Credit Cards (US)

10 best students credit cards 2022: learn the essential ones!

Are you a college student needing a credit card? We can help you! Keep reading to know which are the ten best student credit cards of 2022!

Best options for student credit cards in 2022

If you’re like most college students, your credit card is a significant part of your life. Whether it’s for buying textbooks or paying off lunch at the dining hall, they can be a big help when it comes to budgeting and getting by without going into debt. However, choosing the right one can seem daunting with so many options out there. Luckily we’ve done all the work for you! Use this guide to find out which ten best student credit cards are perfect for your lifestyle and needs!

10 best travel rewards credit cards

The best travel rewards credit cards can help you save on airfare, hotels, and more. Compare and apply for your next credit card!

What is the difference between college student credit cards and regular ones?

There are some key differences between regular credit cards and student cards. For example, student credit cards usually have a lower credit limit and are unsecured. And regular credit cards usually can give you a higher credit limit. Also, you do not need to have a very high credit score to qualify for a student credit card. But, some credit cards that accept those with bad credit need a security deposit. However, many student credit cards do not require one.

Moreover, a student credit card can help you build your credit score if you use it responsibly. Also, after you build your score, you can move to a regular credit card that may have more rewards and perks.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

The best student credit cards: 10 easy to get options in 2022

1. Discover it® Student Chrome

The Discover it® Student Chrome is for students who want to learn how to use a credit card with cash back rewards and other perks. Also, this student card offers 2% cash back rewards at gas stations and restaurants on up to $1,000 considering combined purchases every quarter. So, the rewards can be a bit complicated. However, you can learn how to manage this type of reward to make the best out of this credit card.

| Credit Score | Average and no score. |

| Annual Fee | No annual fee. |

| Regular APR | 12.99% to 21.99% variable APR. |

| Welcome bonus | 2X cash back in your first year. Discover will match all the cash back earned at the end of your first year. |

| Rewards* | 2% cash back at gas stations and restaurants. Unlimited 1% cash back on all other purchases. *Terms apply. |

How to get the Discover it® Student Chrome card?

The Discover it® Student Chrome credit card is a good choice for students who need a start in financial planning. See how to apply for it now!

2. Discover it® Student Cash Back

This Discover credit card for students has excellent features for students to learn how credit cards work in general. Moreover, you can access your FICO® Score for free. Also, your first late payment is waived. In addition, there is a high rewards rate of up to 5% cash back and no annual fee!

| Credit Score | Limited or no score. |

| Annual Fee | No annual fee. |

| Regular APR | 12.99% to 21.99% variable APR. |

| Welcome bonus | Discover will match all the cash back you earned at the end of your first year. |

| Rewards* | 5% cash back on everyday purchases. *Terms apply. |

How to apply Discover it® Student Cash Back?

The Discover it® Student Cash Back gives you rewards with no fees and a chance to build your credit history. See how to apply for it!

3. Deserve® EDU Mastercard for Students

This student credit card can help you build credit fast because it sends your payment reports to all three major credit bureaus. Also, you do not have to pay an annual fee or make an initial security deposit. Moreover, you can earn unlimited 1% cash back on every purchase you make with the card.

| Credit Score | Limited. |

| Annual Fee | No annual fee. |

| Regular APR | 20.99% Variable |

| Welcome bonus | No welcome bonus. |

| Rewards | 1% cash back on all purchases. |

4. Chase Freedom® Student credit card

The Chase Freedom® Student credit card can help you build credit and upgrade to earn better rewards and possibly a credit limit increase. Plus, if you use your card responsibly, you can even upgrade to a regular Chase credit card.

| Credit Score | Good. |

| Annual Fee | No annual fee. |

| Regular APR | 14.99% variable APR. |

| Welcome bonus* | $50 after your first purchases within the first 3 months from your account opening. *Terms apply. |

| Rewards | 1% cash back on all purchases. |

How to apply for the Chase Freedom® Student?

Are you looking for rewards on a credit card? Then, it would be best if you put a star right next to a Chase Freedom® Student card. Check out how to apply for it today!

5. Journey Student Rewards from Capital One

With the Journey Student Rewards from Capital One, you can improve your credit score fast. Also, you can earn 1% cash back on every purchase you make with the card. Plus, if you make all your payments on time for the first five months, you can get a credit limit increase.

| Credit Score | Average. |

| Annual Fee | No annual fee. |

| Regular APR | 26.49% variable APR. |

| Welcome bonus | No welcome bonus. |

| Rewards | Unlimited 1$ cash back on every purchase you make with the card. |

How to apply for the Journey Student Rewards?

