Credit Cards (US)

Discover it® Balance Transfer review

The Discover it® Balance Transfer offers more than a lengthy intro APR on purchases and balance transfers. Check out the review!

Discover it® Balance Transfer: intro APR with no annual fee

Discover it offers a wide range of cards, and I bet you already know it. In this review, we’ll cover the Discover it® Balance Transfer, a credit card with a lengthy intro APR on purchases and balance transfers.

But, it is not only that! Check out the summary right below!

| Credit Score | Good |

| Annual Fee | $0 |

| Regular APR | From 14.24% to 25.24% (variable) |

| Welcome bonus | Cashback Match |

| Rewards | Up to 5% cash back |

How to apply for a Discover it® Balance Transfer?

Discover it® Balance Transfer offers a long 0% intro APR with no annual fee. Check out how to apply!

Now, keep reading our Discover it® Balance Transfer review to learn how this credit card works and the advantages and disadvantages of getting one!

Learn how a Discover it® Balance Transfer works

Balance transfer cards offer a lengthy introductory APR. So, if you are looking for a low-interest card to reestablish your good financial path and make it solid, those cards might be worth considering.

On the other hand, the Discover it Balance Transfer offers much more.

Besides a 0% intro APR for 6 months on purchases and 18 months on balance transfers, this card doesn’t charge an annual fee.

Also, it provides a good rate of rewards. In summary, you earn 1% cash back on all purchases and 5% cash back on eligible everyday purchases up to a maximum limit.

Furthermore, Discover It offers the unlimited Cashback Match program, in which you get doubled rewards by the end of the first year from the account opening.

In addition, there is no foreign transaction fee whatsoever.

The account also provides free access to FICO® score and Social Security Number monitoring.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover it® Balance Transfer highlights

The Discover it Balance Transfer card is best for those looking for avoiding high interest. Besides the long period of 0% intro APR, this card offers a great rate of rewards at a very low cost.

It doesn’t charge annual or foreign transaction fees, plus it provides security features, including free access to FICO® score and Social Security Number monitoring.

Advantages

- It offers 0% intro APR for 6 months on purchases and 18 months on balance transfers;

- It doesn’t charge an annual fee or foreign transaction fee;

- It offers up to 5% cash back plus unlimited Cashback Match in the first year;

- It provides free access to FICO® score and Social Security Number monitoring.

Disadvantages

- It requires a good credit score in the application;

- It sets a maximum limit at the highest tier of rewards.

Credit score recommended

This balance transfer card is an amazing choice for those looking for low APR. But, it is recommended that you have at least a good credit score to apply for it and get approved.

Apply for a Discover it® Balance Transfer

As you can see, this card is amazing for those looking for rewards at a very low cost. Now, check out how easy it is to apply for one!

How to apply for a Discover it® Balance Transfer?

Discover it® Balance Transfer offers a long 0% intro APR with no annual fee. Check out how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Indigo® Mastercard® with Fast Pre-qualification review

Read this Indigo® Mastercard® with Fast Pre-qualification review post to understand how this card can help you build or rebuild your credit!

Keep Reading

How to apply for the Acorns Checking Account?

Do you need an incredible account to invest and earn bonuses for it? If so, read on to learn how to apply for the Acorns Checking Account!

Keep ReadingYou may also like

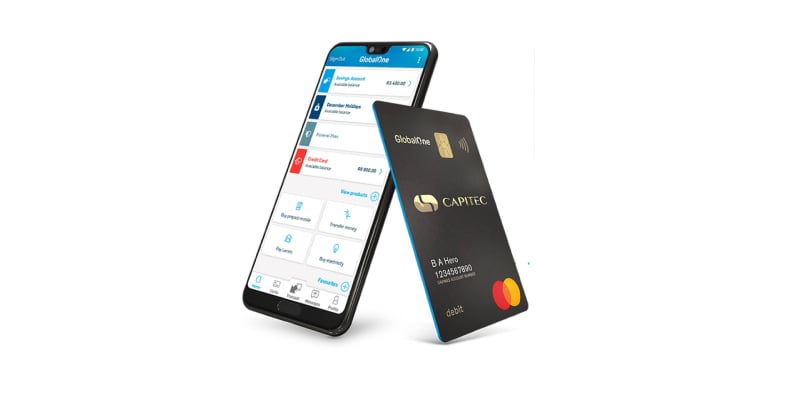

Capitec Bank App review: the easiest way to take care of your finances

The Capitec Bank mobile app review will tell you how to take control of your finances with a simple, easy-to-use interface that makes managing money faster and more convenient. Keep reading!

Keep Reading

Chase Slate Edge℠ review: Consolidate debt easily!

Struggling with multiple cards and debt payments? Check out our Chase Slate Edge℠ review and see how this card helps lower your debts!

Keep Reading

Affordable Connectivity Program (ACP): see how to apply

Access to the internet is a basic human right in today's world. Learn how to apply for The Affordable Connectivity Program, which provides low-cost broadband and Wi-Fi access to people who need it most.

Keep Reading