SA

Capfin Personal Loan full review: simple and affordable

If you need fast money for a personal reason, check out this Capfin Personal Loan review to determine if it would suit your needs and fit your budget.

Capfin Personal Loan: up to R50 000 at low rates

If you are interested in borrowing at low rates, this Capfin Personal Loan review is worth reading.

How to apply for the Capfin Personal Loan?

Read how to apply for a Capfin Personal Loan and get the money you need within 48 hours after approval. See how the online application works!

In sum, Capfin offers a simple application process with good amounts of money at fixed interest rates.

| APR | Fixed and calculated depending on creditworthiness, prime rate, among other factors |

| Loan Purpose | Personal |

| Loan Amounts | Up to R50 000 |

| Credit Needed | Not disclosed |

| Terms | Up to 12 months |

| Origination Fee | Not disclosed |

| Late Fee | Not disclosed |

| Early Payoff Penalty | Not disclosed |

Even though the fees are not disclosed – because it depends on the terms and conditions – you may love to learn that you may receive the money borrowed within 48 hours after approval.

How does the Capfin Personal Loan work?

Capfin is a well-reviewed financial company that offers good credit solutions and services for different purposes, mainly personal, which embraces a whole range of objectives.

In fact, the company is registered as a credit provider, that is it makes it more reliable to borrow money from it.

Basically, Capfin offers amounts of up to R50 000 with terms of up to 12 months. It is important to mention that the minimum term is 6 months, though.

Also, interest rates are fixed, making tracking and controlling loan payments easier.

Moreover, the application is online. But you might be wondering about assistance since the complete process is digital.

So, Capfin is known as an excellent assistance provider, and it guarantees through protection that in case something happens to you, your loan stays with Capfin.

Additionally, you may be able to get the money you want within 48 hours after approval.

In essence, this lender is one of the most accessible credit providers in South Africa.

You will be redirected to another website

Capfin Personal Loan benefits

As can be seen in this Capfin Personal Loan review, borrowing money from this lender is suitable for those who want to access affordable conditions, flexible terms, and fast funding.

On the other hand, it is essential to understand the associated fees before completing an application.

Pros

- Capfin offers amounts of up to R50 000;

- The terms are reasonable and vary from six to 12 months;

- The application is online, and funding is fast;

- Capfin guarantees protection in case of something happens to the borrower.

Cons

- Fees and rates will only be disclosed after evaluation.

How good does your credit score need to be?

Even though Capfin makes it easier for most people to access personal loans, it is crucial to remember that the terms and conditions settled will depend on your creditworthiness.

Thus, make sure you have a healthy credit score to access lower rates and fees.

How to apply for a Capfin Personal Loan?

If you need money fast, take a minute to look at how to apply for a Capfin Personal Loan and enjoy affordable rates with flexible terms.

How to apply for the Capfin Personal Loan?

Read how to apply for a Capfin Personal Loan and get the money you need within 48 hours after approval. See how the online application works!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Woolworths Gold Credit Card full review

If you love purchasing all you need at Woolworths, this Woolworths Gold Credit Card review is worth reading. Check out how this card works!

Keep Reading

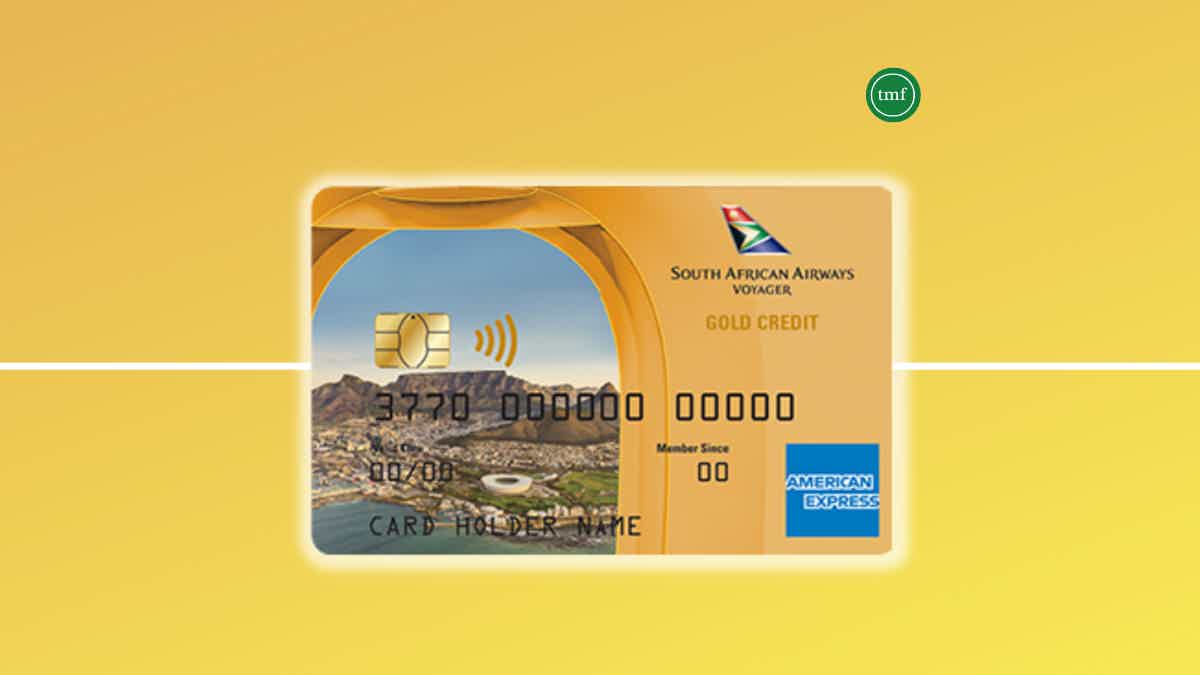

How to apply for the NedBank SAA Voyager Gold Credit Card?

If you need a card to help you earn unlimited miles and travel promotions, read on to apply for the NedBank SAA Voyager Gold Credit Card!

Keep Reading

How to apply for the FNB Aspire Credit Card?

Looking for a card with SLOW Lounge access and many other perks? If so, read on to apply for the FNB Aspire Credit Card!

Keep ReadingYou may also like

Apply for the Verizon Visa® Card: enjoy no annual fee

Find out how to apply for the Verizon Visa® Card and enjoy the convenience of $100 statement credit in the first year. Stay tuned!

Keep Reading

Upgrade Cash Rewards Visa® review

Are you looking for a new credit card with no annual fee? Maybe the Upgrade Cash Rewards Visa® is the right choice for you. This article will show you its benefits.

Keep Reading

Chime Credit Builder Visa Credit Card application: how does it work?

Like everything on the Chime Credit Builder Visa card, the application process is simple, easy, and efficient. If that's something you appreciate on a credit issuer, you're going to love this credit card.

Keep Reading