CA

Conexus Cash Back Mastercard® full review

Conexus Credit Union features a credit card that rewards you with 1 point on every dollar spent in Canada. Do you want to learn more about it? Then, check out our Conexus Cash Back Mastercard® review!

Conexus Cash Back Mastercard® overview

Today, you’ll learn more about a great financial product on our Conexus Cash Back Mastercard® credit card review!

So, Conexus Credit Union is the biggest credit union in Saskatchewan, and it features banking account, ATMs, loans, and more.

Also, it offers some credit cards. And maybe one of them might be the right card for you.

Today, we present to you the Conexus Cash Back Mastercard®.

This card gives at least a one-point reward for each dollar spent on purchases.

| Credit Score | N/A |

| Annual Fee | $0 |

| Regular APR | 19.90% |

| Welcome bonus | N/A |

| Rewards | 2 points for each dollar spent at gas stations 1 point for each dollar spent on all other purchases |

How to apply for a Conexus Cash Back Mastercard®?

The Conexus Cash Back Mastercard® credit card gives you one point-reward for each dollar spent and doubles it on gas station expenses. Apply now!

All about the Conexus Cash Back credit card

This card features a reward program, even though it is not as valuable as cash back itself.

For each dollar spent on purchases, you earn 1 point. And at gas stations, you double the points on every dollar spent.

Plus, you choose how to redeem the points earned, as follows:

- Redeem points for cash back credit on your Conexus account;

- Redeem points for travel rewards, including flights, cruises, hotels, and dining;

- Plus, redeem points for gift cards and merchandise items.

Also, you get a 3.9% intro APR on balance transfers for six months.

Moreover, to be its cardholder means to feel protected and assisted. Therefore, Conexus provides you with purchase and fraud protection, extended warranty, and telephone insurance.

In addition, Mastercard® gives you convenience and agility on your day-to-day through.

Finally, all of that with no annual fee.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Conexus Cash Back Mastercard® benefits and drawbacks

Conexus Cash Back credit card is that card that gives you points on every purchase you make. If you like to travel, it can fit perfectly in your wallet.

But, note that a point-reward program might be less valuable than a regular cash back program offered by other credit cards.

Finally, this Mastercard® provides you with a package of protection and assistance you may find helpful in your routine.

Pros

- No annual fee

- Intro APR on balance transfers

- Flexible point-reward program

- Mastercard® protection and convenience

- Good option for those who spend a lot at gas stations and travels

Cons

- Point-reward program is not as valuable as regular cash back programs

Credit score required for the application

Unfortunately, we weren’t able to check this information.

Learn how to apply for a Conexus Cash Back

Check out how to apply for this card and begin your journey to save up points to redeem them as you want!

How to apply for a Conexus Cash Back Mastercard®?

The Conexus Cash Back Mastercard® credit card gives you one point-reward for each dollar spent and doubles it on gas station expenses. Apply now!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Neo Financial Savings account or EQ Bank Savings Plus account?

Looking for a bank that has modern services? Read on to know which one is best: Neo Financial Savings account or EQ Bank Savings Plus account!

Keep Reading

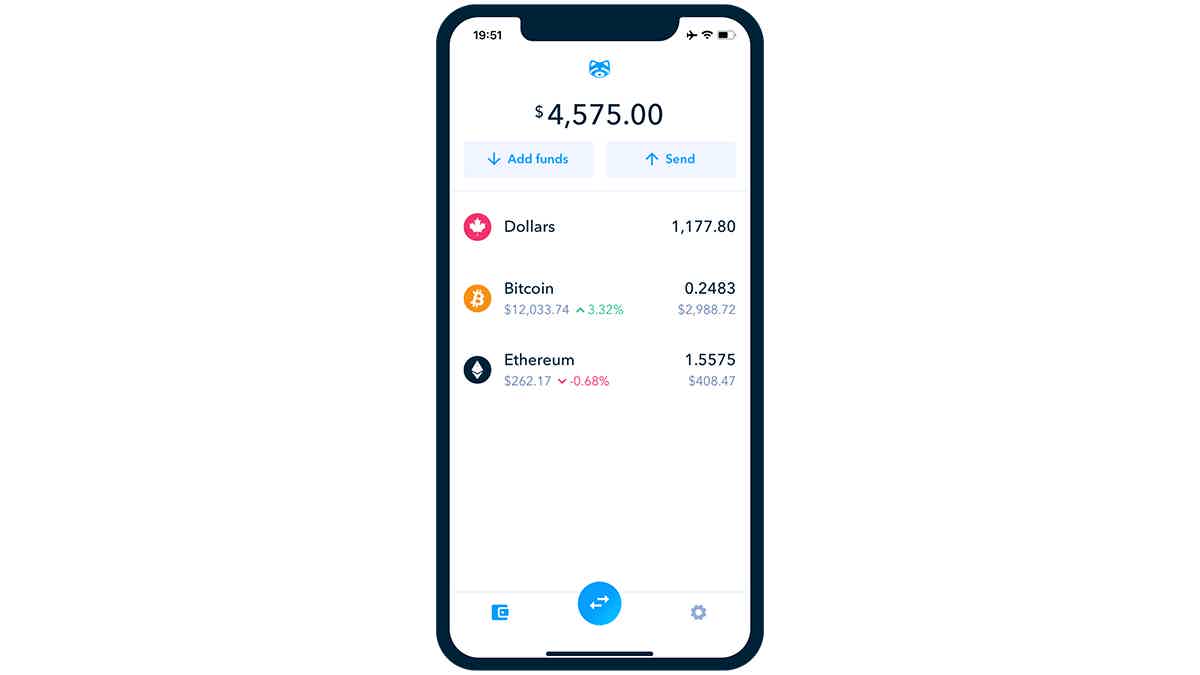

Shakepay review: how does it work?

Check out this Shakepay review and start buying and selling bitcoin & ethereum commission-free. Join more than 1 million Canadians now!

Keep Reading

How to apply for Better Jobs Ontario?

Are you looking for ways to improve your career? If so, read on to learn how to apply for the Better Jobs Ontario program!

Keep ReadingYou may also like

Commodity Supplemental Food Program (CSFP): see how to apply

Are you a low-income senior looking for affordable and nutritious food? Then keep reading and learn how to apply for the CSFP program!

Keep Reading

Earn back: Bank of America® Unlimited Cash Rewards Secured review

Bank of America® Unlimited Cash Rewards Secured is the credit builder card with unlimited cash back and no annual fee! Read on and learn more!

Keep Reading

Cheap Allegiant Air flights: tickets from $34

Find out where you can go on a budget with Allegiant Air cheap flights. Fly with this company and save a lot on your next flight. Keep reading!

Keep Reading