Credit Cards (US)

How to apply for the BankAmericard® Secured Credit Card?

If you need to build or rebuild credit, learn how to apply for the BankAmericard® Secured Credit Card and enjoy its valuable features.

Apply for a BankAmericard® Secured Credit Card: strengthen credit at no high fees

If you need to build, rebuild, or even strengthen your credit score, apply for a BankAmericard® Secured Credit Card to accomplish your financial goals.

Fortunately, Bank of America offers an easy and fast application process.

Also, with this secured card, you will be able to get the following:

- No annual or monthly fees;

- Monthly access to your FICO® Score;

- Certified Financial Health Support;

- Flexible security deposit ranging from $200 to $5,000;

- A $0 Liability Guarantee;

- Optional Balance Connect® for overdraft protection;

- Digital Wallet Technology;

- Contactless Chip Technology;

- Account alerts;

- Optional Paperless Statement;

- Online and Mobile Banking.

Additionally, Bank of America offers the possibility of applying for the BankAmericard® Secured Credit Card through different channels, as described below.

Online Application Process

To apply for a BankAmericard® Secured Credit Card, you can access the official Bank of America website. Then, search for the option of a credit card you want and apply for it through a simple form.

Moreover, make sure the option is the right for you since there is no prequalification available.

You can also schedule an appointment with a card specialist. All you need to do is access the website to choose the best date for you.

Or you can access the Chat to help you with an application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

Firstly, apply for the BankAmericard® Secured Credit Card via the other channels described above.

Then, after being approved, download the Bank of America mobile app to manage your account and build your credit right in the palm of your hand.

BankAmericard® Secured Credit Card vs. BankAmericard® Credit Card for Students

Certainly, a secured card is Always a great choice for those who need to stay in full control f their finances.

Furthermore, Bank of America offers something extra: fantastic support and the possibility to track credit scores.

Then, it might be good for students. On the other hand, if you are a student, you may love to find out there is a card specially designed for you.

| BankAmericard® Secured Credit Card | BankAmericard® Credit Card for Students | |

| Credit Score | All considered | All considered |

| APR | 25.49% (variable) – purchases and balance transfers; 28.49% (variable) – cash advances | From 15.49% to 25.49% (variable) – balance transfers; From 18.49% to 28.49% – cash advances |

| Annual Fee | $0 | $0 |

| Fees | Balance Transfer Fee: 3% of each transaction; Cash Advance Fee: from 3% to 5% of each transaction; Foreign Transaction Fee: 3% of each transaction; Late Payment: up to $40 | Balance Transfer Fee: 3% of each transaction; Cash Advance Fee: from 3% to 5% of each transaction; Foreign Transaction Fee: 3% of each transaction; Late Payment: up to $40 |

| Welcome bonus | None | None |

| Rewards | None | None |

Then, check out how to apply for a BankAmericard® Credit Card for Students.

How to apply BankAmericard® for Students?

See how to apply for a BankAmericard® Credit Card for Students and enjoy an introductory period of 0% APR on purchases and balance transfers.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Charles Schwab Investing app full review

The Charles Schwab Investing app can be great to help you research your investments and trades. Keep reading our full review to know more!

Keep Reading

How to apply for the Milestone® Mastercard® – Less Than Perfect Credit Considered?

Learn how the Milestone® Mastercard® Less Than Perfect Credit Considered application works, and apply without impacting your credit score!

Keep Reading

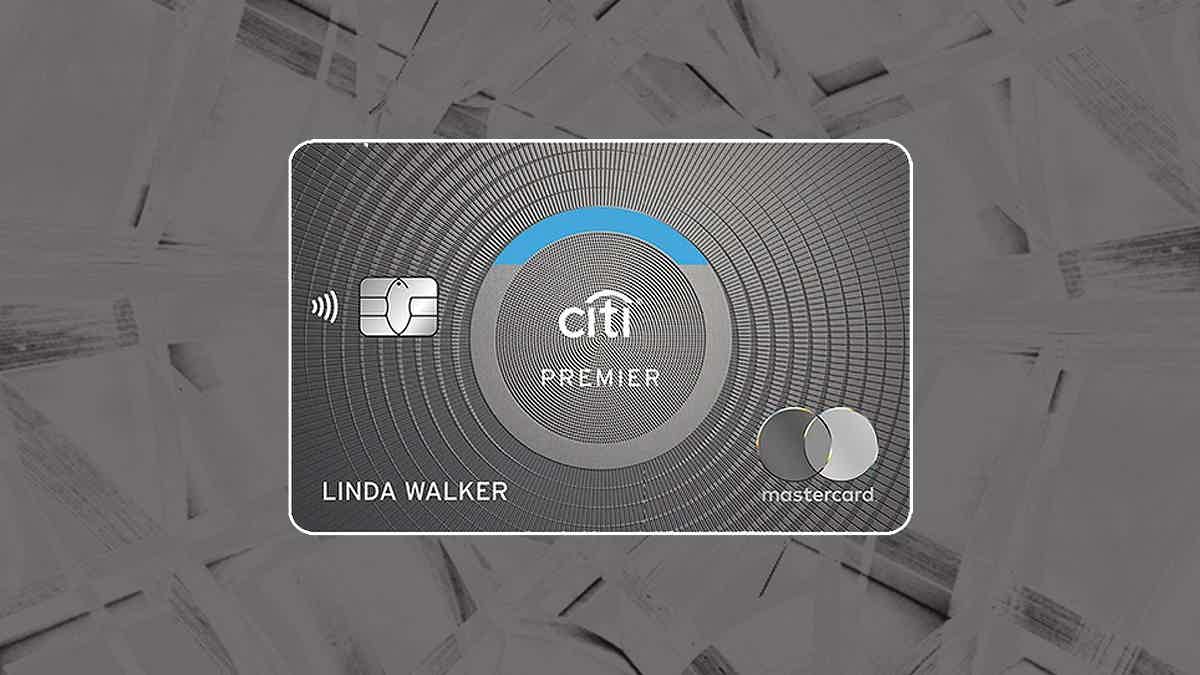

How do you get the Citi Premier® Credit Card?

Do you love to get bonuses and travel rewards for daily purchases? Then keep reading to learn how to apply for the Citi Premier® Credit Card!

Keep ReadingYou may also like

How to start investing with Ally Invest?

Opening an account with Ally Invest is a simple process. In this article we’re going to show you how to do it. So read on and learn how to open your account!

Keep Reading

Mogo Prepaid Card Review

By getting a Mogo Prepaid Card, you can save money while reducing your environmental impact. Check our Mogo Prepaid Card review to learn all that this product can do for you and for the planet.

Keep Reading

Discover it® Chrome Gas & Restaurant Credit Card application: how does it work?

Earn twice the rewards with Discover it® Chrome Gas & Restaurant Credit Card. Get up to 2% cash back on all purchases and pay no annual fee!

Keep Reading