CA

CIBC Costco® Mastercard® review: earn cash back on all purchases

If you're looking for a great credit card with gas station perks, read our CIBC Costco® Mastercard® review to learn more about it!

CIBC Costco® Mastercard®: get perks if you’re a Costco Member!

Did you know that some CIBC cards give cash back on all purchases? Read our CIBC Costco® Mastercard® review to learn more about this card. Plus, you should know that there are no annual fees involved!

How to apply for the CIBC Costco® Mastercard® card

If you're looking for a credit card that offers cash back for all purchases and more, read our post about the CIBC Costco® Mastercard® application!

| Credit Score | N/A. |

| APR* | 19.75% variable for purchases; 21.49% variable for cash. *Terms apply |

| Annual Fee | No annual fee. |

| Fees | Up to 3 additional cardholders with no fee. |

| Welcome bonus | N/A. |

| Rewards* | 3% cash back at restaurants and Costco gas stations; 2% cash back at any other gas station + Costco in Canada; 1% cash back on any other purchase you make with the card (which includes Costco). *Terms apply. |

And if you’re a Canadian looking for a credit card that can give you cash back on purchases related to Costco and other eligible purchases, you’ll love this card.

You can find a reasonable interest rate, and there is no annual fee to enjoy all the benefits this card offers! So, read on to learn more about this card!

How does the CIBC Costco® Mastercard® work?

The first information you need to know about the CIBC Costco® Mastercard® is that you need to have a Costco membership to start the application. So, if you want to get all the benefits, you’ll need it.

You can easily enroll in a Costco membership through Costco’s official website.

If you already have a Costco membership, you’ll be able to apply for this card and earn up to 3% cash back at restaurants and at Costco gas stations.

Also, you’ll be able to earn 2% cash back at any other gas station you like. Moreover, this card also offers 1% cash back on all other purchases you make with the card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

CIBC Costco® Mastercard® benefits

As we mentioned, the CIBC Costco® Mastercard® offers incredible perks to its cardholders. One of the best perks is that you can earn 1% cash back on all purchases with your card.

Moreover, the other rewards rates are also worth it. Plus, you can get all these perks for no annual fee. However, there are also some downsides to this card. So, read our list below to see the pros and cons!

Pros

- Earn up to 3% cash back on eligible purchases at restaurants and Costco gas stations;

- You can get 1% cash back on all other purchases with the card;

Cons

- There is no information about a welcome bonus for new cardholders;

- You need to be an exclusive Costco member to apply for the card;

- There is a minimum annual income of $15,000 to qualify for the card.

How good does your credit score need to be?

The official CIBC website does not disclose if you need a high score to qualify. The most important thing you need is to have a Costco membership.

How to apply for the CIBC Costco® Mastercard®?

You can easily apply for the CIBC Costco® Mastercard®. All you need is to go to the official CIBC website and find the card you need. Also, you need to be a Costco member to qualify!

To understand exactly how this application process works, you can check the following content.

How to apply for the CIBC Costco® Mastercard® card

If you're looking for a credit card that offers cash back for all purchases and more, read our post about the CIBC Costco® Mastercard® application!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Union Power Home Insurance?

Read how the Union Power Home Insurance application works and how you can access a free quotation to estimate costs for fantastic coverage.

Keep Reading

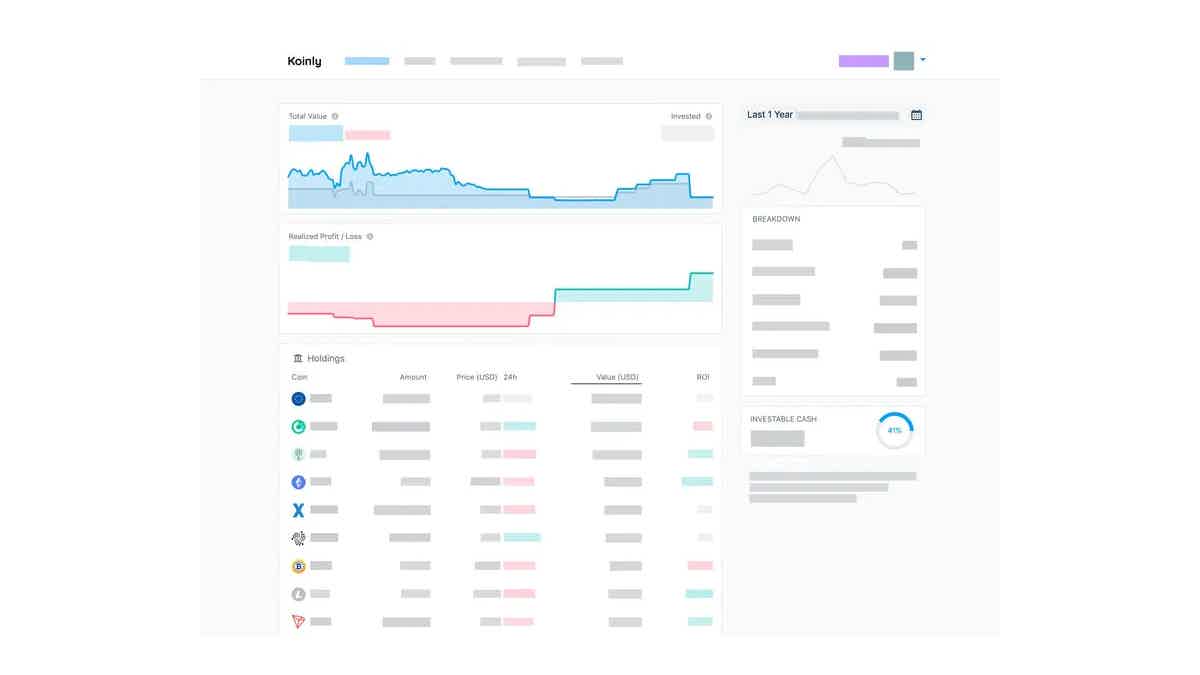

Koinly review: how does it work?

If you are a crypto investor in Canada, you must be aware of declaring your tax return. Check out how to do it with our Koinly review.

Keep Reading

Square One Canada Home Insurance review: comprehensive and affordable policies

Read the Square One Canada Home Insurance review and learn how to get comprehensive and affordable policies for as little as $12 per month.

Keep ReadingYou may also like

OppLoans Personal Loan review: how does it work and is it good?

This personal loan has great benefits and a few reasons you might want to reconsider. Pay no hidden fees! Read on and learn how OppLoans works.

Keep Reading

How do travel credit cards work?

Have you ever asked yourself, "How do travel credit cards work"? If yes, you might want to check out this article. We will answer this question and tell you everything so you can make the most of your travels!

Keep Reading

Chase College Checking℠ application: how does it work?

Learn about the Chase College Checking℠ account application and how you can get a $100 bonus when you open one today. No minimum initial deposit is required. Read on!

Keep Reading