Loans (US)

Flagstar Loans full review: Fixed-rate mortgage!

Are you looking for a long-term, reliable mortgage loan? Flagstar Loans may be the answer! Read our review to learn its pros and cons!

Flagstar Loans: 15-year to 30-year fixed-rate home loans!

Are you looking for a way to finance your dream home? Finding the right mortgage plan may seem overwhelming, but you can read our Flagstar Loans review to help you!

How to apply for Flagstar Loans?

Do you need a home loan with fixed rates and good loan terms? If so, you can read on to learn how to apply for Flagstar Loans!

| APR* | 30-year fixed-rate mortgage: Rate 6.974% with an APR of 7.128%; 15-year fixed-rate mortgage: Rate 6.207% with an APR of 6.452%. *Terms apply. |

| Loan Purpose | Fixed-rate mortgages, government home loans, specialty loans, professional loans, home renovation loans, and more. |

| Loan Amounts* | Around $240,000 for very good credit scores. *Terms apply. |

| Credit Needed | A minimum credit score of 740. |

| Terms | 8 to 30 years for fixed-rate mortgages. |

| Origination Fee | You’ll need to make a minimum 20% down payment for the 30-year fixed rate. |

| Late Fee | There will be late fees depending on the amount owed. |

| Early Payoff Penalty | There are no prepayment penalties. |

So, we’ll provide an in-depth review of its 15-year to 30-year fixed-rate mortgage loans so you can make a better decision for yourself and your family’s future!

In this article, we will take a look at their rates and terms, as well as their customer service and other features that are important when choosing a lender.

Therefore, from loan terms to fee breakdowns, we cover all aspects of Flagstar Loan’s offerings that set them apart from other lenders! So, this is must read if you’re thinking about getting a mortgage!

How do Flagstar Loans work?

With 15-year to 30-year fixed-rate home loans, Flagstar has something for almost everyone.

Moreover, this lender offers flexible loan programs tailored to the unique needs of each borrower and competitive rates.

So, it’s no surprise why many turn to Flagstar Loans when searching for the perfect deal!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Flagstar Loans benefits

As we mentioned, you can find many benefits when applying for a mortgage loan through Flagstar. However, there are also some downsides. So, check out our pros and cons list below to learn more in this Flagstar Loans review!

Pros

- Varied mortgage loans are available;

- Special and personalized home loan programs and rates;

- Find fixed-rate loans;

- You can apply for your loan online or in-branch.

Cons

- You may not be able to get good rates or get approved for a mortgage if you have a low credit score;

- Depending on your state, you may not be able to apply for a loan.

How good does your credit score need to be?

Unfortunately, Flagstar Loans does not offer good terms and rates for those with a low credit score. Moreover, you may not even have any chance of qualifying if you have a not-so-good score.

Therefore, if you plan on getting a mortgage to buy a house through Flagstar, you’ll need at least a good score.

How to apply for Flagstar Loans?

This lender offers an easy and quick application process. Also, you can apply online by giving your personal information on the official website!

How to apply for Flagstar Loans?

Do you need a home loan with fixed rates and good loan terms? If so, you can read on to learn how to apply for Flagstar Loans!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

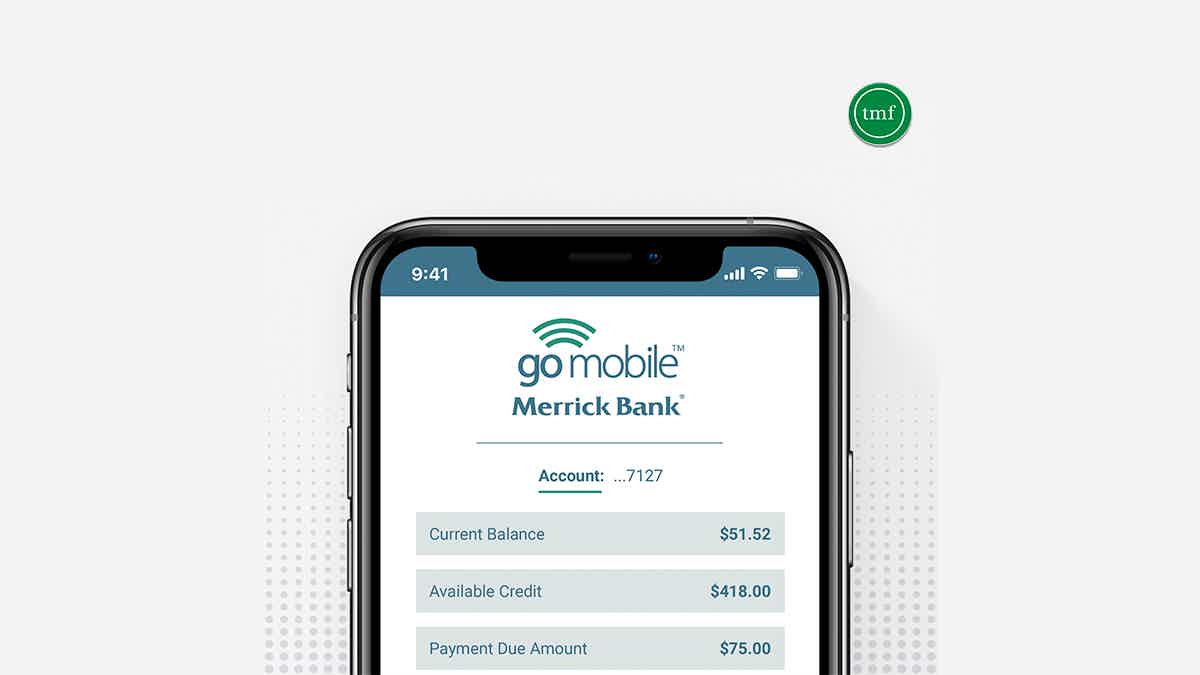

Merrick Bank Recreation Loans full review: what you need to know before applying

If you're looking for a loan specifically to fund your outdoor adventures, read our Merrick Bank Recreation Loans review!

Keep Reading

Mattress Firm Synchrony HOME™ Credit Card overview

Check out this Mattress Firm Synchrony HOME™ Credit Card overview to learn how you can get a brand new mattress with special financing!

Keep Reading

Find the best cards for grocery shopping

Looking for a card to help you save money on everyday purchases? If so, check out our list of the best cards for groceries!

Keep ReadingYou may also like

Wayfair Credit Card review

Unsure about whether or not the new Wayfair credit card is for you? Then read on! This review will explain how this card works and how you can enjoy its multiple benefits!

Keep Reading

Savings vs. checking accounts: Understand the difference

Investing in savings and checking accounts is important in managing your finances. We break down the differences between these two! Read on!

Keep Reading

Ally Platinum Mastercard® review: boost your credit fast!

Looking for a budget way to build your credit? Read our review of the Ally Platinum Mastercard® for more information!

Keep Reading