The Journey Student Rewards from Capital One card helps you build your credit history and offers rewards with no annual fee during the process. Check out how to apply!

6. Capital One Platinum Secured Credit Card

Even though the Capital One Platinum Secured Credit Card is not exclusive for students, it can be an excellent choice for them. Moreover, you can qualify even with a bad credit score. Also, you can qualify for a higher credit limit than your initial security deposit. Plus, there is no annual fee!

| Credit Score | Poor. |

| Annual Fee | No annual fee. |

| Regular APR | 26.99% variable APR. |

| Welcome bonus | No welcome bonus. |

| Rewards | No rewards program. |

7. Capital One SavorOne Student Cash Rewards Credit Card

The Capital One SavorOne Student Cash Rewards Credit Card can be one of the best student credit cards in the market. It offers unlimited cash back rewards on dining, streaming services, entertainment, and more! Plus, you can earn 1% cash back on all other purchases. Moreover, there is no annual fee, and you can build your credit. Also, you can get 8% cash back on tickets at Vivid Seats (January 2023).

| Credit Score | Average score. |

| Annual Fee | No annual fee. |

| Regular APR | 26.49% variable APR. |

| Welcome bonus | No welcome bonus is available. |

| Rewards* | Unlimited 3% cash back on entertainment, dining, streaming services, and grocery stores. 1% cash back on all other purchases. *Terms apply. |

How to apply Capital One SavorOne Rewards?

The Capital One SavorOne Rewards for Students card offers rewards with no annual fee. Learn how to apply for it!

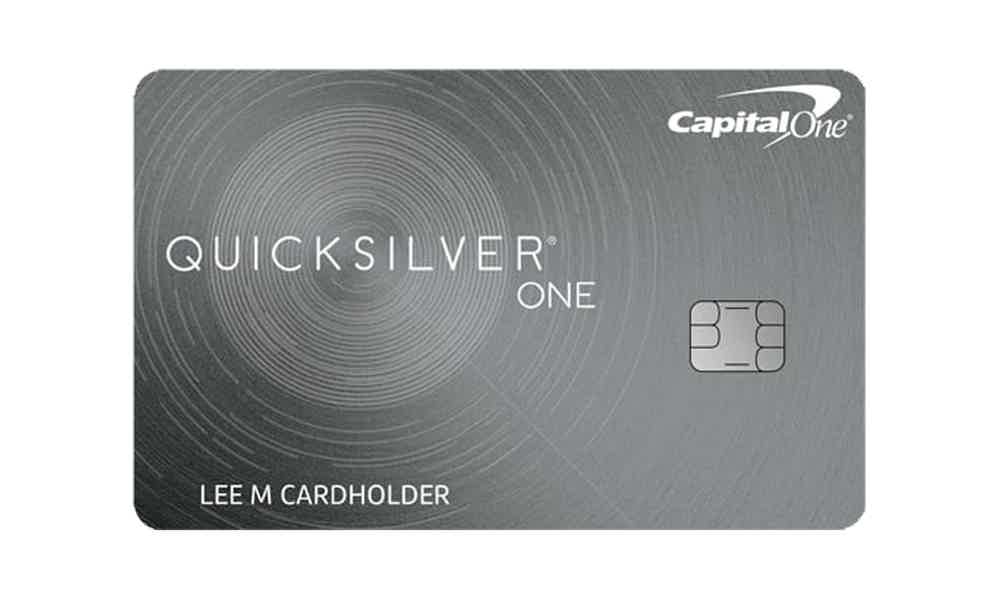

8. Capital One Quicksilver Student Cash Rewards Credit Card

This credit card is an excellent choice for students. You can earn unlimited 1.5% cash back on all purchases. Plus, there is no annual fee, and you can see if you are pre-approved with no impact on your credit score.

| Credit Score | Average. |

| Annual Fee | No annual fee. |

| Regular APR | 26.49% variable APR. |

| Welcome bonus | No welcome bonus. |

| Rewards | Unlimited 1.5% cash back on all purchases. |

How to apply Capital One Quicksilver Rewards?

Capital One Quicksilver Rewards for Students card helps you build your credit history while you use it responsibly and earn cash back on all purchases. See how to apply!

