Loans (US)

Credible Personal Loan Marketplace review

Check out the Credible Personal Loan Marketplace review, learn how to compare rates and different types of loans, and find the best for you!

Compare rates from many lenders within minutes at the Credible Personal Loan Marketplace

Credible was founded in 2013 with the objective of gathering many secured lenders in one place. The lenders offer different types of loans with different terms & conditions.

Therefore, it is an amazing tool for you to compare rates and find the best loan for your needs and goals.

How to apply for the Credible Personal Loan Market

Credible Personal Loan Marketplace gathers loan options and comparisons. Check out the review!

| APR | Personal: from 4.49% to 35.99% |

| Loan Purpose | Student loan refinancing, student loans, personal loans, home, mortgage refinancing, and insurance |

| Loan Amounts | Personal: from $600 to $100,000 |

| Credit Needed | Not disclosed |

| Terms | It depends on the lender |

| Origination Fee | It depends on the lender |

| Late Fee | It depends on the lender |

| Early Payoff Penalty | It depends on the lender |

Interest rates, amounts, terms, and fees depend on the lender’s offer. But you may enjoy the services provided by Credible that include even insurance.

Keep reading to learn how it works.

How does the Credible Personal Loan Marketplace work?

Credible Personal Loan Marketplace gathers multiple lenders in one place. It aggregates loans for different purposes, including personal, student, home, and more.

Also, the company offers refinancing options and insurance.

In addition, the platform partners up with many top lenders, including Sallie Mae, Discover Financial Services, Citizens, LendingClub, Upstart, Loandepot, Marcus by Goldman Sachs, New American Funding, NASB, Union Home Mortgage, Nations Lending, and Allied Mortgage Group.

Credible provides an easy and fast application with no risk and no impact on your credit score.

In addition, prequalifying is 100% free. In summary, Credible offers rate and loan comparisons in certain categories, including student loans, personal loans, and home loans.

Furthermore, it offers student loan refinancing, mortgage refinancing, and insurance.

Although conditions, fees, and terms depend on the lender, Credible discloses the amounts and range of rates for personal loans.

So, in this category, the amounts vary from $600 to $100,000. And rates range from 4.49% to 35.99%.

Plus, it is important to mention that terms, rates, and conditions will vary depending on your creditworthiness, as well.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Credible Personal Loan Marketplace benefits

Credible gathers many lenders on its platform. Therefore, you can take advantage of its easy, secure, and fast application to find the best lender, loan, terms, rates, and conditions for you.

Pros

- Credible gathers multiple top lenders on its platform;

- It offers personal, student, and home loans comparison;

- It provides insurance, student, and mortgage refinancing options;

- The application is free, secure, easy, and fast.

Cons

- It doesn’t disclose all rates, fees, terms, and conditions unless you apply for an option through the platform.

How good does your credit score need to be?

Unfortunately, there is no mention of the minimum credit score required in the application. However, since it gathers multiple lenders, it is possible that all credit scores are considered.

How to apply for Credible Personal Loan Marketplace?

Learn how easy it is to find the best loan for you by reading the step-by-step described in the next post!

How to apply for the Credible Personal Loan Market

Credible Personal Loan Marketplace gathers loan options and comparisons. Check out the review!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for NetCredit?

Looking for a lender to give you flexible loan options and up to $10,000? If so, read on to learn how to apply for NetCredit!

Keep Reading

How to apply for the Capital One Walmart Rewards® Mastercard® Card?

The Capital One Walmart Rewards® credit card is perfect when you like shopping and need some cash back after that. Check out how to apply!

Keep Reading

Start using an e-wallet: what is it and how does it work?

What is an e-wallet or digital wallets? They can make your online life a lot safer and easier. So, read more to know all about them!

Keep ReadingYou may also like

The World of Hyatt Credit Card application: how does it work?

Learn how to apply for the World of Hyatt Credit Card. Earn points on every purchases! Up to 60,000 bonus points in the first 3 months! Read on!

Keep Reading

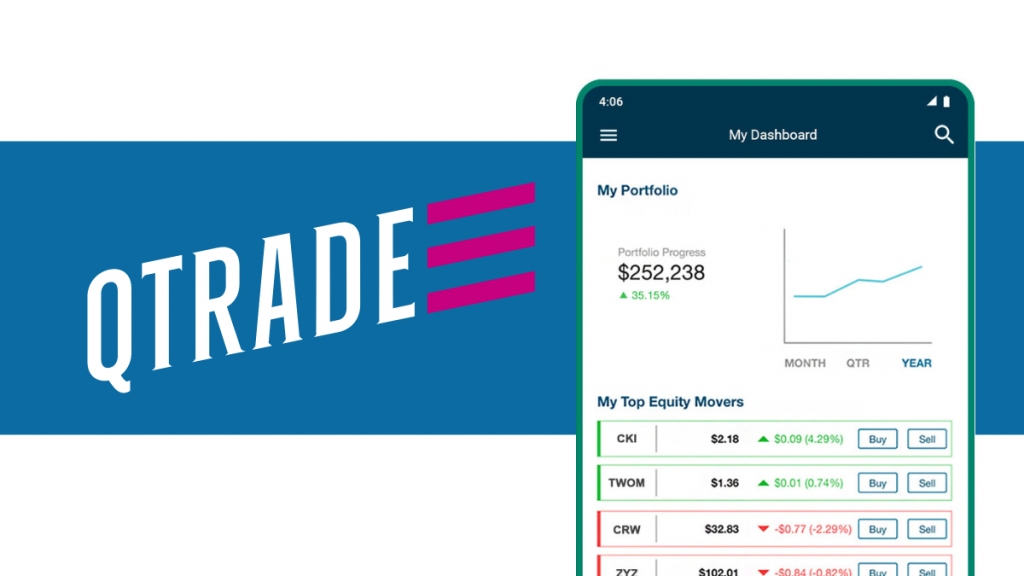

Qtrade Direct Investing Review: Build Your Wealth

Read our Qtrade Direct Investing review to learn about its top-notch customer service and intuitive trading platform. Ideal for both new and seasoned investors, Qtrade offers a streamlined experience for smart investment decisions.

Keep Reading

CreditFresh Review: Fast Cash and Flexible Credit

Need cash fast? CreditFresh promises $5K and no credit check, but is it too good to be true? Read our in-depth review to decide for yourself.

Keep Reading