Credit Cards (US)

Barnes & Noble Mastercard® review: Get cashback!

If you need a credit card to help you make the best out of your book purchases, read our Barnes & Noble Mastercard® review to see its pros and cons!

Barnes & Noble Mastercard®: Earn B&N perks for no annual fee!

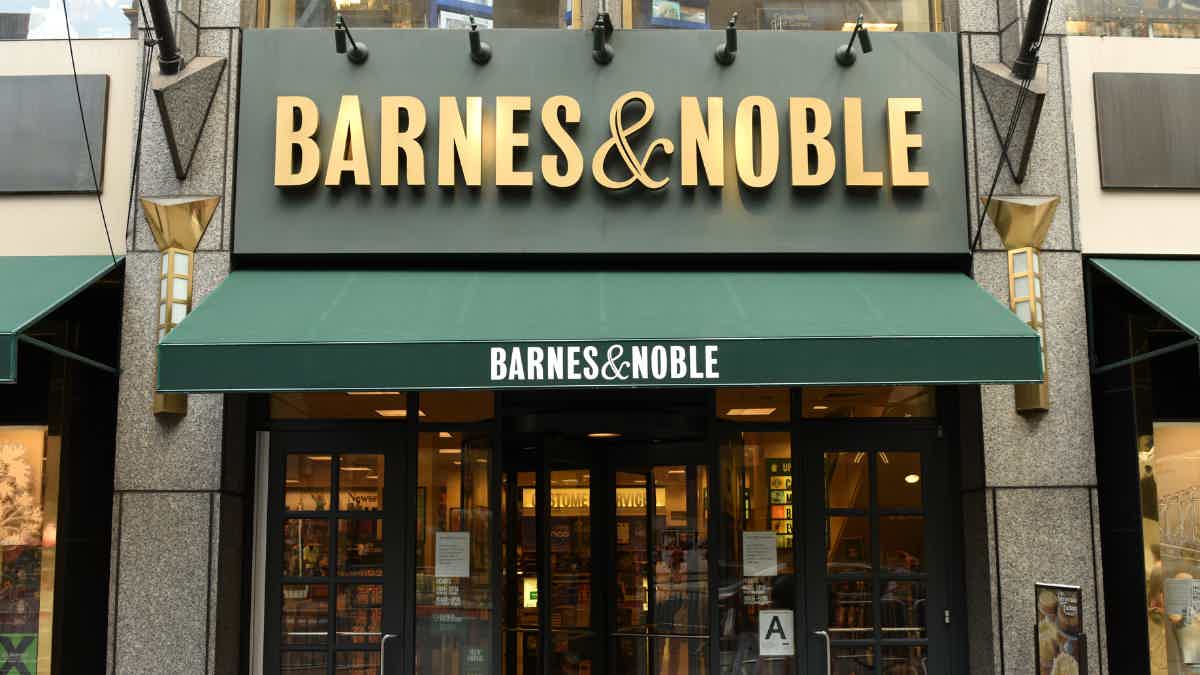

Do you love browsing the aisles of your local Barnes & Noble? If so, then our Barnes & Noble Mastercard® review is perfect for you! Read on to see the pros and cons you can get with this great card!

How to apply for the Barnes & Noble Mastercard®?

Do you shop at B&N often? If so, you need to consider learning how to apply for the Barnes & Noble Mastercard®! So, read on!

| Credit Score | Good to excellent. |

| APR* | 0% intro APR on balance transfers you make in 45 days from account opening (valid for the first 15 billing cycles immediately following each balance transfer). Then, there will be a 17.74% or 28.74% variable APR. 17.74% or 28.74% variable APR for purchases; 28.99% variable APR for cash advances. *Terms apply. |

| Annual Fee | No annual fee. |

| Fees* | Minimum monthly interest: $.50; Balance transfer fee: 5% with a $5 minimum; Cash advance fee: 5% with a $10 minimum; Also, the foreign transaction fee is 3%. *Terms apply. |

| Welcome bonus* | You can get 12 months of free Barnes & Noble membership; After your first purchase or balance transfer, you’ll get a $25 Barnes & Noble gift card. *Terms apply. |

| Rewards* | 5x cash back on all Barnes & Noble purchases; 2x points at restaurant purchases; Also, 1x points on any other purchase you make with your card; *Terms apply. |

With this card, you’ll take advantage of all the great savings and discounts at B&N stores nationwide and earn rewards with every purchase!

Moreover, this card can offer incredible perks for no annual fee! So, kick back and read our Barnes & Noble Mastercard® review as we explain why getting this card is one of the smartest moves!

How does the Barnes & Noble Mastercard® work?

Are you an avid reader looking for a new way to get the most out of your shopping experience regarding Barnes & Noble? If so, the Barnes & Noble Mastercard® is just what you’ve been searching for!

Moreover, this card offers no annual fee, generous cash-back rewards, and exclusive perks such as bonus points on purchases made through B&N and special discounts on select books!

This card can offer the best perks if you love to read. And you can get all of these for no annual fee!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Barnes & Noble Mastercard® benefits

As we mentioned, this credit card offers many benefits and perks to book lovers. Therefore, you should check out the pros and cons of this credit card to learn more and see if it is the best choice for you!

So, read our pros and cons list below!

Pros

- There are no membership fees;

- You can earn up to 5% cash back for B&N purchases;

- There is a welcome bonus for new cardholders;

- No annual fee.

Cons

- There are not many rewards for those who don’t shop at Barnes & Noble;

- You won’t find an intro APR for purchases;

- There is a foreign transaction fee.

How good does your credit score need to be?

You’ll need at least a good credit score if you want a better chance of getting approved for this credit card. Therefore, you won’t have much chance of approval with a not-so-good or low score.

How to apply for the Barnes & Noble Mastercard®?

You can find many ways of applying for this great credit card. Also, you’ll be able to apply by phone or online!

How to apply for the Barnes & Noble Mastercard®?

Do you shop at B&N often? If so, you need to consider learning how to apply for the Barnes & Noble Mastercard®! So, read on!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for TrueAmericanLoan?

TrueAmericanLoan helps you find the perfect lender that will help you with your personal issue. Check out how to access and apply for it.

Keep Reading

10 steps to retire early and reach financial independence

Who doesn't want to retire early and reach financial independence? Read on to know the steps to achieve this goal and enjoy your retirement!

Keep Reading

How to apply for a First Citizens Personal Checking Account?

Check out how easy and fast it is to apply for a First Citizens Personal Checking Account and choose the best option for you and your needs.

Keep ReadingYou may also like

Aer Lingus Visa Signature® Card application: how does it work?

Get ready to take your travels to the next level! Learn to apply for an Aer Lingus Visa Signature® Card! Earn up to 3 Avios per $1 spent!

Keep Reading

Capital One Walmart Rewards® Mastercard® review: is it worth it?

If you're looking for a card that will give you cash back and rewards for your everyday spending, the Capital One Walmart Rewards® Mastercard® may be the perfect fit. Read on for our review and learn how this product can be ideal for your financial needs!

Keep Reading

How to create an easy budget plan in 5 steps

Here's everything you need to know to create a budget that considers your fixed and variable expenses. Check it out!

Keep Reading