CA

Easy Financial Loans review: what you need to know before applying

Check out this Easy Financial Loans review to learn how you can get up to $50,000 with affordable rates to accomplish what you have planned all life.

Easy Financial Loans: borrow up to $50,000!

Easy Financial Loans review is about loans for different purposes at affordable rates. You can borrow up to $50,000 depending on your need.

Easy Financial is a lender committed to providing Canadians a chance to accomplish their goals. So, if you are facing some obstacles requesting your loan from a bank, Easy Financial might be an excellent option for you since it features easy approval requirements.

Check out the full review right below!

| APR | Personal Loans: starting from 29.99% Home Equity Loans: starting from 14.99% Auto Loans: starting from 11.99% |

| Loan Purpose | Personal, Home Equity, and AutoLoans |

| Loan Amounts | Personal Loans: from $500 to $20,000 Home Equity Loans: from $15,000 to $50,000 Auto Loans: from $5,000 to $50,000 |

| Credit Needed | All credit types are considered |

| Terms | Personal Loans: from 9 to 84 Months Home Equity Loans: from 72 to 120 Months Auto Loans: from 12 to 84 Months |

| Origination Fee | Not specified |

| Late Fee | Not specified |

| Early Payoff Penalty | Not specified |

How to apply for Easy Financial Loans?

Borrow up to $50,000 with Easy Financial Loans! Check out how to apply and get your loan in three easy steps!

How does the Easy Financial Loans work?

Easy Financial is a company that lends up to $50,000 to customers for different purposes. So, you can apply for a loan if you intend to pay bills, consolidate debts, or for other personal reasons.

Also, if you are planning to renovate your home or if you have an emergency expense, this lender can help you out with it.

Plus, if you want to buy yourself a new car, you can borrow some money from Easy Financial, too.

And it doesn’t end there. It also offers financing solutions for small businesses, a variety of value-added services, and point-of-sale financing deals.

The rates are affordable, and the terms are flexible, too. You can learn more about it in the summary table above.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Easy Financial Loans benefits

Easy Financial offers a whole range of loans for different kinds of purposes. The rates are affordable, and all credit types are considered.

Furthermore, this company is pretty well-reviewed by its customers and got some awards, such as Waterstone Canada’s Most Admired Corporate Cultures in 2018, Canada’s Top Growing Companies in 2019, Top 50 Fintech Companies, and more.

Pros

- You can borrow up to $50,000;

- All credit types are considered;

- You can rebuild your credit by responsibly paying off your loan;

- The application is easy, and the approval is fast;

- Easy Financial offers many options for loans and financing.

Cons

- Not all fees and costs are specified.

What credit score do you need for Easy Financial Loans?

All credit scores are considered when applying for a loan at Easy Financial. Even if you are a student with no credit history, you may be able to get the money you need.

How to apply for Easy Financial Loans?

If you are interested in borrowing up to $50,000 for any personal, home, or auto purpose, check out how to apply for a loan at Easy Financial!

How to apply for Easy Financial Loans?

Borrow up to $50,000 with Easy Financial Loans! Check out how to apply and get your loan in three easy steps!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Child Disability Benefit in Canada?

Learn how to apply for the Child Disability Benefit and what you need to do to receive the benefit from the Canada Revenue Agency (CRA).

Keep Reading

DUCA Home Insurance review

Check out the DUCA Home Insurance review and learn how to protect your property and car with comprehensive coverage through CUMIS Solutions.

Keep Reading

Scotia iTRADE® review

Get an inside look at one of the best trading platforms in the market with this Scotia iTRADE® review! Learn how you can begin investing now!

Keep ReadingYou may also like

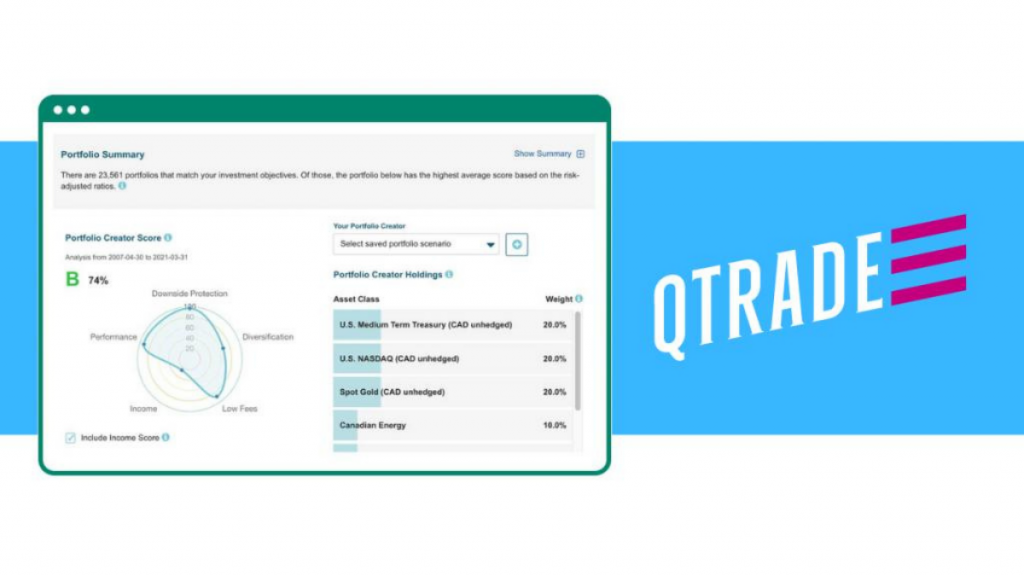

How to invest with Qtrade Direct Investing: Maximize Returns

Begin your investment journey with Qtrade Direct Investing. Our guide covers the essentials, from setting up your account to using their intuitive platform and diverse investment tools for financial growth.

Keep Reading

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

If you have a bad score or no score, this is an excellent way to fix it. Learn more about the advantages of this card and what makes it so successful in our Surge® Platinum Mastercard® credit card review!

Keep Reading

Learn to apply easily for the Honest Loans

Get a loan for an emergency, pay your bills, or even a personal goal. Learn how to apply for Honest Loans and understand how they can help you without paying for their service. Read on!

Keep Reading