Investing (US)

5 safe investments: learn the best low-risk investments

Come find out the benefits of low-risk investments, as well as what are the best options for you! So, keep reading to learn all about it.

Learn what is the best low-risk options for your investments!

A safe investment is one that can be classified as low risk. As the name says, its main feature is being the safer investment option. But these investments depend on two very important factors: volatility and liquidity. Besides being safer, another important point is that they typically protect against inflation and offer good profitability. Want to find out what are the best low-risk investments? Stay with us!

In the financial market, investors are usually divided into three types according to their profile: conservative, moderate, or aggressive. Conservative investors accept lower profits in exchange for greater safety. Moderate investors are the ones who usually diversify their funds: they may have a percentage in fixed income and look for stocks that can yield more. Aggressive investors, on the contrary, invest in products with higher risks and returns.

What is a Bear Market in economics and investing?

What is a Bear Market and why a bear from all animals? Is it possible to benefit from this scenario? Yes, it is. Come see how!

What is a safe investment?

The first thing you should do is identify your profile as an investor. If your profile is conservative, a safe investment option for you is government bonds. But if your desire is to diversify your portfolio, it is worth keeping an eye on the other options we will present next.

Small and medium investors can also benefit from safer and more profitable investments that generate passive and consistent income in the medium and long term. Crowdfunding, for example, is also an alternative for this. Because they make it possible for investors to become partners or to finance high-performance projects in various sectors, with high demand and resistance to economic crises.

We call these investments alternative investments because they are not offered by banks or brokers. They also guarantee high profitability, protection against inflation, and safety, among others advantages. Alternative investment options also offer low volatility in regulated and supervised environments; predictable and timely payments; considerable contractual guarantees or real asset backing; etc.

The portfolio of high-performance investors must include safe, profitable, concrete, and solid investments that are not directly related to the financial market. For example, commodities, real estate, and direct participation in startups and companies via venture capital and private equity funds.

In this way, it is possible to guarantee the safety of these investors’ products, quite different from the proposals commonly made by bank managers or investment advisors. And if you think that for this you will need to meet all the requirements of professional investors, know that you will not.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Low-risk versus high-risk investments

Investing with low or high risk? If a product promises a large return, be cautious. Ask yourself what could happen in the worst-case scenario. If you can answer that question, you become more aware of your real situation. Even then, invest only a portion of your portfolio. Never your entire portfolio.

How can I invest in order to obtain good results in the medium and long term? It is not just about investing for bigger earnings. It is also about building a diversified portfolio that should withstand the ups and downs of the economy. As well as providing positive returns without putting your finances at risk.

Learn to follow an investment portfolio plan. This way you will be headed in the right direction. What is the best way to invest? Staying focused on long-term goals is the key to successful investing. Do not allow current changes to alter your investment plans.

Which investment is the least risky? 5 great options!

Now let’s find out which are the best low-risk options for you to invest in!

1. Index funds

An index fund is a financial product that will seek, as a management strategy, to replicate the portfolio of a

certain market index. An index is an indicator the market uses with the objective of representing the performance of a group of assets.

The indexes must have a complete and public methodology, allowing their replication and describing their objective. To the constitution of an ETF (Exchange Traded Fund), the reference index must also be free of potential conflicts of interest between the fund manager and the index provider. That is, an institution that is exempt from the ETF manager must calculate and disclose the index.

2. Common stocks that pay dividends

Choosing dividend-paying stocks is the goal of most investors. By assembling a portfolio with this strategy, you leverage gains. Publicly traded companies that have reported a net profit in their results are the ones that own dividend-paying stocks. Each company, through its bylaws, establishes the percentage of dividends that it will pay to shareholders. By default, most companies listed on the stock exchange distribute 25% of their adjusted net profit.

There is also no obligation. The law allows companies, in their Annual Shareholders’ Meetings, to define whether to pay dividends or not. However, the transparency of information to shareholders is mandatory by law. But how to know which stocks pay dividends? For this, an important indicator to follow is the DY (dividend yield).

