CA

CIBC Aventura Visa Infinite Card review

This CIBC Aventura Visa Infinite card review article will show you which benefits you can get from this card and its disadvantages, so you can decide whether applying for it is worth it.

CIBC Aventura Visa Infinite: earn rewards and enjoy travel benefits

The Canadian Imperial Bank of Commerce (CIBC) is one of the biggest financial institutions in Canada, and it offers a wide range of products and services, including accounts, credit cards, lines of credit, investments, and insurance. Today, we’re going to give you a CIBC Aventura Visa Infinite card review so you’ll learn more about this product.

Check the table below to see its main features.

| Credit Score | Good |

| Annual Fee | $139 (it is rebated in the 1st year) |

| Regular APR | 20.99% on purchases and from 21.99% (Quebec residents) to 22.99% (non-Quebec residents) on cash advances |

| Welcome bonus | Up to 35,000 Aventura Points in the first year |

| Rewards | 2 points for each $1 spent on travel via CIBC Rewards Centre; 1.5 points at eligible grocery stores, gas stations, and drug stores; 1 point on everything else |

How to apply for CIBC Aventura Visa Infinite?

The CIBC Aventura Visa Infinite credit card offers exclusive benefits for travelers. Check out how to apply!

This credit card is best for those who want to maximize their benefits while traveling. If you don’t mind redeeming rewards for travel perks and purchases, the Aventura Visa Infinite card might be worth considering.

Then, keep reading to learn how it works.

How does CIBC Aventura Visa Infinite work?

The Aventura Visa Infinite credit card is an excellent choice for Canadians who don’t mind redeeming points for travel benefits.

So, if you travel a lot, this card might be a fantastic tool that will help you maximize perks.

But, if you don’t travel a lot, this card still might be worth considering because it offers mobile device insurance and a whole package of security features.

Also, this CIBC credit card offers a generous welcome bonus worth over $1,200 in value. That is, you can get up to 35,000 Aventura Points in the first year, which is 20,000 points the moment you make your first purchase and 15,000 when you spend at least $1,000 per monthly statement in the first year.

Furthermore, even though there is an annual fee of $139, it is rebated in the first year.

Moreover, the card features points for every purchase.

Basically, you get 2 points for each dollar spent on travel purchases via the CIBC Rewards Centre. Plus, 1.5 points at eligible grocery stores, drug stores, and gas stations. And 1 point on everything else.

The points can be redeemed to cover travel expenses, including fees and taxes, hotel & vacation packages, gift cards, credit card balance paid down, and much more.

Besides the rewards, this card offers Visa’s Zero Liability, fraud protection, and security features.

Also, you may enjoy the insurance benefits that include:

- Flight Delay/Baggage Insurance

- Auto Rental Collision/Loss Damage Insurance

- Trip Cancellation/Interruption Insurance

- Emergency Travel Medical Insurance

- Common Carrier Accident Insurance valued at $500,000

- Hotel Burglary Insurance

- Mobile Device Insurance

On the other hand, the APR is relatively high and ranges from 20.99% to 22.99%.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

CIBC Aventura Visa Infinite highlights

This Visa is a great choice for those who are looking for a tool to maximize their travel benefits.

In summary, the CIBC Aventura Visa Infinite offers rewards for every purchase you make, and you can redeem the points earned to pay for travel expenses, including taxes and fees.

Furthermore, the card features one of the most generous welcome bonuses available on the market.

But, be careful about the APR and fees charged.

Pros

- The welcome bonus is fantastic;

- The rewards program is flexible, and you can maximize travel benefits;

- The card offers a whole package of protection and insurance;

- The annual fee is rebated in the first year;

- You earn points on every purchase you make.

Cons

- The annual fee is quite high;

- The APR is relatively high, too;

- You must present a minimum annual income of $60,000 (individual) or $100,000 (household).

How good does your credit score need to be?

Even though this information is not fully disclosed, it is recommended that you have at least a good credit score to apply for this Visa.

Also, you must present a minimum annual income of $60,000 (individual) or $100,000 (household) to be approved.

How to apply for a CIBC Aventura Visa Infinite?

Now, learn how easy it is to apply for a CIBC Aventura Visa Infinite credit card.

How to apply for CIBC Aventura Visa Infinite?

The CIBC Aventura Visa Infinite credit card offers exclusive benefits for travelers. Check out how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

LoanConnect or Fairstone Loans?

Which one is best: LoanConnect or Fairstone Loans? Check out our post to find the best loan platform for your financial needs!

Keep Reading

American Express Business Edge™ Card full review

Keep reading this American Express Business Edge™ Card review and discover everything about this business credit card that offers rewards!

Keep Reading

Scotiabank Platinum American Express® Card full review

Read this Scotiabank Platinum American Express® Card review to find out how to access a spectacular card full of benefits!

Keep ReadingYou may also like

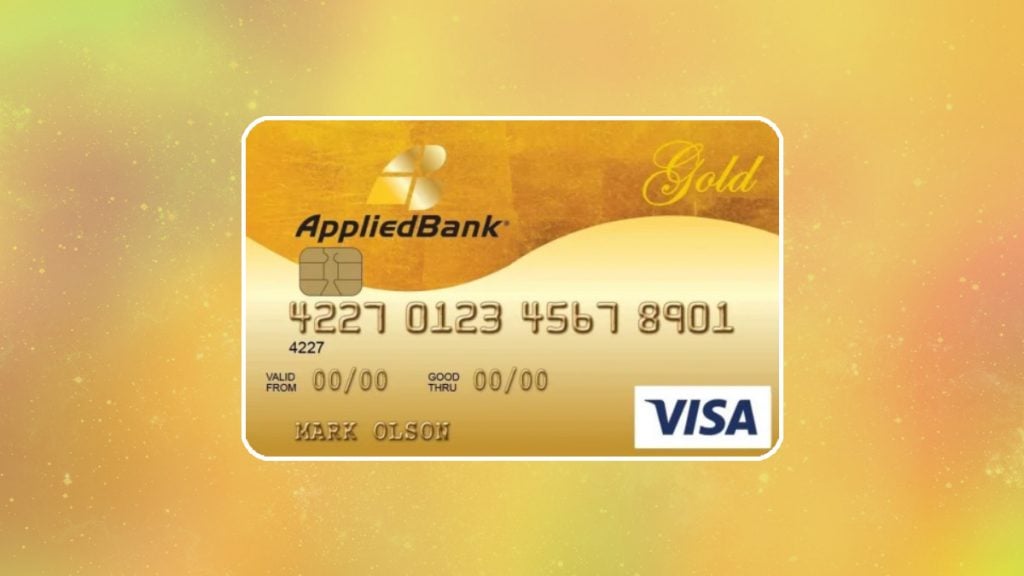

Applied Bank® Gold Preferred® Secured Visa® Credit Card review

Find out if the Applied Bank® Gold Preferred® Secured Visa® Credit Card is right for you. Learn how to apply, what features it has and whether or not a credit check is required.

Keep Reading

NetCredit Personal Loan review: how does it work and is it good?

NetCredit Personal Loan review: Is it worthy? Offering up to $10K with adjustable repayment plans might be tempting! Keep reading to learn more!

Keep Reading

Learn 10 great ways to make extra money while staying at home

People everywhere are looking for ways to make extra money at home. We know for sure you have some of these abilities. You can improve your finances, and we'll show you how in this article!

Keep Reading