply for an FNB Private Wealth Credit Card and enjoy unlimited advantages at a very reasonable cost.

Certainly an extraordinary credit card for those who want to access exclusive and superior perks.

| Requirements | A minimum annual income of R1.8 million or assets worth R15 million; Valid SA ID book or smart card; At least 18 years old; Good credit score; Recent payslip plus bank statements (three months) |

| Initiation Fee | R175.00 (maximum – one-time fee) |

| Monthly Fee | R258.00 |

| Fees | Credit facility service fee: R17.22; Linked Petro Card (per card linked to account): R29.50; Card replacement: R125 (after add 5 cards); Card purchases: Free; Balance enquiries: Free; Mini statement or historic statement: Free; FNB Instant Payments: Free; Payments and transfers (FNB App, online banking, cellphone banking): Free; Debit orders: Free; Send Money: Free; International currency commission and conversion fee: 2% |

| Rewards | eBucks Rewards (get rewarded when purchasing at selected stores) |

Although it offers almost everything an individual might want, it might lack some features. Then, find out more about it now!

How does the FNB Private Wealth Credit Card work?

The FNB Private Wealth Credit Card fits the profile of those who seek exclusivity. Basically, it is a card for wealthy people.

However, it is not that expensive considering its advantages.

Among its benefits, this metal card offers:

- Access to eBucks Rewards and Lifestyle programs, in which you can get rewarded every time you spend at selected stores or can get access to exclusive services;

- Unlimited card swipes;

- Up to 55 days of free interest;

- Unlimited virtual cards;

- Access to the eBucks Travel program, in which you can unlock bonus lounge entries and access airport lounges for your convenience;

- Global travel insurance at no extra cost for the first 90 days of your trip.

Besides all that, the card doesn’t charge:

- FNB ATM fees;

- FNB Branch fees;

- International and other banks’ ATMs fees;

- eBucks Rewards membership fees, and more.

All things considered, as can be seen on this FNB Private Wealth Credit Card review, this card gathers a good package of benefits at reasonable costs.

But you must consider the monthly costs, as shown above, as well as the requirements to be able to apply for it.

You will be redirected to another website

FNB Private Wealth Credit Card benefits

This Visa is one of the most worthwhile credit cards available for those who can afford a luxurious lifestyle.

So, it gathers benefits that might be helpful for travelers and shoppers, such as reward & travel programs.

However, fees apply, and they are not that accessible, even though the advantages surpass the costs.

Pros

- It offers up to 55 days of free interest;

- It provides you with unlimited virtual cards, swipes, and global travel insurance;

- You can access valuable programs to access rewards, airport lounges, and more;

- There are for fees on ATMs, membership, and other basic banking services.

Cons

- It charges quite high monthly fee.

How good does your credit score need to be?

This credit card requires good creditworthiness. Furthermore, you must earn an annual income of at least R1.8 million or have assets worth R15 million.

How to apply for the FNB Private Wealth Credit Card?

As shown on this FNB Private Wealth Credit Card review, this Visa offers extraordinary services at reasonable costs compared to other similar credit cards.

So, now, learn how to apply for it.

How to apply for the FNB Private Wealth Card?

Check out the different ways you can apply for an FNB Private Wealth Credit Card and enjoy unlimited advantages at a very reasonable cost.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Nedbank Personal Loans review: credit solution

Check out this Nedbank Personal Loans review post to learn how to borrow up to R300,000 with simplicity and earn R200 cash back every month!

Keep Reading

Woolworths Black Credit Card full review: Earn WRewards!

Looking for a card that offers great rewards and top-notch travel insurance? If so, read our Woolworths Black Credit Card review!

Keep Reading

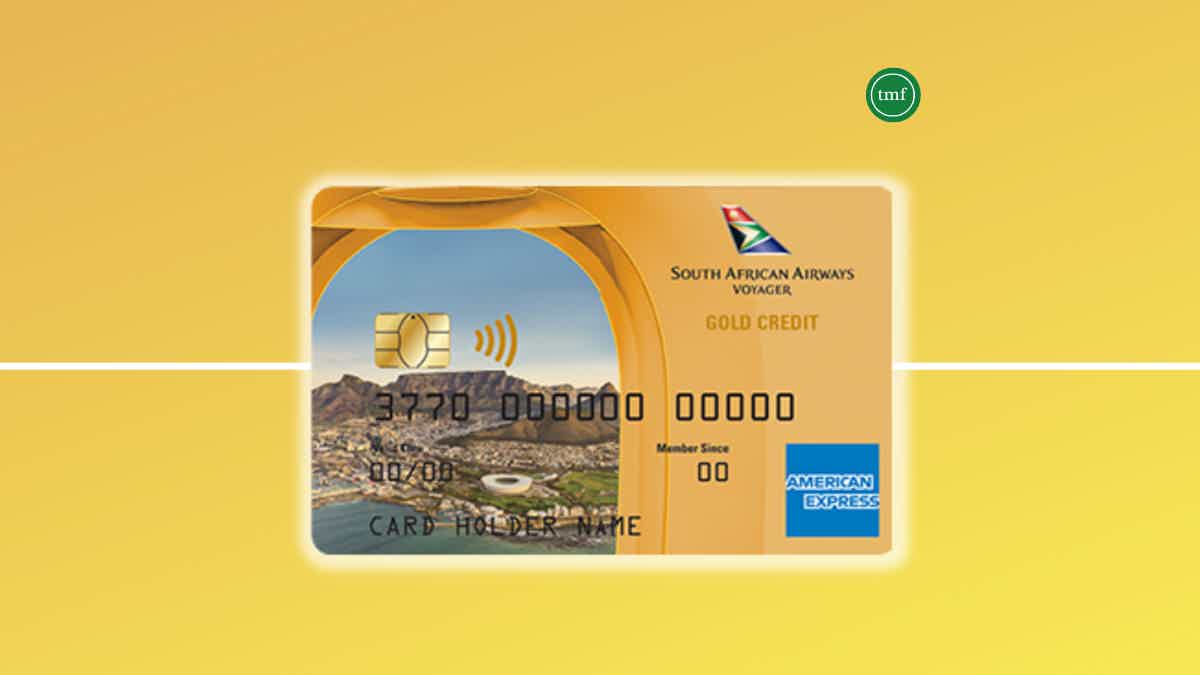

How to apply for the NedBank SAA Voyager Gold Credit Card?

If you need a card to help you earn unlimited miles and travel promotions, read on to apply for the NedBank SAA Voyager Gold Credit Card!

Keep ReadingYou may also like

Application for the Sam’s Club Credit Plus Member Mastercard card: how does it work?

If you're looking for a credit card that offers great rewards, then the Sam’s Club Credit Plus Member Mastercard is a great option. You can earn cash back on your purchases, and there are no annual fees. So how do you apply? Keep reading to find out.

Keep Reading

LendingPoint Personal Loan review: how does it work and is it good?

Unsure if a personal loan is a right choice for your unexpected expenses? Read this LendingPoint Personal Loan review to learn how this product works, what rates you can expect, and more.

Keep Reading

Competitive rates: Apply for Marshland Credit Union Mortgage

Discover how to apply for the Marshland Credit Union Mortgage - quick process and flexible conditions! Read on!

Keep Reading