Dividend yield, simply said, measures the performance of a company concerning its profit distribution and its market value. It is through it that you can compare how much the company pays in dividends, in comparison with the price of its shares.

3. Preferred stocks

Keep in mind that we usually recommend preferred stocks for long-term investments. As seen, one of the main points that justifies its name is the preference in the distribution of earnings and payments, in relation to other types of shareholders.

The company has to distribute a minimum percentage of the profits, preferably among preferred shareholders. As a consequence, if there are not enough funds, it is the ordinary shareholders who will not receive them at that time. So, preferred stocks not only pay dividends. They do so in a priority manner.

The fact that they give preference in the distribution of proceeds can make these stocks more advantageous for those who wish to live only with investment returns. In other words, preferred stocks only do not pay dividends if the company does not show a net profit in the period. Thus, when its results are negative.

4. Mutual funds

Those investors who are thinking about low-risk mutual funds will find a large list to choose from. Money market mutual funds are a low-risk investment with a correspondingly low return. Bond funds are available providing different levels of risk. Government bond funds are considered safe, but rising interest rates tend to deflate bond prices. Balanced funds can be designed to mitigate risks while providing an income.

Mutual funds are designed to meet specific investment objectives. If risk mitigation is a priority, many different types of low-risk mutual funds may be able to help you achieve this goal. Some are designed with various strategies, such as risk mitigation, along with a monthly or quarterly income. By exploring the wide range of mutual funds available, you will discover the right type for your specific need.

A money market fund is required by U.S. law to invest in low-risk securities. They typically invest in government bonds and certificates of deposit. These low-risk mutual funds pay dividends comparable to short-term interest rates. Money market funds are not insured by the federal government.

5. Government bonds

Government bonds are debt securities issued by a government in order to support government spending and obligations. They can pay periodic interest payments, which are we call coupon payments. Those issued by national governments are often considered low-risk investments. Because the issuing authority backs them.

A government institution issues a government bond to raise money to finance projects or daily activities. For example, the U.S. Treasury Department sells the issued bonds during auctions throughout the year. Some of the bonds are traded in the secondary market.

Through these markets, an investor who hired an investment institution or brokerage can buy and sell bonds that were previously issued. They are widely available for purchase through many institutions, like the U.S. Treasury, brokerage firms, ETFs, etc. They all contain a basket of securities.

If you desire risk-free investment options, the U.S. Treasury Department has to compose your portfolio. It is perfect for low-risk profiles because the issuer will back its bonds. We are talking about one of the world’s safest investments. Investments floated by other countries may be riskier.

Extra tip: Where can I invest with low-risk?

We have one extra tip for you to invest with low-risk!

6. Corporate Bonds

Finally, if you are looking for something a little less safe, we recommend high-grade corporate debts. They are corporate bonds that high-performing companies issue. They also usually offer higher results when compared to government treasuries or money market accounts.

However, despite being less safe, if you act cautiously, you will be just fine. As you will not earn the higher rate, if you decide to sell your bonds, you may have to do so for less than you may have paid if the interest rates have risen. But if you hold on to them until maturity, you will receive their face value plus interest.

Moreover, low-performing companies can offer higher interest rates. Consequently, they are more likely to lose your money. This is why it can be even safer to just leave your money in your normal checking or savings account. So, when in doubt, go for the well-established companies. They are more likely to take care of your money.

And if you want to keep learning about finances, check out our post below!

What does HCOL and LCOL area mean? Pros and cons!

Did you know that the place where you live has a direct impact on your financial health? Find out here what HCOL and LCOL area mean!

