Finances (US)

Everything about Home Loans

Everything about Home Loans or home mortgages: definition, types, and much more. Learn all that is about them before applying for one!

Home loans: definition, how they work, types, and more

Usually, it is difficult to have the complete amount of money to purchase a property. Most people rely on home loans to buy their first, second, or third house.

Actually, it would take a lifetime of savings to achieve the dream of a home purchase in most cases. And I bet this is your reality, as it is with many people.

How to apply for the Credible Personal Loan

Check out how the Credible Personal Loan Marketplace application works so you can find the best loan for you to cover your needs and achieve your goals.

That’s why we have prepared a complete guide on how home loans or mortgages work.

Therefore, before applying for a loan to buy your house, read this full article to start planning your home purchase.

What is a home loan?

A home loan or a home mortgage is a way of achieving the dream of buying a property.

It is a type of loan in which a financial institution lends an amount of money to people who want to purchase their first, second, third property, and so on.

As happens with other types of loans, home mortgages include terms and conditions. And the property itself works like collateral to secure the transaction.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How does it work?

In summary, a home loan works like other loans. But, it has its particularities, especially because we are talking about a greater amount of money to be borrowed.

Also, a home loan allows many people to achieve the dream of owning a property. Without it, most wouldn’t dare to dream of it.

A home loan or a home mortgage is given by a financial institution to those who are willing to accept and meet the requirements of the loan, including terms and conditions.

In addition, the property itself works like collateral to secure the transaction.

Therefore, let’s suppose you are not able to meet the obligations. Then, the property will be taken by the lender.

On the other hand, the owner or borrower will receive the title back if all terms are met and payments paid.

Furthermore, home loans could have fixed or adjustable rates that apply monthly to the principal loan amount.

In the first-rate option, periodic payments are generally the same. On the contrary, in the second rate option, both rate and periodic payment vary.

Since the risk is higher in the second option, the rate is usually lower.

Moreover, mortgages may include an insurance requirement depending on the type you apply for and the down payment you are able to pay.

And, usually, lenders include property taxes in your loan payments.

Finally, typical home loans offer 30-year terms, and amounts vary widely according to the loan type, your financial situation, and the lender conditions.

What are the types of mortgages and home loans?

This is an important part of this guide. Knowing the types of home loans will help you choose the best for you, which will fit your budget, needs, and goals.

FHA Loans

FHA (Federal Housing Administration) loans are backed by the government and provided by private lenders.

These loans are designed for people with less-than-perfect credit scores and income.

Since FHA loans require a lower down payment, you don’t need to have a high income or even a perfect credit score to apply for them.

On the other hand, you need to meet specific requirements to be accepted.

Conventional Loans

Conventional loans are issued by private lenders and not backed by the government. It works differently than home loans, but you can use it for this purpose.

Although they offer more flexibility than FHA loans, conventional loans usually require private mortgage insurance if the borrower pays less than 20% as a down payment.

Specialty Loans

On the other hand, specialty loans aren’t part of FHA or conventional categories. Some examples of specialty loans are:

- VA loans that are provided for veterans;

- USDA loans are provided for borrowers in eligible rural territories to buy their property without a down payment requirement.

How to choose a home loan and apply for it?

Firstly, you must do vast research on the lenders to find the best home loan offers. Since there are several available on the market, including banks, you need to consider getting to know them.

Also, it is important to define which type of loan your profile fits according to your needs and goals.

After that, it is crucial to consider lenders that offer a prequalification process. Therefore, you may check your estimated rates before going forward with your application.

In addition, prequalification processes don’t harm your credit score.

Furthermore, it might be worth getting to know home loan aggregators. Nowadays, there are many online platforms that gather several secure lenders.

The moment you prequalify for a home loan, the loan aggregator shows you your options. So, you may choose the best for you!

Recommendation: Mortgage Refinancing – is it worth it?

Now, let’s suppose you already have a mortgage and need to refinance it. Do you know the advantages and disadvantages of doing it?