9. Bank of America® Unlimited Cash Rewards Credit Card for Students

With this Bank of America® credit card, you can earn 1.5% cash back on all purchases. Plus, you can get a 0% intro APR. Moreover, there is no annual fee, and you can earn a $200 online cash reward after spending $1,000 on your first 90 days from account opening.

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 13.99% to 23.99% variable APR. |

| Welcome bonus | $200 online bonus after spending at least $1,000 in your first 90 days from account opening. |

| Rewards | Unlimited 1.5% cash back on all purchases. |

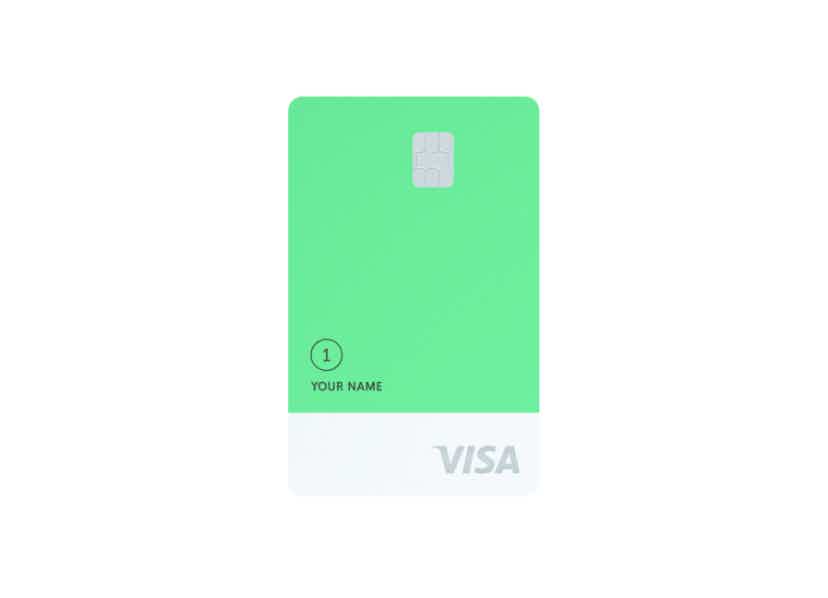

10. Petal® 1 “No Annual Fee” Visa® Credit Card

This is not a credit card designed for students. However, it can be an excellent choice for them! The Petal® 1 “No Annual Fee” Visa® Credit Card has no annual fee, and you can get approved even with bad credit. Plus, you can get a credit limit increase after six months if you fit the requirements.

| Credit Score | Bad. |

| Annual Fee | No annual fee. |

| Regular APR | 19.99% to 29.49% variable APR. |

| Welcome bonus | No welcome bonus. |

| Rewards | 2% to 10% cash back for eligible merchants. |

How to apply for the Petal 1 Visa® credit card?

The Petal 1 Visa® card gives you up to 10% cash back on eligible merchants with no annual fee. And it helps you build a credit score. Check out how to get yours!

Now, if you are a student, you must be looking for ways to make more money. Investments can be an excellent choice to start making more money. So, check out our post below with a list of the ten best investment apps!

The 10 best investment apps of 2021

Needing an investment app? Come see the main ones. They'll definitely help you to invest better, follow the market, and get great results!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Capital One Quicksilver Secured Cash Rewards review

Check out the Capital One Quicksilver Secured Cash Rewards review article and learn how to build a credit score at a very low cost with it.

Keep Reading

How to join My Credit Monitor?

Looking for the best way to monitor your credit score and report 24/7? If so, read on to learn how to join My Credit Monitor!

Keep Reading

What happens when you close a secured credit card?

If you have a secured card, you may wonder what happens when you close your secured credit card. Well, you can keep reading to find out!

Keep ReadingYou may also like

Learn how to calculate your credit scores!

Understanding how your credit score will be calculated is the first step to increasing it. So, find out essential information about it and start improving your personal finances!

Keep Reading

Best investments for beginner investors: an easy guide on funds and more!

Are you wondering what the best investments for beginner investors are? This is a common doubt. The first step is the most important - and scariest. Don't worry, and we'll show you how to start.

Keep Reading

Accepted Account review: Great chances of approval for all credit scores

Do you want to be part of a membership of great prices and discounts while you get a $25 bonus each month? Read on to learn more in the Accepted Account review.

Keep Reading