About the author / Thais Daou

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

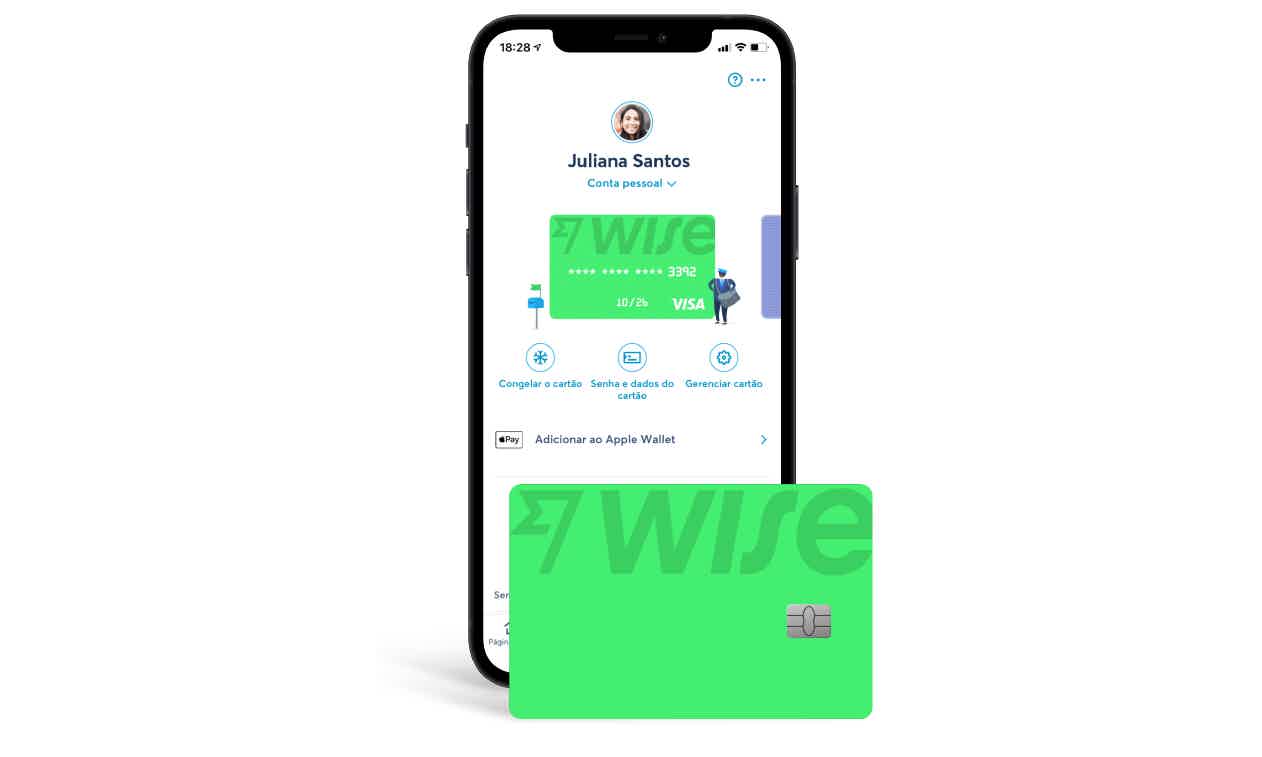

Wise Debit Card full review

In this Wise debit card review article, you will learn how it works and the benefits of having a cheap borderless account! Check it out!

Keep Reading

How to apply for Lowe’s® Advantage Card?

Looking for a card to help you pay for your home improvements and get perks? If so, read on to apply for Lowe’s® Advantage Card!

Keep Reading

How to apply for AARP® Travel Rewards Mastercard®?

Are you looking to get more out of your travel credit card? If so, learn how to apply for the AARP® Travel Rewards Mastercard®!

Keep ReadingYou may also like

Delta SkyMiles® Reserve American Express Card review

If you're looking for an American Express credit card that will give you access to airport lounges, the Delta SkyMiles® Reserve American Express Card review is for you. Keep reading!

Keep Reading

Learn to apply easily for the Citrus Loans

Need a loan? Learn how to apply now with Citrus Loans and get your money fast! They make getting the loan you need easy without all the hassle. Keep reading!

Keep Reading

Self Visa® Credit Card review: start building credit today!

Self Visa® Credit Card offers several Visa benefits and wide acceptance. Keep reading to learn how this card works!

Keep Reading