Mortgage refinancing might be a great option in some cases. For example, you may find some good options to lower your current rates. Also, you may find better terms and conditions.

In addition, applying for a mortgage refinance may lead you to decrease your monthly payments or even eliminate mortgage insurance.

On the other hand, you need to be careful about proceeding with it, since you might take longer terms and worst conditions when you don’t know how mortgage refinancing works.

Moreover, applying for a mortgage refinance may temporally affect your credit score, and you must consider the costs of closing your current mortgage.

So, we have prepared a complete guide on how mortgage refinancing works, the advantages and disadvantages, and what you need to keep in mind before applying for a refinance.

Keep reading to check this guide out before considering refinancing your mortgage!

Mortgage Refinancing: is it worth it?

Mortgage Refinancing: is it worth it? Learn how it works and how you can get an offer from a top lender through the Credible Personal Loan Marketplace.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Blue Cash Preferred® Card from American Express review

If you like cash back on everyday purchases, this Blue Cash Preferred® Card from American Express review is for you. Check it out!

Keep Reading

Best travel credit cards: get rewards while enjoying your trips!

Learn the best travel credit cards, choose one, and take advantage of the perks. We’ve selected the top 10 for you to decide the best!

Keep Reading

How to apply for the Destiny Mastercard® Card?

Are you looking for an unsecured card that doesn’t require a good credit score? Check out how to apply for the Destiny Mastercard® card!

Keep ReadingYou may also like

Chase College Checking℠ review: Get a $100 bonus

Learn more about the Chase College Checking℠ account and its features with our review! From student benefits to flexible banking options, it offers great solutions for college students!

Keep Reading

Home Depot Consumer Credit Card Review: Is it a smart choice?

Explore our Home Depot Consumer Credit Card review to discover its special financing options. Stay tuned to find out if it's the right fit for your projects.

Keep Reading

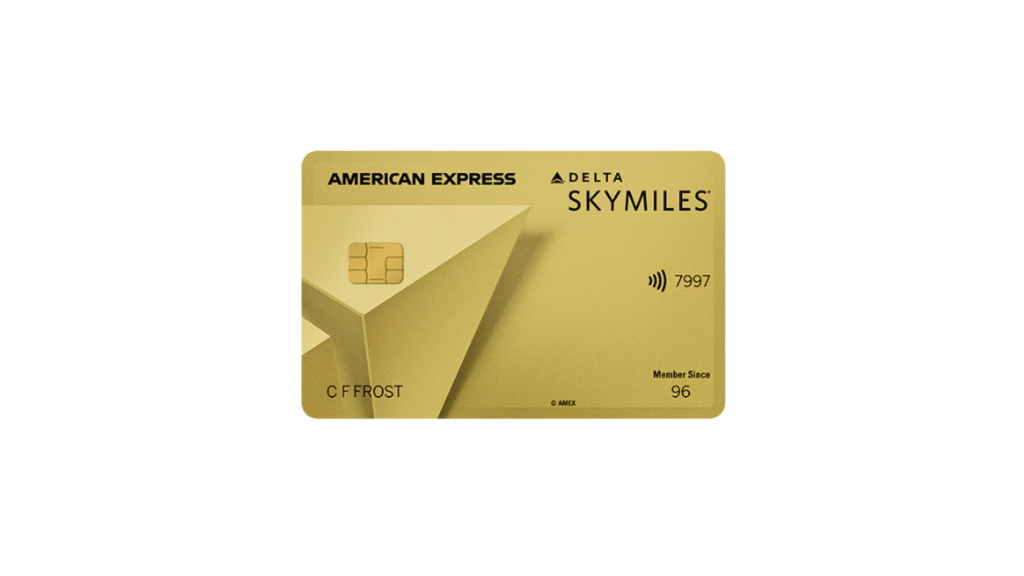

Apply for the Delta SkyMiles® Gold American Express Card

Here is a complete guide on how to apply for The Delta SkyMiles® Gold American Express Card. You'll earn miles for purchases and have access to a variety of benefits. Read on!

Keep Reading